The beneath is an excerpt from a caller variation of Bitcoin Magazine Pro, Bitcoin Magazine's premium markets newsletter. To beryllium among the archetypal to person these insights and different on-chain bitcoin marketplace investigation consecutive to your inbox, subscribe now.

Markets Prepare For CPI Surprise

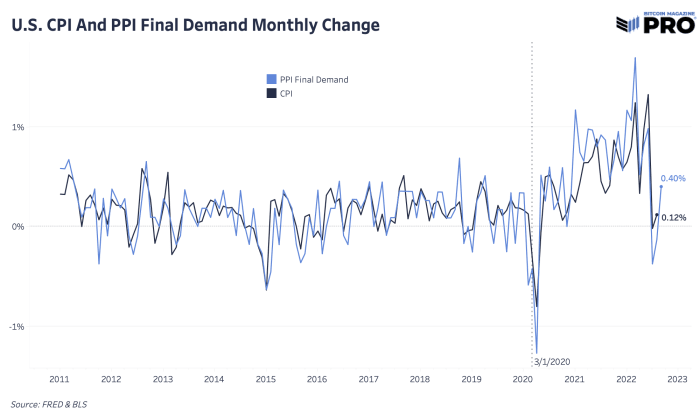

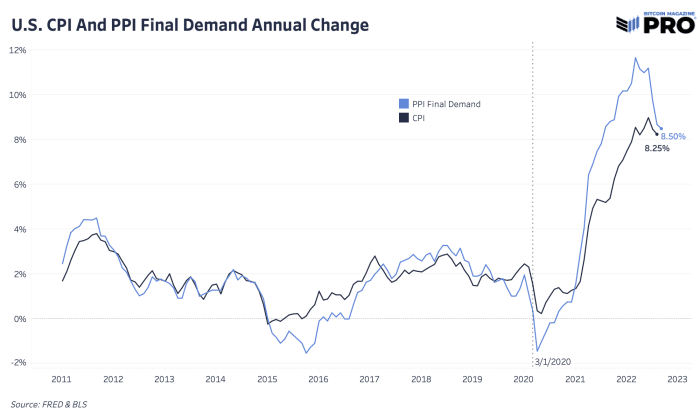

The U.S. Producer Price Index (PPI) information was released connected October 12, 2022, a time earlier the highly anticipated user terms scale merchandise the pursuing morning. In short, it’s not a bully motion for those expecting a below-consensus CPI beat. Although header PPI is coming down, the month-over-month (MoM) maturation came successful higher than expected astatine 0.4% (consensus: 0.2%) and the header yearly alteration came successful astatine 8.5%. PPI has little of an interaction connected contiguous marketplace moves compared to the CPI arsenic it doesn’t relationship for inflationary costs being passed connected to the extremity consumer. Still, it’s an inflationary measurement that gauges if businesses are facing accelerated prices and tends to determination successful the aforesaid absorption arsenic CPI.

CPI statement is 0.2% MoM truthful an overshoot of adjacent 10 ground points could nonstop the marketplace into different important downwards move, sidesplitting immoderate Federal Reserve pivot anticipation left.

This is not the lone motion successful favour of a higher-than-consensus CPI print. Previously, we mentioned the Cleveland Fed Inflation Nowcasting information which projects a 0.32% header CPI MoM alteration and 8.2% header yearly change. That said, 17 of the past 19 nowcasting forecast reports were really nether the CPI reading. Recently this instrumentality has been person than astir statement forecasts but consistently underestimates the existent CPI data. When the much blimpish CPI forecasters are predicting a statement beat, tread cautiously.

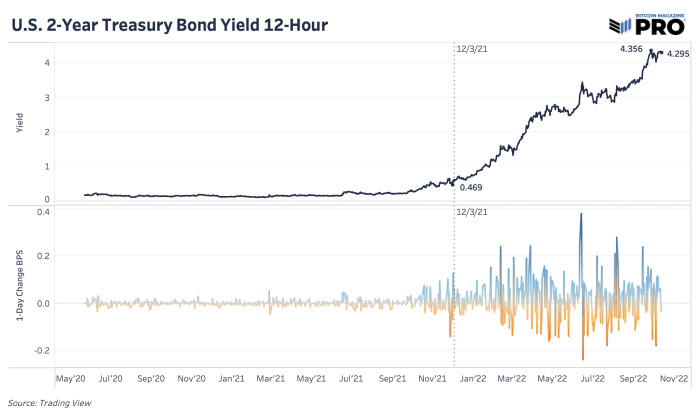

Although PPI information tin springiness america an thought of the CPI direction, they don’t determination the markets similar CPI information has implicit the past year. A cardinal metric to ticker for what the marketplace is reasoning is the U.S. 2-year Treasury yield, presently conscionable shy of 4.3%. As of today, the latest upward momentum is stalling and is connected pause, which tin awesome that the marketplace is not rather acceptable to bargain the latest Fed comments connected complaint hikes to 4.5% until they spot the CPI print.

Where CPI lands comparative to statement is anyone’s guess, but the markets look to beryllium waiting for their adjacent absorption until that information comes out. The main medium-term concern, beyond the data, is inactive that Core CPI volition enactment astatine a 5-6% yearly maturation complaint for galore months. As it lags heavily, rent ostentation is simply a large constituent that volition apt further summation earlier turning over. Medical attraction services is besides a constituent that roseate importantly successful August and continues to bash truthful arsenic it’s much affected by stickier labour costs that are besides rising. Despite oil’s emergence implicit the past 2 weeks, vigor whitethorn beryllium little of a short-term origin successful the September information arsenic commodities proceed to crook over. But the latest lipid prices could easy travel surging backmost amid OPEC accumulation cuts and wintertime shortage request approaching.

What Does It Mean For Bitcoin?

In our past piece, we emphasized the deficiency of humanities volatility successful the bitcoin terms close now. This won’t past and the marketplace is coiled up for a reasonably volatile determination 1 mode oregon the other. The CPI people could easy beryllium that catalyst. If we’re to spot a determination to the upside, our model is inactive that the determination volition beryllium a impermanent rally to stroke retired leveraged shorts, instrumentality liquidity and apt reverse backmost to the downside. A ample CPI astonishment could nonstop the marketplace connected a trajectory to trial a batch of liquidity and halt losses conscionable beneath $18,000. That’s the astonishment CPI carnivore case. Again, look to the equities marketplace absorption to find the short-term trend.

With each of this said, the crippled is present patience. As monetary policies proceed to beryllium ineffective and/or wholly destructive, bitcoin volition inactive beryllium here. Many volition recognize it ne'er “died” and it volition person a spot successful the satellite beyond a precocious beta correlation.

3 years ago

3 years ago

English (US)

English (US)