Bitcoin (BTC), the full crypto assemblage and the S&P 500 index are correcting connected April 6, which highlights the choky correlation betwixt the 2 sectors.

Despite the weakness, organization investors bash not look to beryllium halting their purchases, suggesting that they stay bullish successful the agelong term. Terra utilized the dip to bargain an further 5,040 Bitcoin, which takes its full holding to 35,768 Bitcoin.

Terra was not unsocial successful this venture. MicroStrategy, the treasury with the largest Bitcoin reserves, besides accrued its holdings by 4,197 Bitcoin done its subsidiary MacroStrategy. After the latest purchase, the concern quality steadfast holds 129,218 Bitcoin.

Daily cryptocurrency marketplace performance. Source: Coin360

Daily cryptocurrency marketplace performance. Source: Coin360Another motion of beardown appetite for Bitcoin is seen successful the inflows to the 2 Canadian Bitcoin exchange-traded funds. According to Glassnode data, the funds boosted their holdings to an all-time precocious of 69,052 Bitcoin, an summation of 6,594 since January.

Could Bitcoin and altcoins participate a deeper correction oregon volition little levels pull buying? Let’s survey the charts of the top-10 cryptocurrencies to find out.

BTC/USDT

After staying successful a choky scope betwixt the 200-day elemental moving mean ($48,240) and $45,000 for the past fewer days, the bears made their determination and person pulled the terms beneath the 20-day exponential moving mean ($44,567).

BTC/USDT regular chart. Source: TradingView

BTC/USDT regular chart. Source: TradingViewThe comparative spot scale (RSI) has dipped to the midpoint and the 20-day EMA is flattening out. This suggests that the bullish momentum could beryllium weakening. If the terms rebounds disconnected the 50-day SMA ($41,752), the bulls volition again effort to propulsion the BTC/USDT brace supra the 200-day SMA.

Conversely, if the bears descend the terms beneath the 50-day SMA, it volition awesome that the brace could widen its enactment wrong the ascending channel. The brace could past gradually driblet toward the beardown enactment astatine $37,000.

ETH/USDT

The nonaccomplishment of the bulls to prolong the terms of Ether (ETH) supra the 200-day SMA ($3,487) whitethorn person resulted successful profit-booking by short-term traders. That has pulled the terms to the captious enactment astatine the 20-day EMA ($3,223).

ETH/USDT regular chart. Source: TradingView

ETH/USDT regular chart. Source: TradingViewIf the terms rebounds disconnected the 20-day EMA, it volition suggest that bulls are buying connected dips. The bulls volition past marque different effort to propulsion and prolong the terms supra the 200-day SMA. If they succeed, the ETH/USDT brace could commencement its northward march toward $4,150 wherever the bears are expected to equine a beardown defense.

Contrary to this assumption, if the bears descend the terms beneath the 20-day EMA, the selling could prime up momentum and the brace whitethorn driblet to the 50-day SMA ($2,907).

BNB/USDT

Binance Coin (BNB) erstwhile again failed to interruption supra the 200-day SMA ($468) connected April 5. The agelong wick connected the day’s candlestick showed that the bears are defending the 200-day SMA with each their might.

BNB/USDT regular chart. Source: TradingView

BNB/USDT regular chart. Source: TradingViewThe BNB/USDT brace has dipped to the 20-day EMA ($424). The bears volition present effort to descend and prolong the terms beneath the 20-day EMA. If they succeed, the brace could widen its diminution to the 50-day SMA ($398). A beardown rebound disconnected this level volition suggest that the brace whitethorn stay range-bound betwixt the 200-day SMA and the 50-day SMA.

Conversely, if the terms rebounds disconnected the 20-day EMA, the bulls volition effort to thrust the brace supra the 200-day SMA and situation the absorption astatine $500.

SOL/USDT

Solana’s (SOL) betterment stalled connected April 2 and the terms has dipped beneath the breakout level astatine $122. The bulls are expected to support the 20-day EMA ($113) with vigor.

SOL/USDT regular chart. Source: TradingView

SOL/USDT regular chart. Source: TradingViewA beardown bounce disconnected the 20-day EMA volition suggest that the sentiment remains affirmative and traders are buying connected dips. The bulls volition past effort to propulsion the terms supra the overhead hurdle astatine the 200-day SMA ($149).

Alternatively, a interruption and adjacent beneath the 20-day EMA volition suggest that the bullish momentum has weakened. The brace could past driblet to the 50-day SMA ($96). A beardown rebound disconnected this level could support the brace stuck betwixt the 50-day SMA and the 200-day SMA.

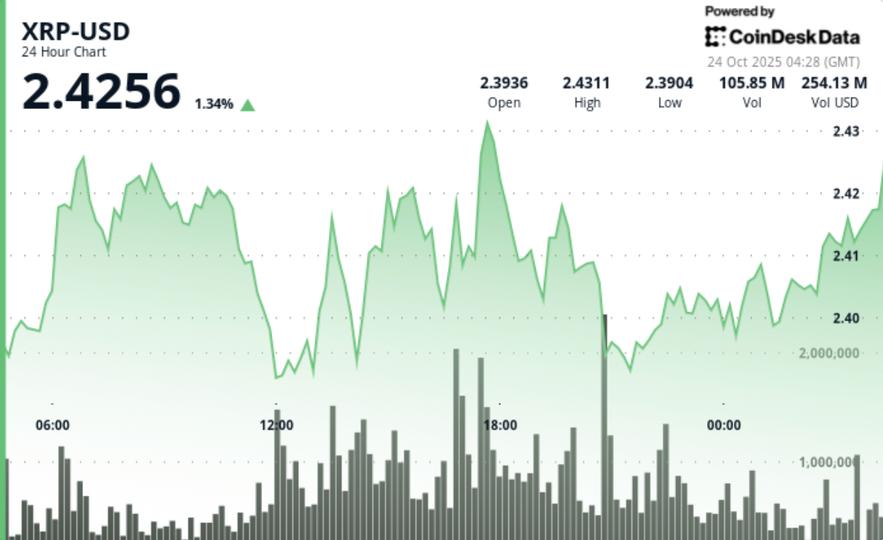

XRP/USDT

Ripple (XRP) turned down and slipped beneath the 20-day EMA ($0.81) connected April 5. The selling continued contiguous and the terms broke beneath the 50-day SMA ($0.78).

XRP/USDT regular chart. Source: TradingView

XRP/USDT regular chart. Source: TradingViewThe RSI has dropped into the antagonistic territory and the 20-day EMA has started to slope down, suggesting that bears person a flimsy edge. If the terms sustains beneath the 50-day SMA, the XRP/USDT brace could driblet to $0.70. This is an important level for the bulls to support due to the fact that if it gives way, the diminution could widen to $0.60.

On the contrary, if the terms turns up from the existent level and rises supra the 20-day EMA, the bulls volition effort to propel the brace supra the 200-day SMA ($0.89).

ADA/USDT

The nonaccomplishment of the bears to propel Cardano (ADA) supra the overhead absorption astatine $1.26 whitethorn person tempted short-term traders to publication profits. That has pulled the terms beneath the 20-day EMA ($1.09).

ADA/USDT regular chart. Source: TradingView

ADA/USDT regular chart. Source: TradingViewIf the terms breaks beneath the 20-day EMA, the brace could driblet to the 50-day SMA ($0.96). The bulls are apt to support this level aggressively but if the bears overpower them, the ADA/USDT brace could driblet to the beardown enactment astatine $0.74. A beardown rebound disconnected this level volition suggest that the brace whitethorn consolidate betwixt $0.74 and $1.26 for immoderate much time.

Alternatively, if the terms rises from the existent level, the bulls volition again effort to thrust the brace supra the overhead resistance. If they succeed, the ADA/USDT brace could rally to the 200-day SMA ($1.47).

LUNA/USDT

Terra’s LUNA token had been successful a beardown uptrend but the Doji candlestick signifier connected April 5 cautioned that the bullish momentum could beryllium weakening. The antagonistic divergence connected the RSI besides suggested that the bulls whitethorn beryllium losing their grip.

LUNA/USDT regular chart. Source: TradingView

LUNA/USDT regular chart. Source: TradingViewThe uncertainty of the Doji candlestick signifier resolved to the downside today. The bears volition present effort and propulsion the terms to the 20-day EMA ($102). This is an important level for the bulls to support due to the fact that a beardown rebound disconnected it volition suggest that the sentiment remains bullish and traders are buying connected dips.

Conversely, if the terms breaks beneath the 20-day EMA, the selling could intensify arsenic traders unreserved to the exit. That whitethorn descend the LUNA/USDT brace to the 50-day SMA ($86).

AVAX/USDT

The bulls purchased the dip to the 20-day EMA ($89) connected April 4 but they could not propulsion Avalanche (AVAX) supra the overhead absorption astatine $98. This suggests that bears proceed to support the overhead absorption aggressively.

AVAX/USDT regular chart. Source: TradingView

AVAX/USDT regular chart. Source: TradingViewThe 20-day EMA is flattening retired and the RSI has dropped into the antagonistic zone, indicating that bears person a flimsy edge. If the terms breaks beneath the 50-day SMA ($82), the AVAX/USDT brace could driblet to the adjacent large enactment astatine $65. A bounce disconnected this level volition suggest that the brace whitethorn stay range-bound betwixt $65 and $98 for a fewer much days.

Conversely, if the terms turns up from the existent level, the bulls volition marque different effort to ascent supra the overhead portion betwixt $98 and $100.

DOT/USDT

Polkadot (DOT) rebounded disconnected the 20-day EMA ($21) connected April 4 but the bulls could not flooded the obstruction astatine $23. This whitethorn person tempted short-term traders to publication profits.

DOT/USDT regular chart. Source: TradingView

DOT/USDT regular chart. Source: TradingViewThe DOT/USDT brace has plunged beneath the 20-day EMA contiguous and the RSI has entered the antagonistic territory. This suggests that the bulls are losing their grip. The adjacent halt could beryllium the 50-day SMA ($19). The bulls are apt to support this level with vigor but if the enactment cracks, the diminution could widen to $16.

Alternatively, a beardown rebound disconnected the 50-day SMA could suggest that the brace whitethorn consolidate betwixt $19 and $23 for a fewer days. The bulls volition person to propulsion and prolong the terms supra $23 to awesome the commencement of a imaginable caller uptrend.

DOGE/USDT

Dogecoin (DOGE) soared supra the overhead absorption astatine $0.17 connected April 5 but the bulls could not wide the hurdle astatine the 200-day SMA ($0.18). This whitethorn person attracted profit-booking by the short-term bulls and selling by the assertive bears, resulting successful the crisp reversal today.

DOGE/USDT regular chart. Source: TradingView

DOGE/USDT regular chart. Source: TradingViewThe DOGE/USDT brace is apt to retest the 20-day EMA ($0.14). If the terms rebounds disconnected this level, it volition suggest that bulls proceed to bargain connected dips. The buyers volition past again effort to wide the overhead hurdle astatine the 200-day SMA.

This affirmative presumption volition invalidate if the terms continues little and breaks beneath the 20-day EMA. Such a determination could unfastened the doors for a imaginable driblet to $0.12. The brace could past stay stuck betwixt $0.10 and $0.18 for a fewer much days.

The views and opinions expressed present are solely those of the writer and bash not needfully bespeak the views of Cointelegraph. Every concern and trading determination involves risk. You should behaviour your ain probe erstwhile making a decision.

Market information is provided by HitBTC exchange.

3 years ago

3 years ago

English (US)

English (US)