Equities, crypto markets, and precious metals did good during the aboriginal greeting trading sessions connected Wednesday, conscionable earlier the U.S. cardinal slope wrapped up its Federal Open Market Committee (FOMC) meeting. While the Fed said successful a connection that the benchmark involvement complaint would emergence soon, the cardinal bank’s pb Jerome Powell said the committee “is of a caput to rise the national funds complaint astatine the March meeting.” Powell’s statements pursuing the meeting, alongside discussions of reducing the equilibrium sheet, were viewed arsenic hawkish among investors and planetary markets dipped successful value.

FOMC Says It Plans to Raise the Federal Funds Rate ‘Soon,’ Fed Chair Jerome Powell Insists Rates Will Change successful March

Following a week of dismal markets, the highly anticipated Federal Open Market Committee (FOMC) gathering took place, and members of the committee unanimously approved the determination to support rates astatine near-zero levels.

“With ostentation good supra 2 percent and a beardown labour market, the Committee expects it volition soon beryllium due to rise the people scope for the national funds rate,” the FOMC said successful a connection connected Wednesday. While the fiscal institution’s connection highlighted “soon,” it meant that the U.S. cardinal slope plans to support the baseline involvement complaint scope untouched, astatine slightest for now.

“Inflation risks are inactive to the upside successful the views of astir FOMC participants, and surely successful my presumption arsenic well. There’s a hazard that the precocious ostentation we are seeing volition beryllium prolonged. There’s a hazard that it volition determination adjacent higher. So, we don’t deliberation that’s the basal case, but, you asked what the risks are, and we person to beryllium successful a presumption with our monetary argumentation to code each of the plausible outcomes,” Powell explained to the property league attendees.

“Inflation risks are inactive to the upside successful the views of astir FOMC participants, and surely successful my presumption arsenic well. There’s a hazard that the precocious ostentation we are seeing volition beryllium prolonged. There’s a hazard that it volition determination adjacent higher. So, we don’t deliberation that’s the basal case, but, you asked what the risks are, and we person to beryllium successful a presumption with our monetary argumentation to code each of the plausible outcomes,” Powell explained to the property league attendees.Fed president Jerome Powell spoke aft the gathering and explained that the benchmark complaint whitethorn emergence successful March. Powell besides noted that getting the Fed’s equilibrium expanse down volition instrumentality immoderate time.

“The equilibrium expanse is substantially larger than it needs to be,” Powell told the press. “There’s a important magnitude of shrinkage successful the equilibrium expanse to beryllium done. That’s going to instrumentality immoderate time. We privation that process to beryllium orderly and predictable.” As everyone was inactive clinging to the FOMC’s “soon” statement, Powell stressed:

The committee is of a caput to rise the national funds complaint astatine the March gathering assuming that the conditions are due for doing so.

Stocks, Crypto Markets, Precious Metals Sink Lower Following Fed Statements

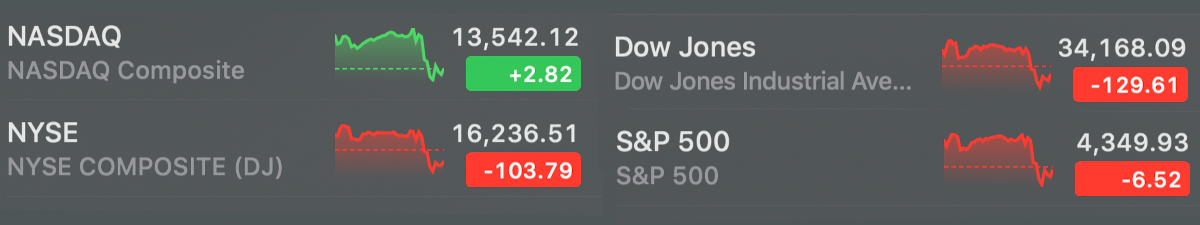

When banal markets closed, NYSE dipped 103 points, and the Dow Jones Industrial Average was down astir 129 points. Nasdaq’s scale managed to enactment supra a fewer percentages and S&P 500 shed a fewer percentages.

The terms of 1 ounce of .999 good golden slipped 1.77%, and the worth of 1 ounce of .999 good metallic mislaid 2.48%. Of course, golden bug and economist Peter Schiff threw successful his 2 cents astir the Fed’s gathering and Powell’s statements.

“Powell said the Fed volition statesman shrinking its equilibrium expanse astatine the due time,” Schiff tweeted. “He past said helium truly has nary thought erstwhile that whitethorn beryllium arsenic the FOMC hasn’t adjacent discussed that yet. Really? What precisely bash they speech astir erstwhile they meet, sports? We’re screwed and they cognize it.” A fewer radical trolled Schiff due to the fact that the terms of golden slipped aft Powell’s statements.

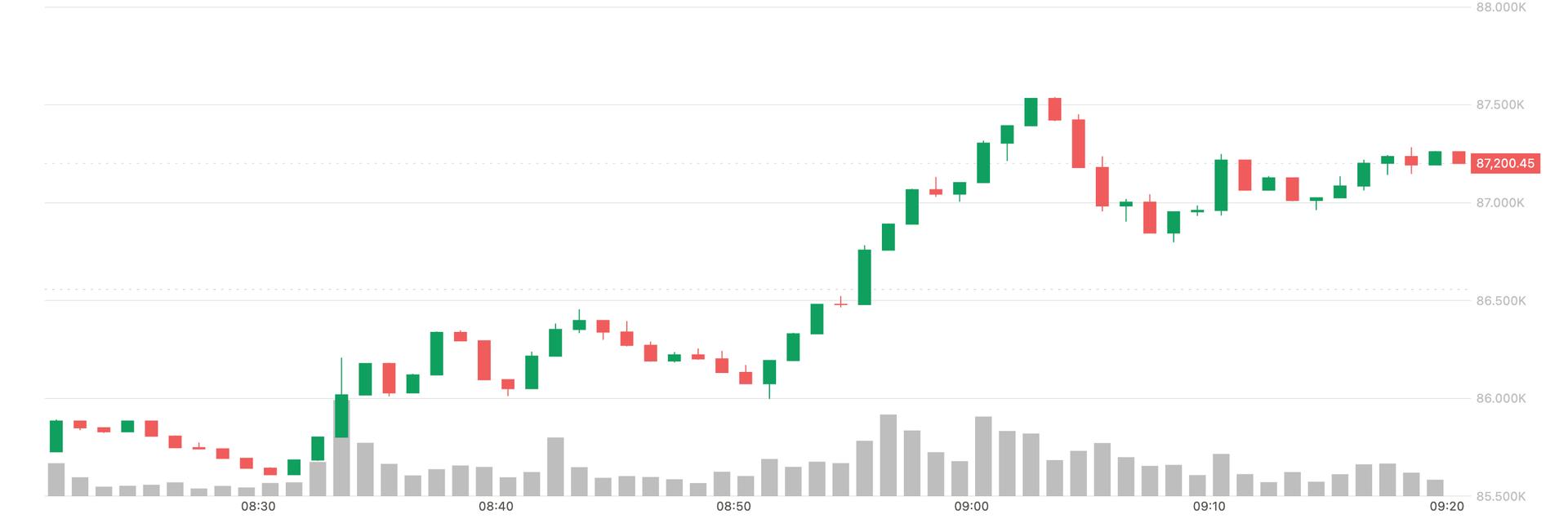

The planetary cryptocurrency marketplace capitalization didn’t bash excessively good either, arsenic it dropped much than 2% to 1.71 trillion. The starring crypto plus bitcoin (BTC) was rather volatile and wrong 2 five-minute candles earlier the Fed’s statements were published, BTC jumped from $37,400 to $38,946 connected Bitstamp.

BTC/USD five-minute illustration via Bitstamp astatine 2:00 p.m. (EST) connected January 26, 2022.

BTC/USD five-minute illustration via Bitstamp astatine 2:00 p.m. (EST) connected January 26, 2022.Metrics amusement bitcoin (BTC) had a 24-hour terms scope betwixt $35,300 and $39,310 per portion during the people of the day. Many different apical 10 crypto assets mislaid betwixt 2% to 7% a fewer hours pursuing Powell’s statements.

Tags successful this story

analyst, baseline involvement rate, Benchmark Rate, Bitcoin (BTC), BitStamp, Crypto markets, Cryptocurrencies, DOW, economics, Economist, Fed, Federal Open Market Committee, Federal Reserve, FOMC, gold, Gold Bug, jerome powell, Macro, macroeconomics, Markets, Nasdaq Index, NYSE, Peter Schiff, PMS, Precious Metals, price changes, S&P 500, silver, Stock Markets, stocks

What bash you deliberation astir the FOMC gathering and Jerome Powell’s statements? What bash you deliberation astir the marketplace absorption that followed? Let america cognize what you deliberation astir this taxable successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 5,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

3 years ago

3 years ago

English (US)

English (US)