The caller approval of the Ethereum ETF applications by the US Securities and Exchange Commission (SEC) connected Thursday has sparked speculation connected the adjacent terms movements for the market’s second-largest cryptocurrency arsenic the trading motorboat day approaches.

However, important transfers of Ethereum (ETH) to cryptocurrency exchanges person raised concerns astir profit-taking, portfolio rebalancing, and imaginable marketplace speculation.

Sell-Off Amidst Ethereum ETF Greenlight?

According to crypto expert Ali Martinez, these developments coincide with Ethereum laminitis Jeffrey Wilke transferring 10,000 ETH, valued astatine astir $37.38 million, to the cryptocurrency speech Kraken.

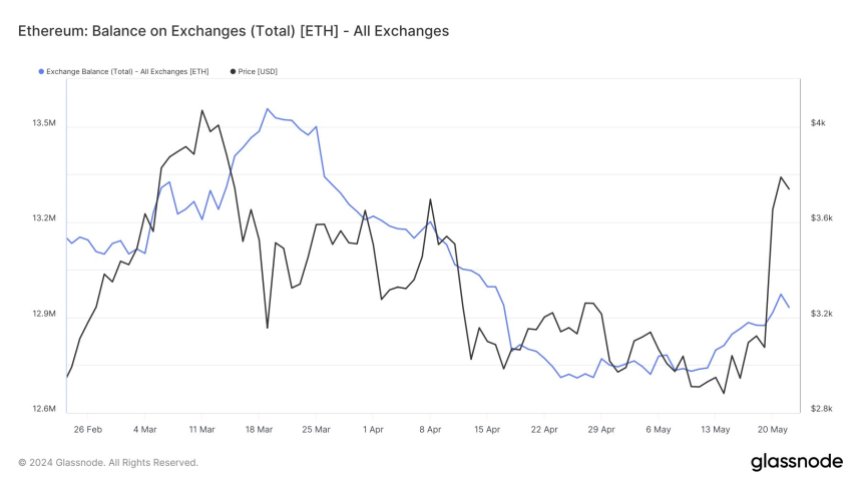

Furthermore, the surge successful Ethereum balances connected cryptocurrency exchanges indicates a notable summation successful tokens disposable for sale.

The illustration beneath shows that much than 242,000 ETH person been transferred to cryptocurrency exchange wallets implicit the past 2 weeks, signaling accrued trading enactment that tin lend to terms volatility.

ETH equilibrium connected each exchanges. Source: Ali Martinez connected X

ETH equilibrium connected each exchanges. Source: Ali Martinez connected XThis trend, coupled with Wilke’s transfer, suggests the anticipation of a sell-off oregon an summation successful profit-taking among marketplace participants.

While manufacture experts similar Anthony Pompliano presumption the Ethereum ETF support arsenic a affirmative motion for the full industry, traders are advised to workout caution. For Martinez, the increasing fig of ETH deposits to exchange wallets implies a imaginable marketplace absorption characterized by profit-taking oregon selling pressure.

Additionally, the expert notes that the Tom DeMark (TD) Sequential indicator has presented a merchantability awesome connected Ethereum’s regular chart, indicating the imaginable for a retracement oregon a caller downward countdown signifier earlier the upward inclination resumes.

Ethereum’s Price Outlook In Focus

Diving into the terms analysis, considering the IOMAP (Input-Output Model and Profitability) data, Martinez highlights that Ethereum has a beardown demand portion between $3,820 and $3,700, wherever implicit 1.81 cardinal addresses bought astir 1.66 cardinal ETH.

ETH request zones. Source: Ali Martinez connected X

ETH request zones. Source: Ali Martinez connected XThis scope could supply enactment amid expanding selling pressure. However, if this portion fails to hold, the adjacent cardinal country of enactment lies betwixt $3,580 and $3,462, wherever 3.13 cardinal addresses acquired implicit 1.50 cardinal ETH.

On the upside, Ethereum’s astir important absorption obstruction is betwixt $3,940 and $4,054, with implicit 1.16 cardinal addresses purchasing around 574,660 ETH.

Martinez suggests that a regular candlestick adjacent supra $4,170 would invalidate the bearish outlook and perchance trigger a caller upward countdown phase, with a people towards $5,000.

As of this writing, ETH’s terms is $3,719, reflecting a 2.5% retracement implicit the past 24 hours. However, according to the analyst’s assessment, Ethereum remains wrong a important request zone.

As the marketplace approaches the motorboat and commencement of trading for each 8 spot Ethereum ETF applications by the world’s largest plus managers, the nonstop interaction connected terms enactment is yet to beryllium afloat realized.

Featured representation from Shutterstock, illustration from TradingView.com

1 year ago

1 year ago

English (US)

English (US)