The Federal Reserve’s astir caller league of the Federal Open Market Committee (FOMC) wrapped up, leaving involvement rates arsenic they were. The market, expecting complaint reductions successful 2024 and influenced by Fed Chair Jerome Powell’s dovish stance, reacted positively. This uplift was evident successful the emergence of U.S. stocks, the crypto economy, and precious metals similar golden and silver.

Federal Reserve Maintains Current Rates, Eyes Potential Reductions successful 2024

Following the FOMC’s latest announcement, fiscal benchmarks displayed a bullish trend. Major U.S. banal indices saw important growth, mirroring the market’s upbeat temper post-meeting. The crypto sector besides rallied, signaling a important 3.66% increase, with bitcoin (BTC) ascending 4%. Moreover, accepted safe-haven assets similar gold and silver roseate by 2.41% and 4.48%, respectively, reflecting a wide optimistic effect to the Fed’s decision.

In his comments aft the meeting, Powell discussed the contiguous economical situation. He stated the system isn’t presently successful a recession, but didn’t disregard the imaginable of 1 adjacent year. Powell underlined the request for cautious monetary policy, saying, “We are precise focused connected not making the mistake of keeping rates excessively precocious excessively long.” He further acknowledged the advancement connected halfway ostentation and non-housing services inflation. His comments suggested a cautious yet adaptive attack to aboriginal monetary argumentation adjustments.

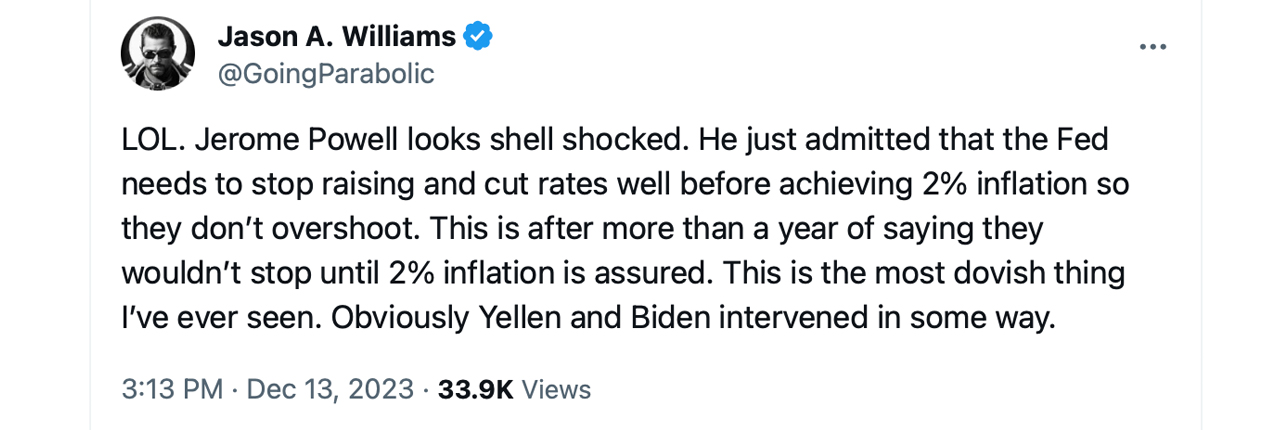

Contrary to immoderate market speculations, further complaint hikes look unlikely. Powell indicated a displacement successful the cardinal bank’s policy, hinting that the existent argumentation complaint is apt astatine oregon adjacent its highest for this tightening cycle. This is important arsenic it aligns with the speculators’ belief that the Fed whitethorn beryllium done hiking rates and that cuts could beryllium connected the skyline successful 2024. The FOMC’s connection and Powell’s remarks, highlighted the Fed’s committedness to returning ostentation to its 2% target, but the method to execute this appears to beryllium evolving.

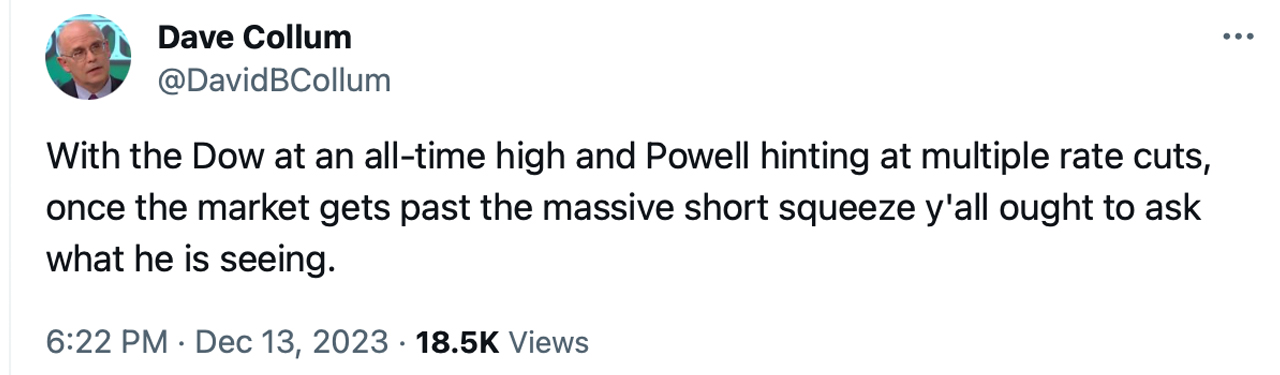

Several marketplace experts weighed successful post-Powell’s speech. Economist Peter Schiff commented connected societal media level X, “The lone crushed Powell tin assertion helium won the ostentation warfare without inflicting immoderate collateral harm connected the system oregon employment is due to the fact that helium didn’t really win, helium surrendered,” Schiff added. “The lone crushed the phony system and bull marketplace are inactive live is that ostentation is not dead.”

Sven Henrich of Northman Trader offered his insights. “By further fanning the occurrence of easing fiscal conditions Powell has abandoned each his erstwhile pugnacious speech which the marketplace had already ignored anyways,” Henrich wrote. “The credibility demolition is present complete.” Henrich added:

Powell claims the Fed is astatine a restrictive argumentation level portion fiscal conditions person eased to the aforesaid escaped levels they were erstwhile they started raising rates.

The X relationship known arsenic “QE Infinity” posted, “Powell conscionable poured a elephantine tin of lighter fluid connected a occurrence that was astir to [burn out]. Consequences beryllium damned.” The FOMC’s prime to support the national funds complaint was influenced by assorted factors, including persistent ostentation worries and the broader economical climate.

However, portion Powell’s code indicated that complaint hikes are nearing their bounds and reductions mightiness hap successful 2024, the CME Fedwatch instrumentality predicts a complaint summation astatine the adjacent FOMC gathering successful January. The marketplace anticipates a hike with a probability of 89.7%, portion 10.3% foresee nary change.

What bash you deliberation astir the Fed’s stance close now? Do you expect much hikes oregon complaint cuts successful the future? Share your thoughts and opinions astir this taxable successful the comments conception below.

2 years ago

2 years ago

English (US)

English (US)