On a sure-to-be historical time for Bitcoin, I spent the greeting looking backmost astatine humanities information to spot however impactful the archetypal Gold ETF was astatine the time. We’ve seen plentifulness of analysts, including our own, speech astir however Gold ETFs changed the scenery for the commodity, starring to outsized gains implicit the proceeding 20 years. Yet, what was it truly similar astatine the time? Did golden detonate connected time one, oregon did it instrumentality time? Let’s excavation in.

First, let’s look astatine the timeline of the applicable exchange-traded products we volition look at.

On Nov. 18, 2004, State Street Corporation launched SPDR Gold Shares (GLD), acquiring $114,920,000 successful assets nether absorption connected motorboat and $1 cardinal successful its archetypal 3 trading days.

On Oct. 19, 2021, ProShares launched ProShares Bitcoin Strategy ETF (BITO), which had $570 cardinal successful inflows connected day one, hitting $1 cardinal successful assets the adjacent day.

On Jan. 11, 2024, eleven spot Bitcoin ETFs volition motorboat successful the U.S. with $115.88 cardinal nether absorption via the sponsors’ effect funds. This means erstwhile they’ve taken $115 cardinal successful inflows, issuers similar BlackRock, Ark, VanEck, and institution volition bargain Bitcoin from the unfastened marketplace via Coinbase and Gemini, conscionable similar the remainder of us.

Thus, earlier trading commences (removing Grayscale, which is converting its trust* into an ETF that already has $28.58 cardinal successful AUM), the combined spot Bitcoin ETFs volition person surpassed GLD’s time 1 trading. If we see Grayscale, spot Bitcoin ETFs person much assets nether absorption than golden did for the archetypal 5 years. GLD didn’t garner $29 cardinal successful AUM until Feb. 12, 2009.

However, to beryllium fair, it was nary longer the lone golden ETF by this point. BlackRock launched its iShares® COMEX® Gold Trust successful 2005. Combined with GLD, golden ETFs reached an equivalent AUM astir Feb. 10, 2009, with IAU obtaining $2 billion successful assets by the extremity of Q1 2009.

By the extremity of 2009, 3 gold-backed ETFs were traded successful the United States: ETFS Physical Swiss Gold Shares, SPDR Gold Shares, and iShares Comex Gold Trust.

| Bitwise | 20 |

| VanEck | 72.50 |

| Valkyrie | 0.52 |

| Franklin Templeton | 2.60 |

| WisdomTree | 4.95 |

| Invesco Galaxy | 4.85 |

| BlackRock | 10 |

| Ark | 0.46 |

| Grayscale | 2,858 |

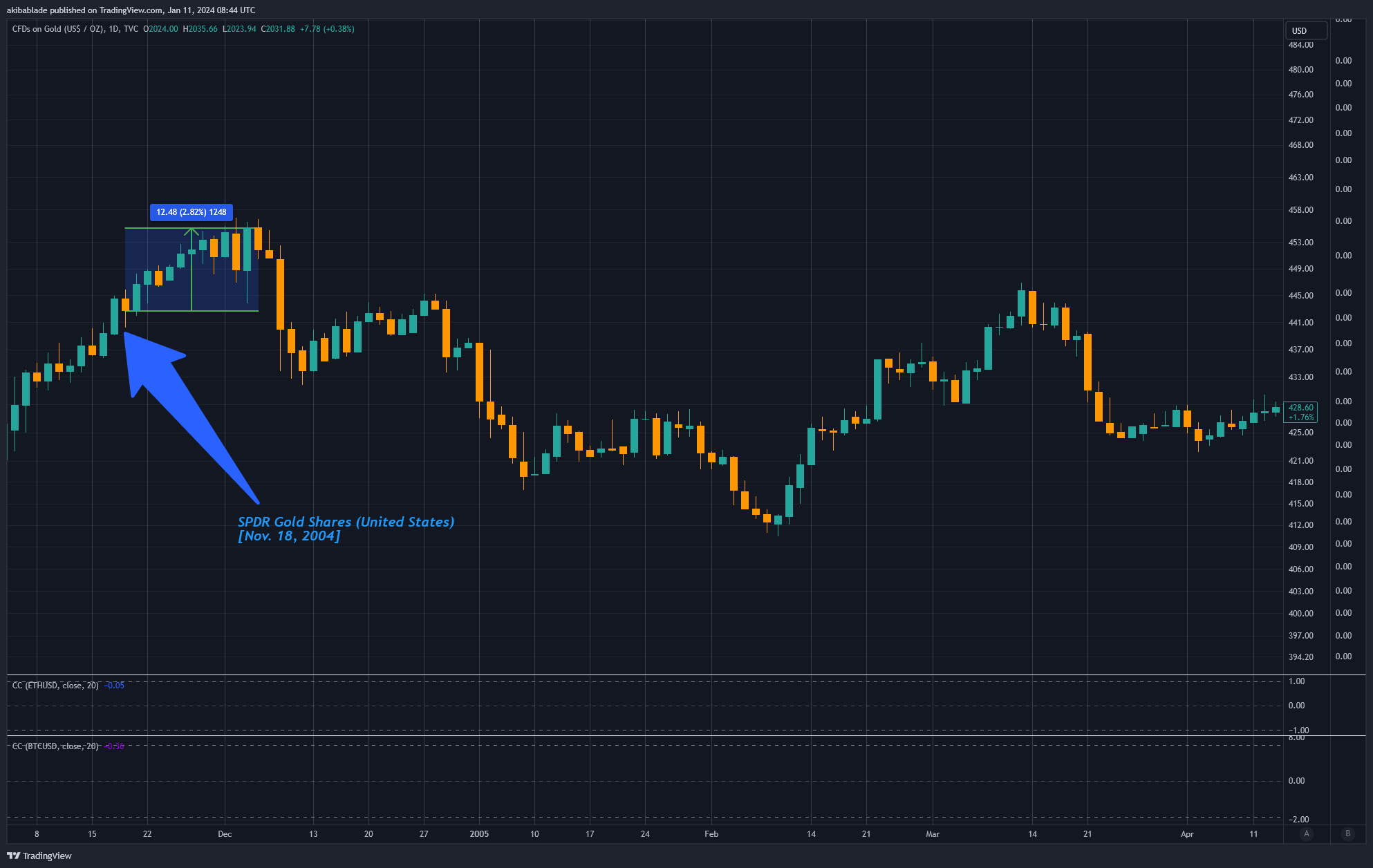

How did GLD commercialized astatine launch?

The archetypal golden ETF was launched successful the U.S. connected Nov. 18, 2004, and wrong 12 days, the terms of golden was up conscionable 2.82%.

Gold Price (Source: TradingView)

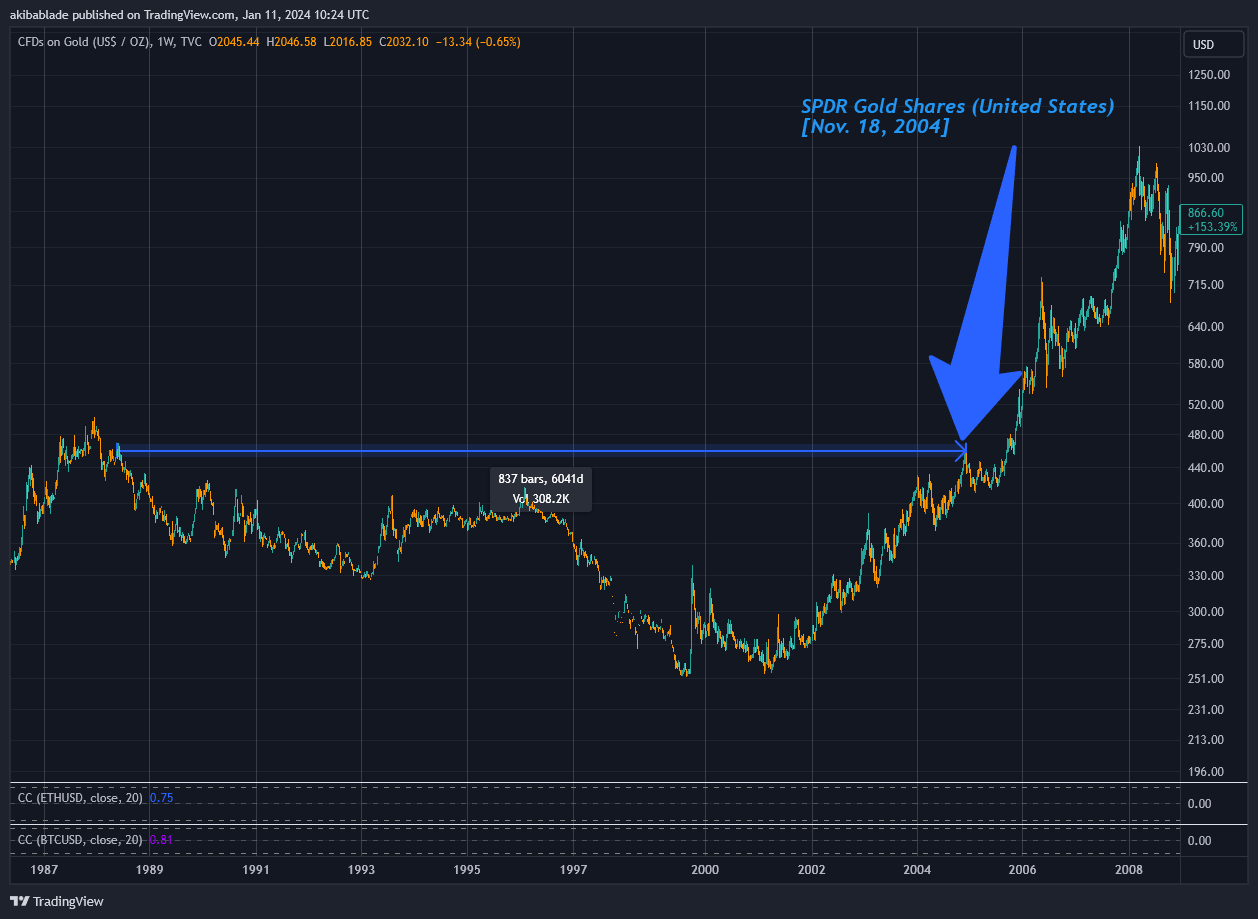

Gold Price (Source: TradingView)This marked a sixteen-year precocious for gold, which had not reached $453 per ounce since May 1988. However, it was not astatine an all-time high. In fact, it would instrumentality different 4 years earlier that would occur.

Gold Price (Source: TradingView)

Gold Price (Source: TradingView)Following the section precocious successful Dec. 2004 astatine $453.40, golden went connected a prolonged downward trajectory, with the terms down 4% implicit the adjacent six months. On its sixth-month birthday, GLD had acquired $2.4 cardinal successful assets nether management, with golden priced astatine $419.75.

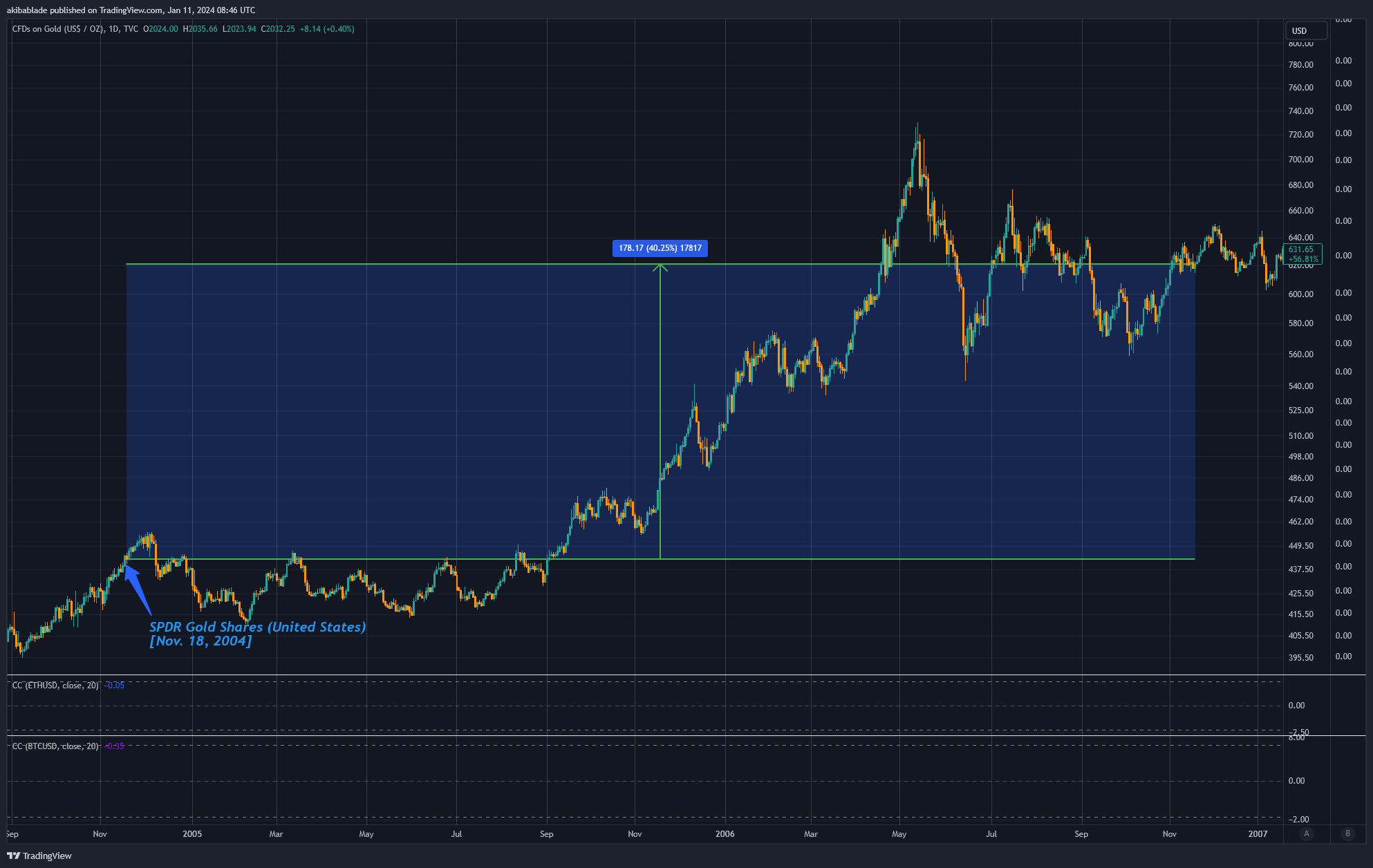

Gold Price (Source: TradingView)

Gold Price (Source: TradingView)However, things started to get overmuch amended for the flagship commodity. By Nov. 2004, connected the day of its launch, golden had risen to $485,85, up 8.15% since launch. Thus, golden was up little than Bitcoin aft a twelvemonth and could plaything connected a Gary Gensler tweet. Far from the earth-shattering interaction galore foretell from the examination to the golden ETF launch.

Gold Price (Source: TradingView)

Gold Price (Source: TradingView)As GLD turned 2 connected Nov. 18, 2006, golden was up to $620.50, an summation of astir 40%.

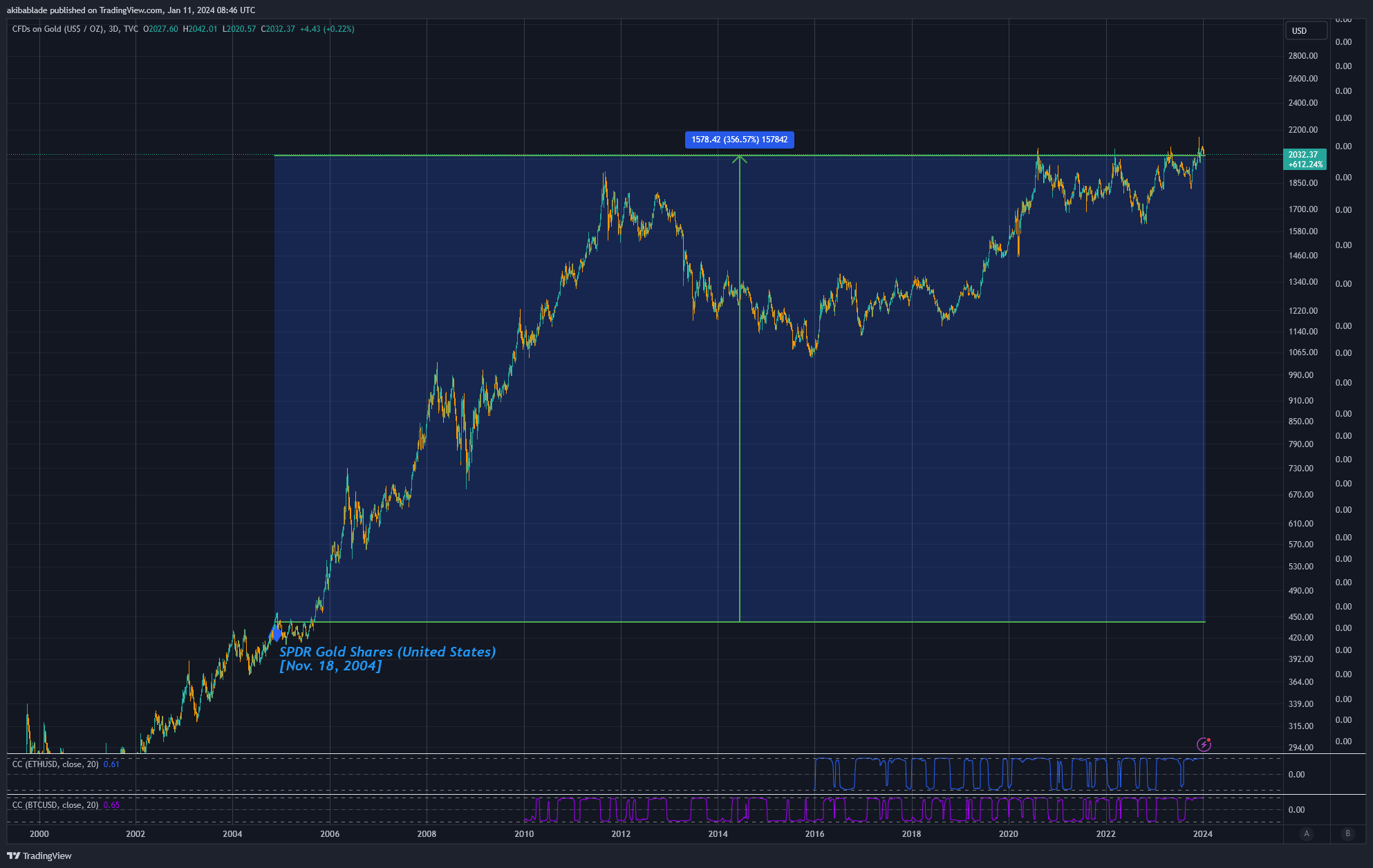

Gold Price (Source: TradingView)

Gold Price (Source: TradingView)Today, golden is priced astatine astir $2,032 arsenic of property clip and a staggering 356%. However, that is connected a astir 20-year timeframe. By comparison, were Bitcoin priced astatine $210,000 connected Jan. 11, 2044, however galore investors would beryllium blessed with that return? Following gold’s trajectory, that’s the terms constituent we’d beryllium looking at.

Gold Price (Source: TradingView)

Gold Price (Source: TradingView)However, golden and Bitcoin are similar comparing apples with oranges. While we whitethorn sermon Bitcoin arsenic integer gold, it is undoubtedly overmuch more.

Let’s commencement by looking astatine golden successful narration to the M2 wealth proviso successful the U.S. M2 is simply a wide measurement of the wealth supply. It includes each components of M1 (notes and coins, checking accounts, different checkable deposits, traveler’s checks) plus savings deposits, small-denomination clip deposits (time deposits successful amounts of little than $100,000), and balances successful retail wealth marketplace funds.

M2 lone excludes ample deposits, organization wealth marketplace funds, short-term repurchase agreements, and different much sizeable liquid assets, making it a applicable semipermanent metric to measure the spending powerfulness of the U.S. dollar.

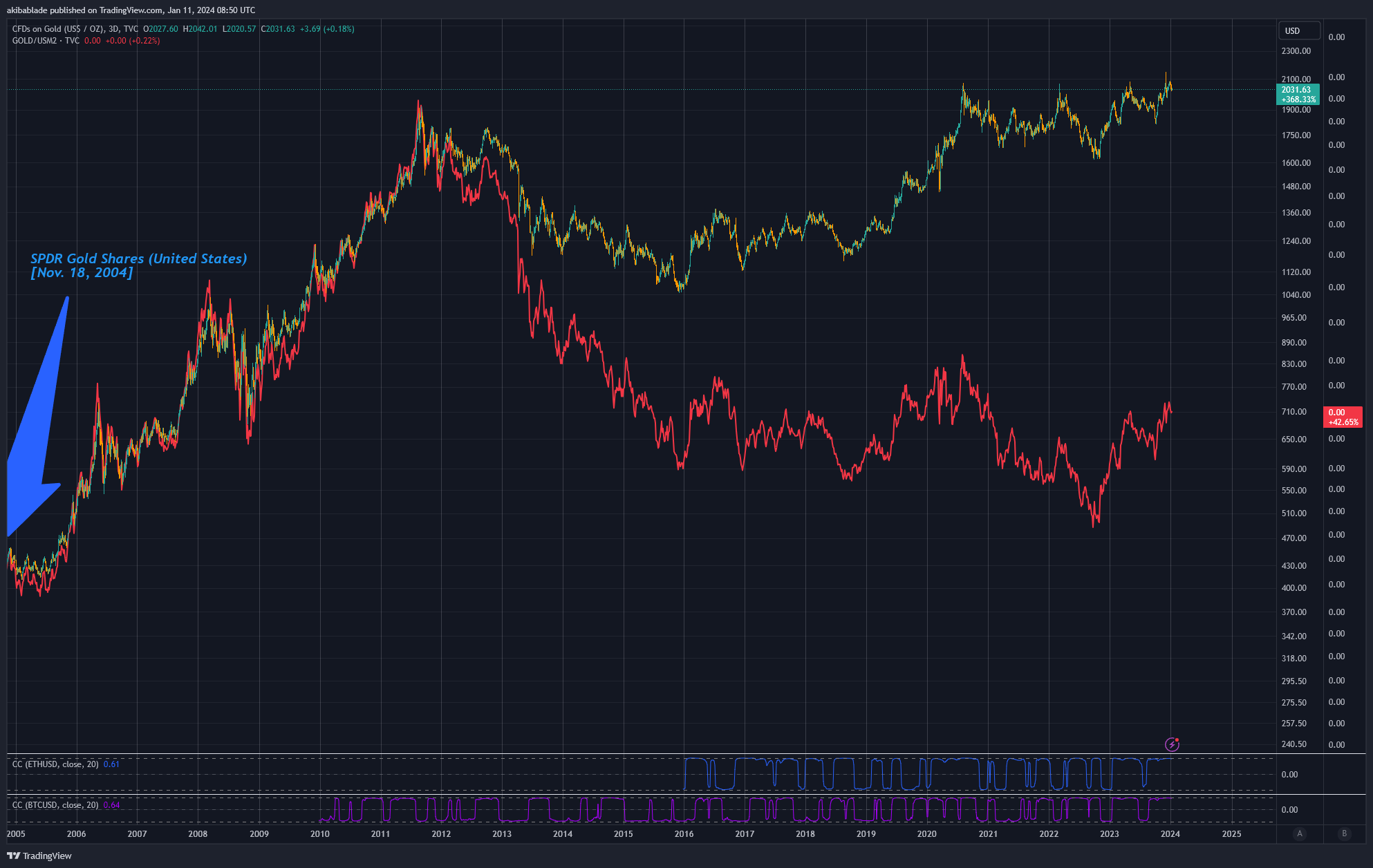

When adjusted for the M2 supply, golden is up conscionable 42%. Gold followed Gold/M2 beauteous tightly from 2004 until 2012, and portion the dollar terms of golden continued to rise, Gold/M2 has been connected a downtrend ever since.

Gold Price vs. M2 Money Supply (Source: TradingView)

Gold Price vs. M2 Money Supply (Source: TradingView)Comparisons with Bitcoin

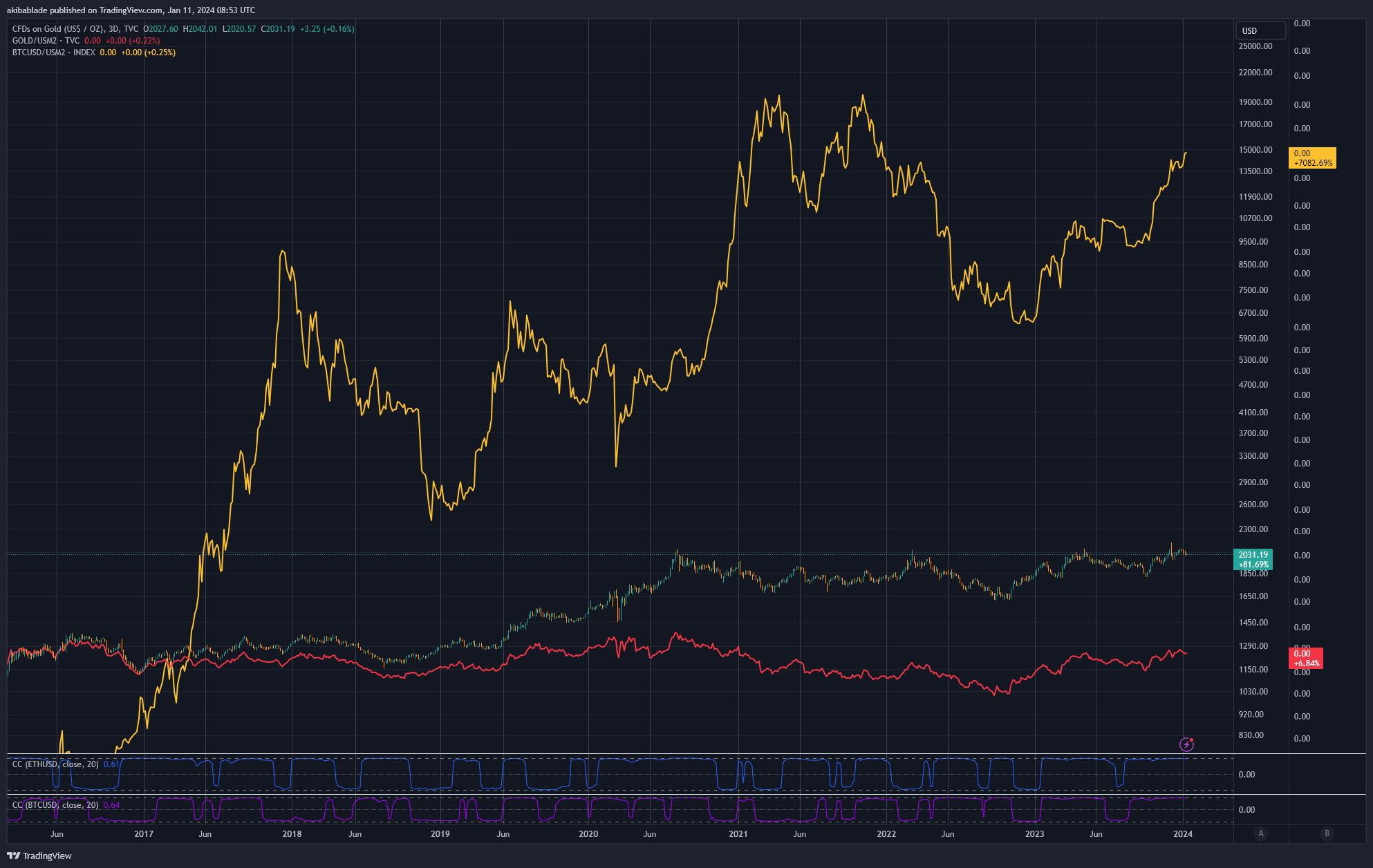

As we can’t comparison Bitcoin implicit the aforesaid play arsenic it was not launched until 2009, and its terms find was highly volatile during its aboriginal days, I’ve utilized 2015 – 2024 successful the illustration beneath to comparison Gold/M2 to Bitcoin/M2.

As you tin see, Bitcoin has performed importantly amended than golden (7,082%) implicit the past decade, adjacent accounting for the 70% summation successful the fig of dollars included successful the M2 supply.

Gold Price vs. M2 Money Supply vs. Bitcoin (Source: TradingView)

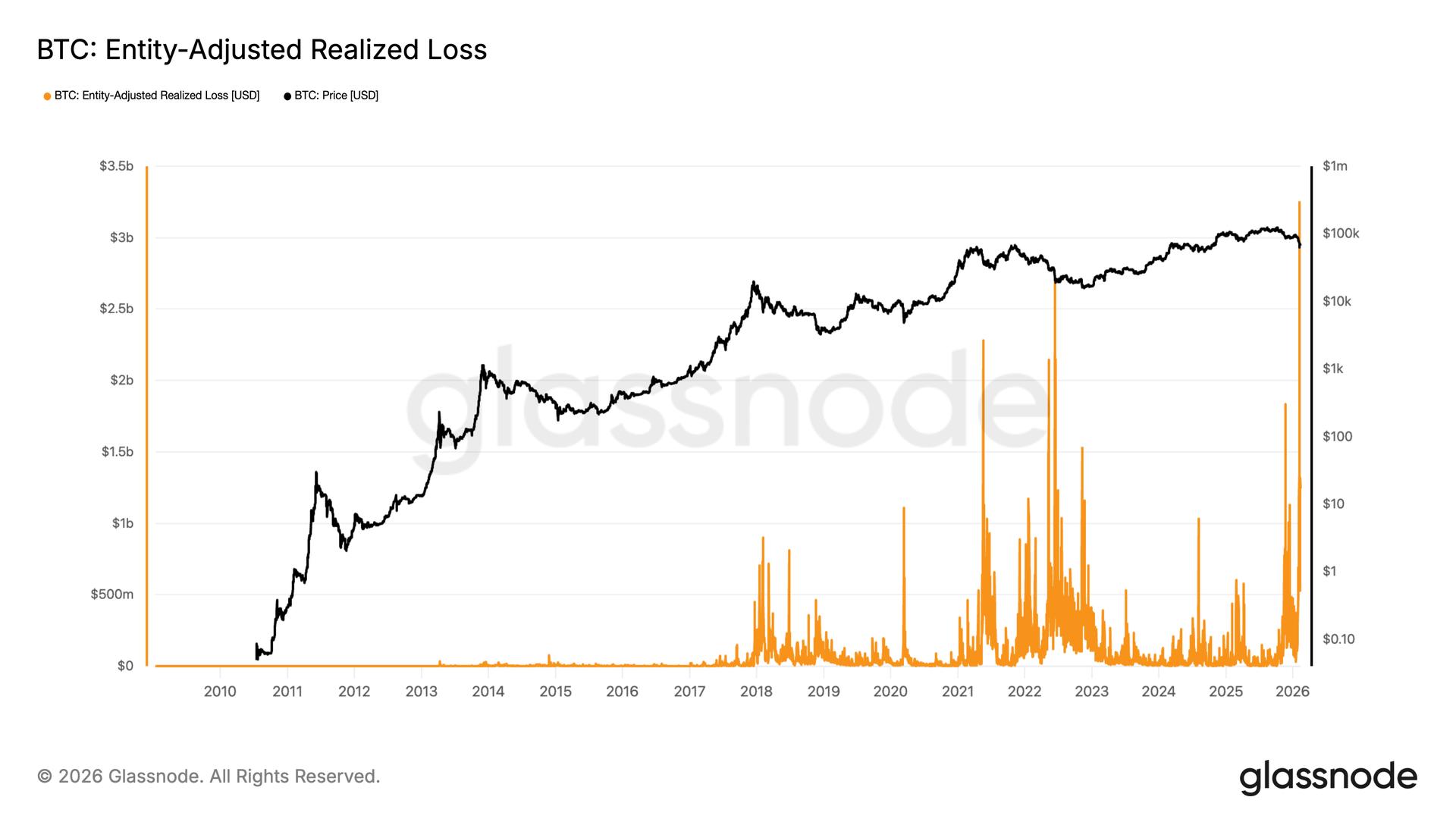

Gold Price vs. M2 Money Supply vs. Bitcoin (Source: TradingView)However, not lone has Bitcoin shown to summation adjacent against dollar dilution, but it besides has a fixed proviso and choky marketplace dynamics. Only 30% of each Bitcoin successful circulation has been traded wrong the past 12 months.

Bitcoin’s proviso is capped astatine 21 cardinal coins, making it fundamentally scarce. This scarcity is simply a important operator of its value, akin to precious metals similar gold. However, Bitcoin’s proviso is predictably finite, dissimilar gold, wherever caller reserves tin beryllium discovered and mined. The introduction of the spot Bitcoin ETFs is apt to amplify the scarcity effect.

As much investors bargain into the ETF, a information of Bitcoin’s constricted proviso volition beryllium locked up to backmost these concern products, reducing the disposable proviso for regular trading connected unfastened markets. This decreased proviso could pb to terms appreciation, particularly successful the look of expanding request (often spurred by easier entree done fiscal products similar ETFs). There is besides a cyclical effect present whereby ETF issuers indispensable capable baskets of shares with Bitcoin from the unfastened market.

Moreover, the information that 70% of the existent circulating proviso of Bitcoin hasn’t moved successful implicit a twelvemonth indicates a robust holding behaviour among existent Bitcoin owners. This holding signifier reduces the effectual circulation of Bitcoin, further enhancing its scarcity.

When semipermanent holders clasp a important information of an asset, immoderate summation successful demand, specified arsenic that generated by the motorboat of a caller concern conveyance similar the spot Bitcoin ETFs, tin person a disproportionate effect connected the price. There’s little proviso disposable to conscionable this caller demand.

This behaviour contrasts with gold, wherever holding patterns are much divers and see important concern and jewelry use, which tin dampen the scarcity-driven terms appreciation seen successful assets similar Bitcoin.

Thus, portion golden has seen exceedingly coagulated gains implicit the past 20 years, comparing its ETF-fueled maturation to Bitcoin may, successful reality, beryllium exceedingly underwhelming.

It’s important to enactment that request for Bitcoin successful narration to its scarcity inactive has to correlate to its request astatine the asking price. It’s improbable that Bitcoin volition person the aforesaid request astatine $1 cardinal per coin arsenic it would astatine $1 per coin, for instance. In my view, this is wherever the rubber meets the road; astatine what terms does the request for Bitcoin change?

Digging into the numbers – Bitcoin vs golden AUM

Yesterday, Bitcoin traded $52 cardinal crossed each exchanges astatine astir $45,000 – $47,000.

Around 6.2 cardinal BTC are successful the marketplace (they moved wrong the past 12 months). Glassnode estimates astir 7.9 cardinal coins person been mislaid oregon are improbable to determination immoderate clip soon. Given the existent circulating proviso of astir 19.59 million, we tin frankincense estimation a liquid excavation of betwixt 6.2 and 11.6 cardinal coins disposable for purchase.

At today’s value, this equates to astir $291 to $545 cardinal successful liquid coins successful the market, oregon astir 10 times the regular measurement traded.

Thus, hypothetically, each of the 11 spot Bitcoin ETFs launching contiguous would request to get astir $49 cardinal successful AUM to devour up the full theoretical liquidity successful the market.

As of Jan. 10, 2024, the apical golden ETF, GLD, has an AUM of $56 billion. Assessing the wide apical ETFs, SPY has $483 billion, and IVV has $396 billion.

The full worth of assets nether absorption for each golden ETFs successful the U.S. is around $114 billion.

Thus, determination is surely country successful the marketplace for spot Bitcoin ETFs to get presently liquid coins, but it is inactive a choky market, and successful little than 100 days, it volition go adjacent tighter.

When analysts comparison the occurrence of a spot golden motorboat 20 years agone with the imaginable for Bitcoin to travel suit, I deliberation they whitethorn beryllium drastically underestimating the differences betwixt golden and ‘digital gold.’

Putting it into context, if BlackRock acquires the aforesaid AUM successful Bitcoin arsenic it has successful golden (roughly $27 billion,) it would beryllium 5% to 9% of each liquid Bitcoin connected the market. Moreover, determination are presently 2.35 cardinal BTC connected exchanges. So it would request to acquisition 24% of exchange-listed Bitcoin… astatine existent prices, that is.

Drawing connected the parallels and contrasts betwixt the humanities interaction of Gold ETFs and the imaginable power of the upcoming spot Bitcoin ETFs, it becomes evident that portion the occurrence of Gold ETFs was significant, the unsocial attributes of Bitcoin, specified arsenic its fixed proviso and prevailing holding patterns, could pb to an adjacent much profound interaction connected the market, accentuating the imaginable for a transformative effect acold beyond what was observed with gold.

The station Prediction: Bitcoin ETF volition present dwarf golden show based connected humanities data appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)