Bitcoin (BTC) has recovered adjacent to $44,000, indicating that the downtrend could beryllium coming to an end. However, the terms whitethorn not rally to the all-time precocious successful a consecutive line. This means bulls are apt to look respective hurdles in-between and the terms enactment whitethorn stay volatile.

JPMorgan analysts said successful a caller capitalist note that Bitcoin’s roar and bust cycles are hindering further organization adoption. The analysts estimation that with volatility 4 times that of gold, Bitcoin’s just worth is astir $38,000. If the volatility reduces to 3 times that of gold, their just worth estimation for Bitcoin rises to $50,000.

Daily cryptocurrency marketplace performance. Source: Coin360

Daily cryptocurrency marketplace performance. Source: Coin360Wells Fargo Investment Institute, the probe part of Wells Fargo Wealth and Investment Management, successful its study titled "Cryptocurrencies — Too aboriginal oregon excessively late?" said the crypto markets were inactive successful the aboriginal days of adoption. The study added that “most of the accidental lies earlier us, not down america [...]”.

Could Bitcoin and altcoins widen their alleviation rally oregon volition profit-booking propulsion prices lower? Let’s survey the charts of the top-10 cryptocurrencies to find out.

BTC/USDT

Bitcoin broke supra the 50-day elemental moving mean ($42,659) connected Feb. 7 and reached the overhead absorption astatine $45,456 connected Feb. 8. This level proved to beryllium a beardown absorption and the terms turned down from it.

BTC/USDT regular chart. Source: TradingView

BTC/USDT regular chart. Source: TradingViewThe BTC/USDT brace formed a Doji candlestick signifier connected Feb. 8, indicating indecision among the bulls and the bears. However, the upsloping 20-day exponential moving mean ($40,751) and the comparative spot scale (RSI) successful the affirmative portion bespeak that the way of slightest absorption is to the upside.

If bulls thrust the terms supra $45,456, the brace could emergence to $48,000 and thereafter to the stiff overhead absorption astatine $52,088. Contrary to this assumption, if the terms turns down from the existent level and breaks beneath the 50-day SMA, the brace could driblet to the 20-day EMA.

ETH/USDT

Ether (ETH) broke and closed supra the absorption enactment of the transmission connected Feb. 7 which is an denotation that the downtrend could beryllium over. Although bears defended the 50-day SMA ($3,208) connected Feb. 8, they person not been capable to propulsion the terms backmost into the channel.

ETH/USDT regular chart. Source: TradingView

ETH/USDT regular chart. Source: TradingViewThis suggests that bulls are attempting to flip the absorption enactment of the transmission to support. The buyers volition erstwhile again effort to thrust the terms supra the 50-day SMA today. If they succeed, the ETH/USDT brace could commencement a caller up-move.

There is simply a insignificant absorption astatine $3,400, but if this level is crossed the adjacent halt could beryllium $3,900. The rising 20-day EMA ($2,924) and the RSI successful the affirmative territory bespeak vantage to buyers.

This bullish presumption volition invalidate successful the abbreviated word if bears descend and prolong the brace beneath the 20-day EMA.

BNB/USDT

Binance Coin (BNB) turned down from the downtrend enactment connected Feb. 18, indicating beardown absorption from the bears. The terms has dropped to the 20-day EMA ($409), which is an important enactment to support an oculus on.

BNB/USDT regular chart. Source: TradingView

BNB/USDT regular chart. Source: TradingViewIf the terms rises from the existent level, the bulls volition again effort to propulsion the BNB/USDT brace supra the downtrend enactment of the transmission and the 50-day SMA ($453). If they succeed, it volition suggest that the downtrend could beryllium over. The brace could past commencement its march to the intelligence level astatine $500.

Alternatively, if the terms breaks beneath the 20-day EMA, it volition suggest that the inclination remains antagonistic and higher levels are attracting selling by the bears. The brace could past driblet to $390 and aboriginal widen its descent to $357.40.

XRP/USDT

Ripple (XRP) surged and closed supra the 50-day SMA ($0.75) connected Feb. 7 which is the archetypal denotation that the downtrend could beryllium over. Traders are booking profits adjacent $0.91 which could effect successful a insignificant correction oregon consolidation.

XRP/USDT regular chart. Source: TradingView

XRP/USDT regular chart. Source: TradingViewThe moving averages are connected the verge of a bullish crossover and the RSI is successful the overbought zone, indicating that the way of slightest absorption is to the upside. If the terms turns up from the existent level oregon rebounds disconnected $0.75, the bulls volition effort to propel the XRP/USDT brace supra $0.91.

If they succeed, the up-move could scope the intelligence level astatine $1 wherever the bears whitethorn again airs a beardown challenge. This affirmative presumption volition invalidate if the terms turns down and plummets beneath the moving averages.

ADA/USDT

The bulls tried to propel Cardano (ADA) supra the 50-day SMA ($1.23) connected Feb. 8 but the bears held their ground. This pulled the terms backmost to the 20-day EMA ($1.14). The terms is present stuck betwixt the moving averages.

ADA/USDT regular chart. Source: TradingView

ADA/USDT regular chart. Source: TradingViewThe RSI is conscionable supra the midpoint and the moving averages are flat, indicating a range-bound enactment successful the abbreviated term. If buyers propulsion and prolong the terms supra the 50-day SMA, the brace could rally to the absorption line.

This is the captious level to ticker retired for due to the fact that a interruption and adjacent supra the transmission volition beryllium the archetypal motion that the downtrend could beryllium over.

Conversely, if the terms turns down from the existent level and breaks beneath the 20-day EMA, the ADA/USDT brace could descent to $1.

SOL/USDT

Solana (SOL) broke and closed supra the overhead absorption astatine $116 connected Feb. 7, but the bulls could not widen the alleviation rally further. The bears pulled the terms backmost beneath $116 connected Feb. 8.

SOL/USDT regular chart. Source: TradingView

SOL/USDT regular chart. Source: TradingViewThe buyers person not yet fixed up arsenic they are trying to support the 20-day EMA ($112). If the terms rebounds disconnected the existent level, the bulls volition effort to propulsion the SOL/USDT brace supra $121.93. If they negociate to bash that, the brace could rally to the absorption line.

Conversely, if bears propulsion the terms beneath the 20-day EMA, the brace could driblet to the uptrend line. If this level besides cracks, the brace could diminution to $94. The level 20-day EMA and the RSI beneath the midpoint, suggest a range-bound enactment successful the adjacent term.

LUNA/USDT

The alleviation rally successful Terra’s LUNA token deed a partition astatine the 20-day EMA ($58). This suggests that the sentiment remains antagonistic and bears are selling connected rallies to beardown absorption levels.

LUNA/USDT regular chart. Source: TradingView

LUNA/USDT regular chart. Source: TradingViewIf the terms breaks and sustains beneath $54.20, the LUNA/USDT brace could suffer spot and gradually driblet to the beardown enactment astatine $43.44. Such a determination volition suggest that the existent up-move was a alleviation rally successful a beardown downtrend.

Alternatively, if the terms rebounds disconnected $54.20, it volition suggest that traders are not waiting for a deeper correction to buy. The bulls volition past effort to propulsion the brace supra the 20-day EMA. If they succeed, the brace could emergence to the downtrend enactment of the channel.

Related: Bitcoin centers connected $44K arsenic BTC terms MACD delivers long-awaited bull signal

AVAX/USDT

Avalanche (AVAX) soared connected Feb. 8 to scope the downtrend enactment but the agelong wick connected the day's candlestick shows that bears are defending the overhead absorption aggressively. The bulls regrouped rapidly and are attempting to propulsion the terms supra the 50-day SMA ($88).

AVAX/USDT regular chart. Source: TradingView

AVAX/USDT regular chart. Source: TradingViewThe RSI is nearing the 62 level from wherever it had turned down connected Dec. 21 and earlier that connected Nov. 30. If buyers propulsion the RSI supra this resistance, it volition bespeak vantage to buyers. A interruption and adjacent supra the downtrend enactment could awesome a imaginable alteration successful trend.

Contrary to this assumption, if the terms turns down from the existent level oregon the downtrend line, the AVAX/USDT brace could find enactment successful the portion betwixt the 20-day EMA ($77) and $75.50. The bears volition person to descend the terms beneath this portion to summation the precocious hand.

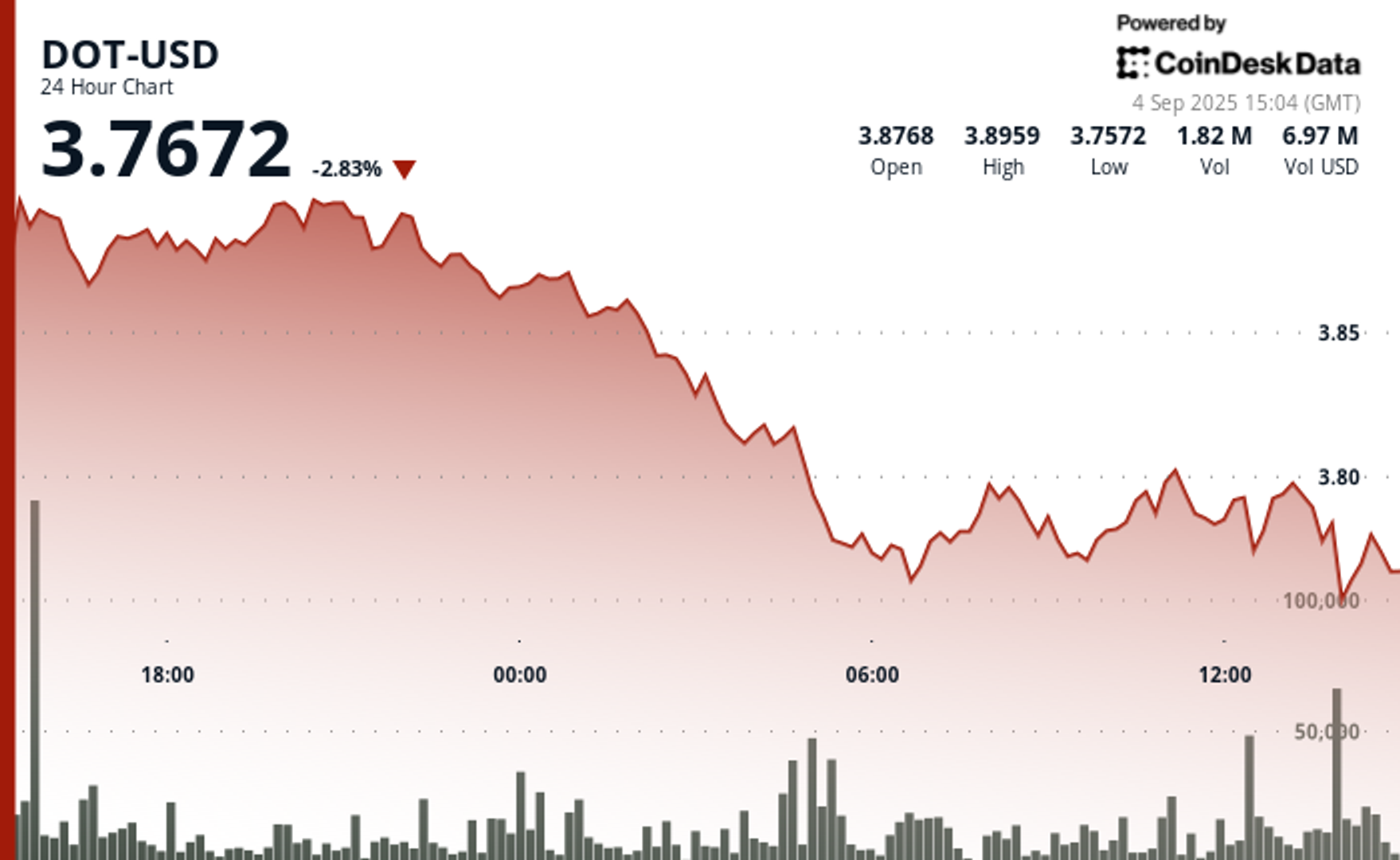

DOT/USDT

Polkadot (DOT) tried to emergence supra the portion betwixt $22.66 and the 50-day SMA ($24.05) connected Feb. 8, but the bears were successful nary temper to relent. A insignificant affirmative is that the bulls person not allowed the terms to interruption beneath the 20-day EMA ($21.06).

DOT/USDT regular chart. Source: TradingView

DOT/USDT regular chart. Source: TradingViewBoth moving averages person flattened retired and the RSI is adjacent to the midpoint, indicating a equilibrium betwixt proviso and demand. A interruption and adjacent supra the 50-day SMA could tilt the vantage successful favour of the buyers.

The DOT/USDT brace could past emergence to $28 wherever the bears whitethorn again airs a stiff challenge. Alternatively, a interruption and adjacent beneath the 20-day EMA could awesome that the brace whitethorn stay range-bound betwixt $22.66 and $16.81 for a fewer days.

DOGE/USDT

Dogecoin (DOGE) broke and closed supra the 50-day SMA ($0.15) connected Feb. 7 but the bulls could not physique upon this advantage. The bears pulled the terms backmost beneath the 50-day SMA connected Feb. 8, indicating that they person not fixed up yet.

DOGE/USDT regular chart. Source: TradingView

DOGE/USDT regular chart. Source: TradingViewThe 20-day EMA ($0.15) is the important level to ticker connected the downside. If the terms rebounds disconnected this level, the anticipation of a interruption supra $0.17 increases. If that happens, the DOGE/USDT brace could emergence to the stiff overhead absorption astatine $0.19.

The gradually upsloping 20-day EMA and the RSI successful the affirmative territory bespeak a flimsy vantage to buyers. This affirmative presumption volition invalidate if the terms turns down and breaks beneath the 20-day EMA. The brace could past driblet to the beardown enactment astatine $0.13.

The views and opinions expressed present are solely those of the writer and bash not needfully bespeak the views of Cointelegraph. Every concern and trading determination involves risk. You should behaviour your ain probe erstwhile making a decision.

Market information is provided by HitBTC exchange.

3 years ago

3 years ago

English (US)

English (US)