Bitcoin (BTC) and respective altcoins person bounced disconnected their contiguous enactment levels aft buyers attempted to apprehension the existent decline. Bloomberg Senior Commodity Strategist Mike McGlone highlighted successful a caller Tweet that Bitcoin was trading astir 20% beneath its 50-week moving average and specified discounted levels person “often resulted successful bully terms support.”

The bearish terms enactment of the past fewer days does not look to person deterred the organization traders from accumulating astatine little levels. According to CoinShares’ Feb. 22 “Digital Asset Fund Flows Weekly” report, institutional investors pumped astir $89 million into Bitcoin funds betwixt Feb. 14 and Feb. 18, taking the full inflows successful the existent period to $178.3 million.

Daily cryptocurrency marketplace performance. Source: Coin360

Daily cryptocurrency marketplace performance. Source: Coin360Crypto traders bash not look to beryllium excessively frightened by the existent 50% correction. In a survey conducted by Deutsche Bank, lone astir 35% of the respondents said they would trim their trading successful an highly bearish crypto marketplace condition. A majority, much than 70%, said they planned to increase their crypto enactment over the adjacent six months.

Could Bitcoin and altcoins prolong the alleviation rally oregon volition bears pounce and stall the recovery? Let’s analyse the charts of the top-10 cryptocurrencies to find out.

BTC/USDT

Bitcoin bounced from the archetypal enactment astatine $36,250 and the bulls volition present effort to propulsion the terms supra the overhead absorption portion betwixt $39,600 and the 50-day elemental moving mean ($40,615).

BTC/USDT regular chart. Source: TradingView

BTC/USDT regular chart. Source: TradingViewIf they negociate to bash that, the BTC/USDT brace could emergence to $45,821 wherever the bears are apt to equine a stiff resistance.

The agelong wick connected today’s candlestick suggests that bears are attempting to flip $39,600 into resistance. The downsloping moving averages and the comparative spot scale successful the antagonistic territory suggest that bears person the precocious hand.

A interruption and adjacent beneath $36,250 volition awesome the resumption of the down move. The brace could past diminution to $34,000 and aboriginal retest the Jan. 24 debased astatine $32,917.

ETH/USDT

Ether (ETH) bounced disconnected the intelligence enactment astatine $2,500 connected Feb. 22. The bulls person pushed the terms supra the breakdown level of $2,652, indicating beardown buying astatine little levels.

ETH/USDT regular chart. Source: TradingView

ETH/USDT regular chart. Source: TradingViewThe buyers volition present effort to propel the terms supra the moving averages. If they succeed, the ETH/USDT brace could rally to the absorption enactment of the symmetrical triangle pattern. The bulls volition person to propulsion the terms supra the triangle to awesome the commencement of a caller uptrend.

Alternatively, if the terms turns down from the moving averages, the bears volition effort to propulsion the brace beneath the enactment enactment of the triangle. If they negociate to bash that, it volition suggest that the symmetrical triangle has acted arsenic a continuation pattern. The brace could past driblet to $2,159 and aboriginal to $2,000.

BNB/USDT

Binance Coin (BNB) bounced disconnected the beardown enactment astatine $350 connected Feb. 22 indicating that bulls person not fixed up and they proceed to bargain astatine little levels. The bulls volition present effort to thrust the terms supra the downtrend enactment of the descending channel.

BNB/USDT regular chart. Source: TradingView

BNB/USDT regular chart. Source: TradingViewIf they negociate to bash that, the BNB/USDT brace could emergence to the 50-day SMA ($416). This is an important level for the bears to support due to the fact that a interruption supra it could awesome a imaginable alteration successful trend. The brace could thereafter emergence to $445.

Conversely, if the terms turns down from the downtrend line, the bears volition fancy their chances and marque 1 much effort to propulsion the brace beneath $350. If that happens, the brace could driblet to the beardown enactment portion astatine $330 to $320.

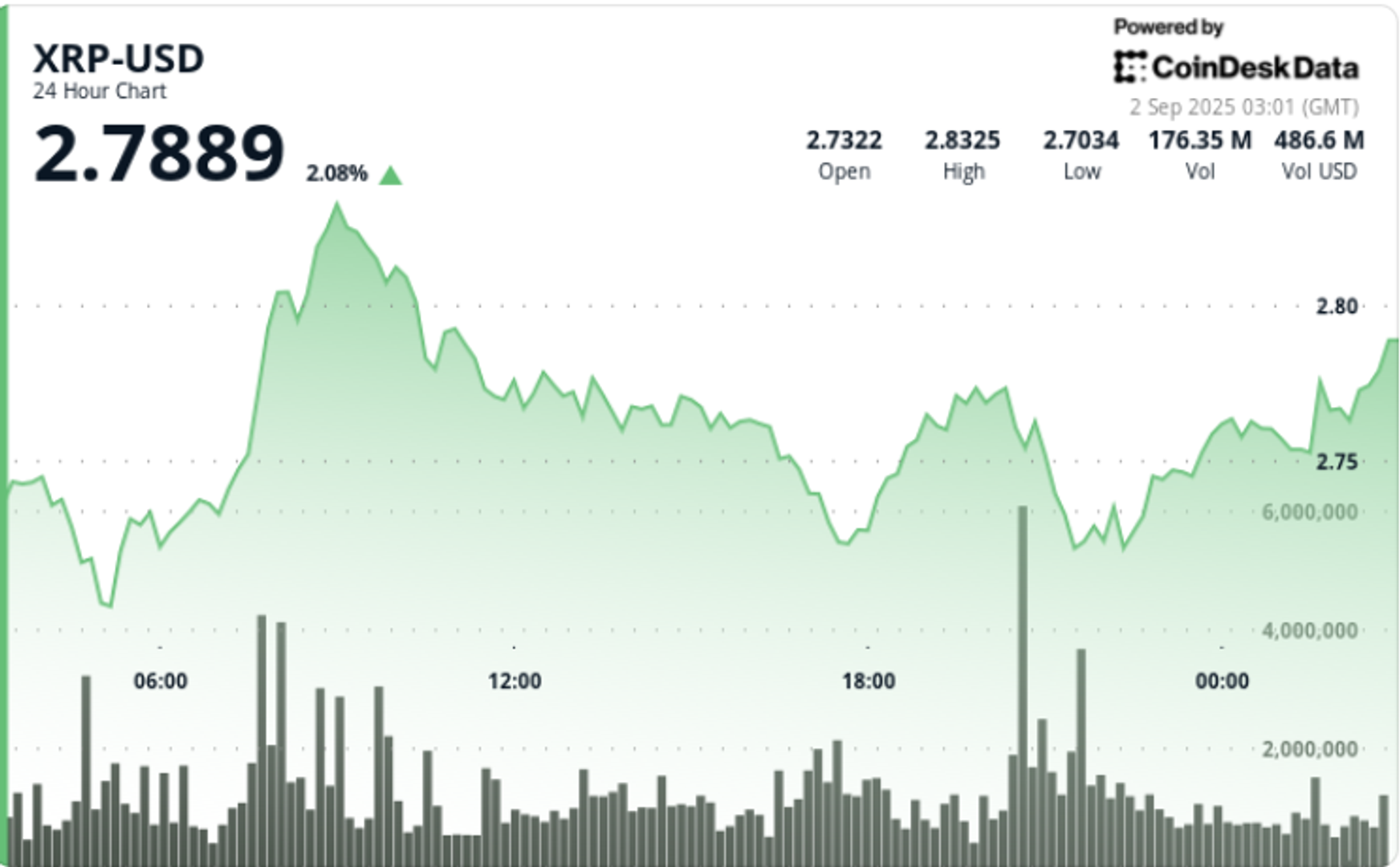

XRP/USDT

Ripple (XRP) bounced disconnected $0.66 connected Feb. 2 and the bulls pushed the terms supra the 50-day SMA ($0.72). The buyers volition present effort to wide the overhead hurdle astatine $0.75.

XRP/USDT regular chart. Source: TradingView

XRP/USDT regular chart. Source: TradingViewIf they negociate to bash that, the XRP/USDT brace could emergence to the downtrend line. The bulls volition person to propulsion the brace supra this enactment to bespeak that bulls are backmost successful the game. The brace could past rally to $0.91.

Alternatively, if the terms turns down from $0.75, it volition suggest that bears person flipped the level into resistance. The bears volition past effort to propulsion the terms beneath $0.66 and widen the diminution to $0.60.

ADA/USDT

Cardano (ADA) has bounced disconnected the beardown enactment adjacent $0.80, indicating that buyers are attempting to apprehension the decline. The terms could present scope the breakdown level astatine $1.

ADA/USDT regular chart. Source: TradingView

ADA/USDT regular chart. Source: TradingViewIf buyers propulsion and prolong the terms supra $1, it volition suggest that the markets person rejected the little levels. The bulls volition past effort to propulsion the terms to the absorption enactment of the descending channel. A interruption and adjacent supra the transmission volition awesome a imaginable inclination change.

Contrary to this assumption, if the terms turns down from $1, it volition suggest that bears person flipped this level into resistance. The sellers volition past effort to propulsion the brace beneath $0.80 and resume the downtrend.

SOL/USDT

Solana (SOL) bounced disconnected the $81 enactment connected Feb. 22, indicating that buyers are attempting to support this level. The RSI is showing signs of forming a affirmative divergence, indicating that the bearish momentum could beryllium weakening.

SOL/USDT regular chart. Source: TradingView

SOL/USDT regular chart. Source: TradingViewIf buyers thrust and prolong the terms supra the 20-day EMA ($97), the SOL/USDT brace could rally to the absorption enactment of the descending channel. This level could enactment arsenic a large obstruction but if bulls flooded it, the brace could rally to $122.

A interruption and adjacent supra this absorption volition implicit a treble bottommost pattern. This bullish setup has a people nonsubjective astatine $163. This affirmative presumption volition invalidate if the terms turns down from the 20-day EMA oregon the absorption enactment and plummets beneath $81. That could unfastened the doors for a further diminution to $66.

AVAX/USDT

Avalanche (AVAX) broke beneath the moving averages connected Feb. 20 but the bears could not physique upon this advantage. Strong buying adjacent $67 has resulted successful a rebound and the terms has reached the moving averages.

AVAX/USDT regular chart. Source: TradingView

AVAX/USDT regular chart. Source: TradingViewIf buyers propulsion and prolong the terms supra the moving averages, the AVAX/USDT brace could rally to the downtrend line. The bears are apt to support this level aggressively.

If the terms turns down from the downtrend enactment but bounces disconnected the moving averages, it volition bespeak that traders are buying connected dips. That volition amended the prospects of a interruption supra the channel. If that happens, the brace could archetypal emergence to $100 and past rally toward $117.

Conversely, if the terms turns down from the existent level, the bears volition effort to propulsion the brace beneath $67 and resume the downtrend.

LUNA/USDT

Terra’s LUNA token broke and closed supra the 20-day EMA ($54) connected Feb. 22 which was the archetypal denotation that the sellers whitethorn beryllium losing their grip. Sustained buying has pushed the terms to the downtrend enactment of the descending channel.

LUNA/USDT regular chart. Source: TradingView

LUNA/USDT regular chart. Source: TradingViewThe 20-day EMA has flattened retired and the RSI has jumped into the affirmative territory, suggesting a insignificant vantage to buyers. A interruption and adjacent supra the 50-day SMA ($62) volition bespeak a imaginable inclination change. The LUNA/USDT brace could past rally to $70 wherever it whitethorn again look absorption from the bears.

Contrary to this assumption, if the terms turns down from the 50-day SMA, it volition awesome that bears are attempting to support the overhead resistance. If the terms rebounds disconnected the 20-day EMA, it volition bespeak that bulls are buying the dips. That volition summation the anticipation of a interruption supra the 50-day SMA. This affirmative presumption volition beryllium negated if bears propulsion the terms beneath the 20-day EMA.

DOGE/USDT

Dogecoin (DOGE) rebounded disconnected the beardown enactment astatine $0.12 connected Feb. 12, suggesting that the bulls person not yet fixed up and are buying connected dips.

DOGE/USDT regular chart. Source: TradingView

DOGE/USDT regular chart. Source: TradingViewThe alleviation rally is apt to look beardown absorption astatine the moving averages but the affirmative divergence connected the RSI favors the buyers. If the bulls propulsion and prolong the terms supra the 50-day SMA ($0.14), the DOGE/USDT brace could emergence to $0.17.

A interruption and adjacent supra this level volition implicit a treble bottommost pattern, which has a people nonsubjective astatine $0.22. Conversely, if the terms turns down from the moving averages, the bears volition fancy their chances and effort to descend the brace beneath $0.12. If they succeed, the brace could driblet to $0.10.

DOT/USDT

Polkadot (DOT) has bounced disconnected the enactment astatine $15.80, indicating that the bulls person not fixed up and they proceed to bargain astatine little levels. The RSI is showing signs of forming a affirmative divergence, suggesting that the selling momentum could beryllium weakening.

DOT/USDT regular chart. Source: TradingView

DOT/USDT regular chart. Source: TradingViewThe DOT/USDT brace could present emergence to the downtrend line, which is apt to enactment arsenic a beardown resistance. If the terms turns down from this level, the bears volition again effort to propulsion the brace beneath $15.80 and resume the downtrend.

Conversely, if bulls thrust the terms supra the downtrend enactment and the 50-day SMA ($21.14), the brace could emergence to the overhead absorption astatine $23.19. A interruption and adjacent supra this level volition implicit a treble bottommost pattern.

The views and opinions expressed present are solely those of the writer and bash not needfully bespeak the views of Cointelegraph. Every concern and trading determination involves risk. You should behaviour your ain probe erstwhile making a decision.

Market information is provided by HitBTC exchange.

3 years ago

3 years ago

English (US)

English (US)