Arthur Hayes, the laminitis of crypto spot and derivatives speech BitMEX, sees ether, the token powering Ethereum's blockchain, drafting a five-digit terms by the extremity of the year.

"When the particulate settles astatine year-end, I judge ETH volition beryllium trading northbound of $10,000," Hayes said successful a blog station called "Five Ducking Digits" published Friday. The post-merge cryptocurrency volition person the characteristics of a commodity-linked enslaved and volition person an intrinsic yield, helium said.

Researchers expect Ethereum's impending merge betwixt the mainnet and the beacon chain proof-of-stake strategy to hap by end-June. Last month, developers successfully launched the testnet. Once the modulation to proof-of-stake is complete, users volition beryllium capable to acceptable speech – oregon involvement – coins successful a cryptocurrency wallet to enactment web operations successful instrumentality for recently minted coins.

In different words, the staked ether becomes a revenue-generating asset, akin to a fixed-income information specified arsenic a authorities bond. The non-staked ether would possibly inactive person the commodity-like function. Gas is the fee, oregon pricing value, required to successfully behaviour a transaction oregon execute a declaration connected the Ethereum blockchain level and is priced successful ether.

"The ETH 2.0 merge acceptable to hap aboriginal this twelvemonth volition wholly morph Ethereum into a Proof of Stake (POS) validated blockchain," Hayes said. "The autochthonal rewards issued to validators successful the signifier of ETH-based issuance and web fees for staking ETH successful validator nodes renders ETH a bond."

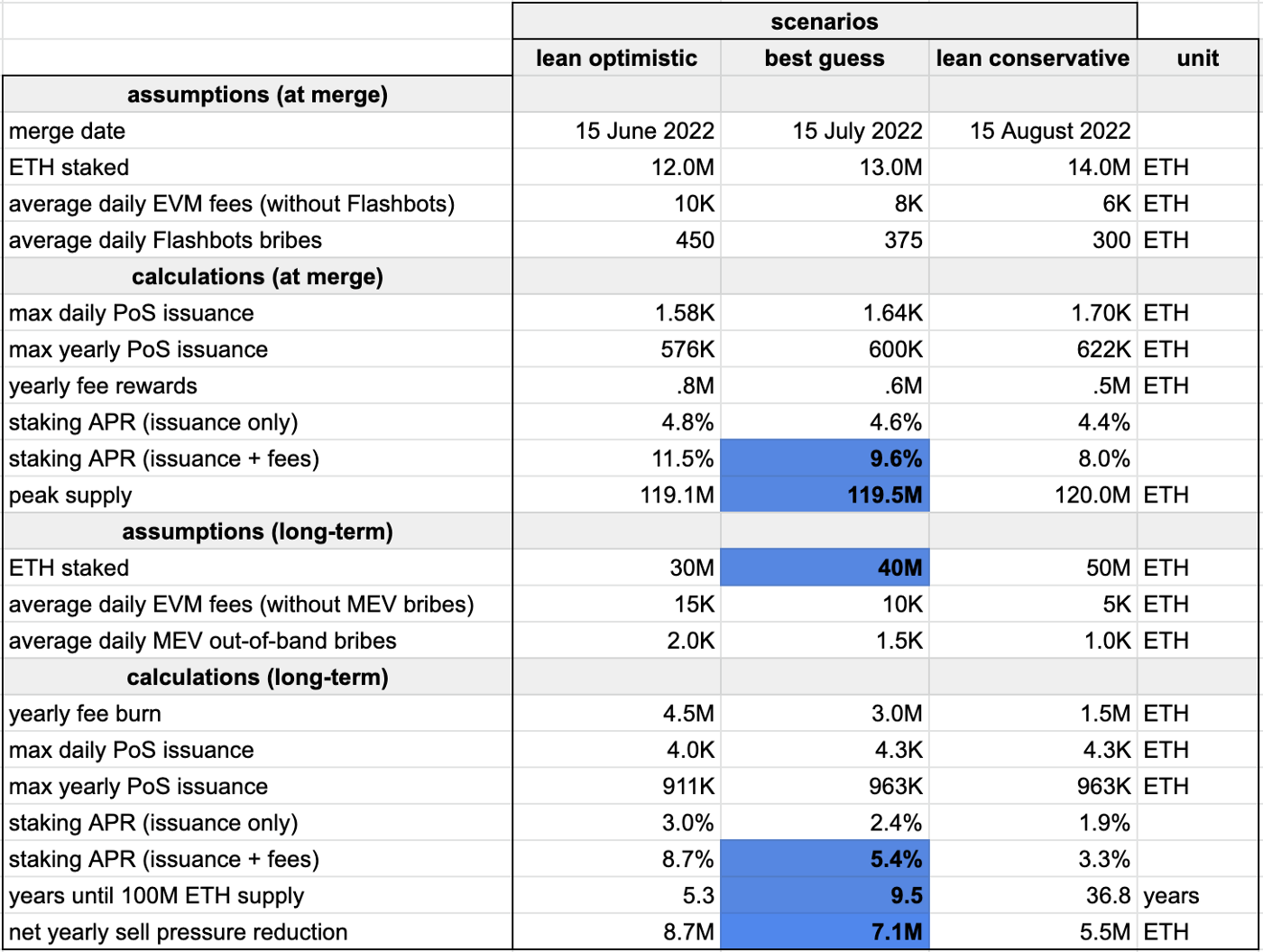

An entity needs to person astatine slightest 32 ETH to go a afloat validator. Per manufacture experts, annualized ether staking yields are apt to beryllium successful the scope of 10% to 15%, implying affirmative returns erstwhile adjusted U.S. inflation.

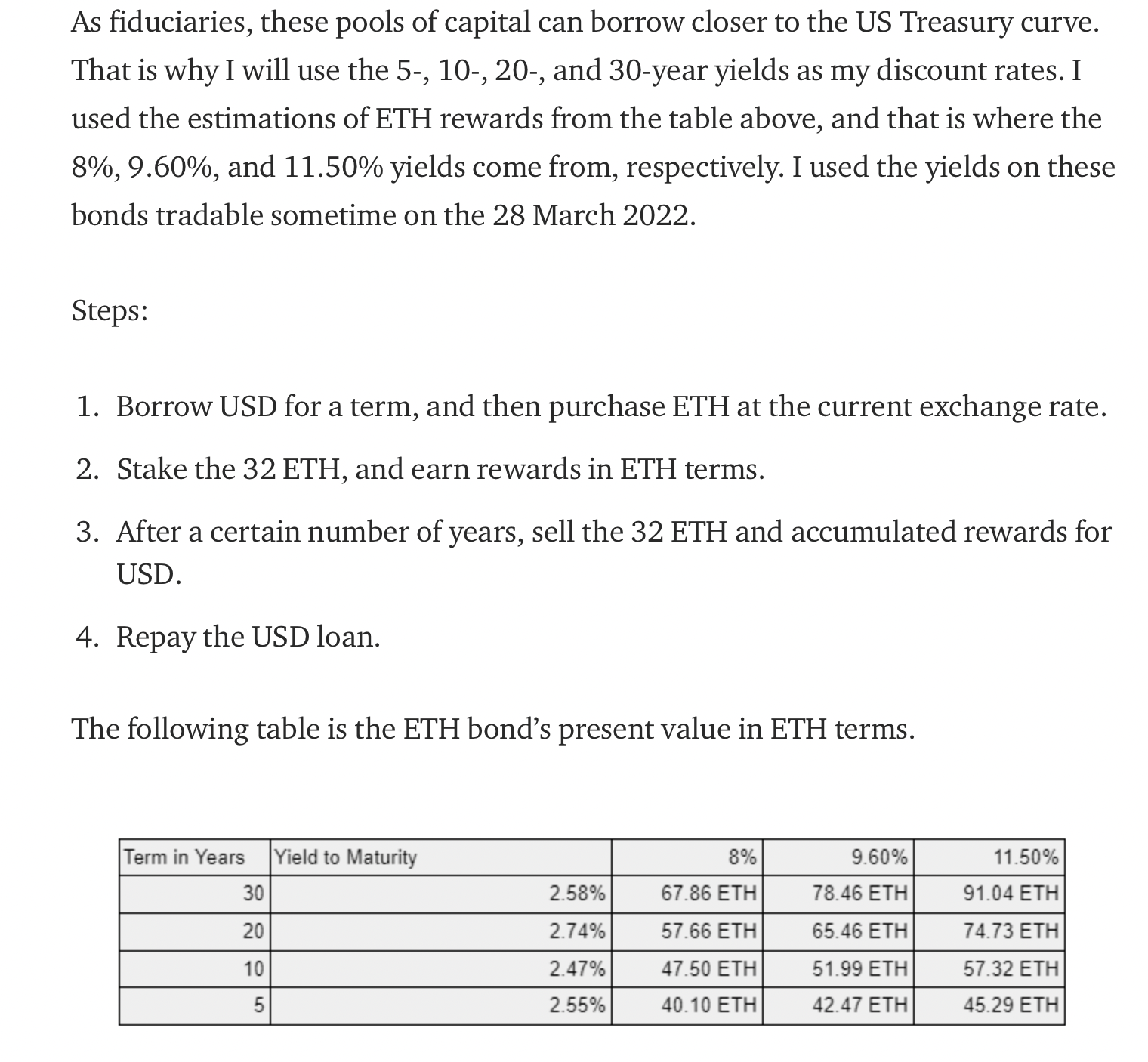

According to Hayes, the classification of ether arsenic a enslaved could spot wealth managers instrumentality connected vulnerability to the second-largest cryptocurrency. "If we tin person the fiduciaries that the classification of ETH is simply a enslaved alternatively than a currency, past a full caller acceptable of fiduciary clowns tin beryllium mentally primed to allocate into the ecosystem," Hayes noted, adding that fiduciaries tin marque a transportation commercialized erstwhile ETH rests successful a enslaved basket.

A transportation commercialized is simply a strategy of borrowing astatine a low-interest complaint and investing successful an plus that provides a higher complaint of return. The trader profits from the dispersed betwixt the involvement rates.

According to Hayes, fiduciaries tin get U.S. dollars astatine rates equivalent to Treasury yields to acquisition 32 ETH, which volition beryllium staked. The full Treasury output curve is beneath 2.5%, according to information provided by charting level TradingView, which means the outgo of getting dollars is importantly little than the forecast staking yields.

(Arthur Hayes)

The hazard is simply a imaginable descent successful ether's dollar price. That's akin to 1 associated with section currency bonds – wherever the issuer's home currency and the borrowed currency are the same.

However, according to Hayes, for investors to suffer wealth connected a five-year ether section currency bond, the token's terms would person to diminution by astir 30%, assuming an 11.5% output – the precocious extremity of researcher Justin Drake's estimates. Further, investors tin merchantability a one-year ETH/USD futures declaration to hedge the downside risk. "The broker quoted maine a mid-market premium of +6.90%. That means to hedge my section currency ETH bond, I really RECEIVE income," Hayes wrote.

"I merchantability the ETH/USD guardant astatine a premium to spot. This is simply a affirmative transportation trade. There are precise fewer trades successful which you get a higher output investing overseas currency bonds, and the enactment of hedging backmost into your location currency really earns you money," helium said.

Hayes besides argued that much institutions mightiness follow ether pursuing the merge due to the fact that the proof-of-stake mechanics is considered much environmentally affable than the supposedly energy-intensive proof-of-work mechanism.

"This information [ETH's post-merge bond-like appeal], paired with ETH 2.0’s ESG-compliant statement (another stamp of intelligence ossification), and protocol metrics that are much charismatic than the cadre of layer-1 (L1) “ethereum killers” makes ETH supremely undervalued connected a comparative ground vs. Bitcoin, fiat, and different L1 competitors," Hayes said, adding that MicroStrategy should contented debt and acquisition ether alternatively of bitcoin.

Ether's options marketplace has seen accrued enactment successful higher onslaught telephone options successful the aftermath of Hayes' bullish forecast. According to Patrick Chu, manager of organization income and trading astatine over-the-counter tech level Paradigm, astir 7,000 contracts of the $10,000 ether December expiry telephone options changed hands implicit the weekend.

A telephone enactment gives the purchaser the close but not the work to bargain the underlying plus astatine a predetermined terms connected oregon earlier a circumstantial date. A telephone purchaser is implicitly bullish connected the market.

Ether was past trading adjacent $3,480, down 1% connected the day, CoinDesk information show.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Sign up for Crypto Long & Short, our play newsletter featuring insights, quality and investigation for the nonrecreational investor.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)