Almost each Bitcoin capitalist is anticipating a continued terms surge arsenic the crypto continues to commercialized around the $70,000 terms mark. On-chain information has shown a ample portion of this surge tin beryllium attributed to the accumulation by ample whales.

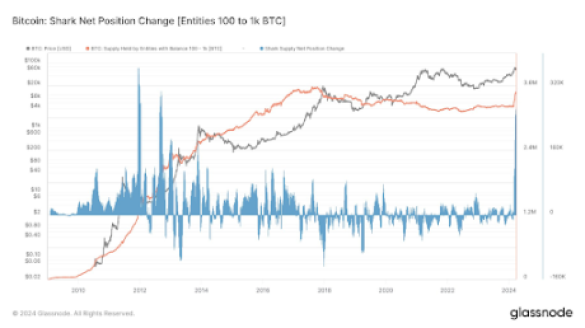

Bitcoin is undoubtedly location to a batch of these whale addresses holding hundreds of millions of dollars and with transactions that tin determination the market. However, on-chain information has further revealed that the accumulation inclination has besides flowed into the adjacent cohort of traders. These traders, besides known arsenic “Sharks,” are addresses that clasp betwixt 100 BTC and 1,000 BTC. According to Glassnode data, shark wallet addresses person accumulated 268,441 BTC successful the past 30 days, which is the biggest nett presumption alteration since 2012.

Increased Accumulation Of BTC

According to a Glassnode illustration shared connected societal media by crypto expert James Van Straten, Bitcoin accumulation by shark investors changeable up successful 2024 to reverse a multi-year consolidation since 2020. As a result, these addresses accrued their holdings by 268,441 successful 30 days, astir converting to $18 billion.

While these sharks bash not person arsenic overmuch idiosyncratic powerfulness implicit terms question arsenic precise ample whales, their corporate behaviour is inactive worthy monitoring arsenic they besides subordinate to the sentiment among investors. Consequently, this ample accumulation inclination could pb to much buying which would awesome a continued terms surge for Bitcoin.

The surge successful accumulation is not truly surprising, arsenic the motorboat of Spot Bitcoin ETFs successful the US has ushered successful a bigger question of accumulation sentiment from each cohorts of Bitcoin investors. As different expert pointed retired connected societal media, this shark accumulation could’ve been owed to ETFs purchasing monolithic amounts of Bitcoins from Coinbase OTC desks.

Bitcoin whales (addresses holding much than 1,000 BTC) person besides upped their enactment successful the past fewer days, signaling strategical positioning successful the market. Various transaction alerts from Whale Alerts person shown strategical question from whale addresses.

Notably, the crypto whale transaction tracker has revealed $1.3 cardinal worthy of BTC exchanged betwixt whale addresses successful the past 24 hours. Among these ample BTC movements was a notable transportation of 3,599 BTC worthy $252 cardinal betwixt 2 chartless wallets. Another notable transaction was the transportation of 3,118 BTC from an chartless wallet to Coinbase Institutional.

Bitcoin To $100,000?

Data from IntoTheBlock has besides reiterated this accumulation inclination with its nett transportation inclination from exchanges. Data from ITB’s platform shows a $16.18 cardinal outflow from exchanges arsenic against a $15.76 cardinal inflow successful the past 7 days. Bitcoin is present trading astatine $67,931 and has failed to stabilize supra the $70,000 people again.

However, the accumulation by whales and sharks, expanding mainstream involvement from organization investors done Spot Bitcoin ETFs, and the approaching halving each constituent to the anticipation of important terms appreciation to $100,000.

Featured representation from BBC, illustration from Tradingview.com

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

1 year ago

1 year ago

English (US)

English (US)