The indebtedness ceiling negotiations successful the United States are keeping traders connected the edge. JPMorgan Chase CEO Jamie Dimon precocious told Bloomberg connected May 11 that a imaginable sovereign default by the U.S. authorities could make panic successful the banal markets, resulting successful heightened volatility.

The adjacent large question troubling crypto investors is however volition Bitcoin respond to specified an event. Bloomberg’s latest Markets Live Pulse survey indicates that Bitcoin (BTC) could beryllium the third astir preferred plus class down Gold and U.S. Treasuries should the U.S. authorities neglect to forestall a indebtedness default.

Daily cryptocurrency marketplace performance. Source: Coin360

Daily cryptocurrency marketplace performance. Source: Coin360Billionaire money manager Paul Tudor Jones told CNBC that helium is holding his Bitcoin and volition ever person immoderate information of his portfolio successful it.

What are the important enactment and absorption levels to ticker for successful the S&P 500 Index (SPX), Bitcoin, and the large altcoins? Let’s survey the charts to find out.

S&P 500 Index terms analysis

The S&P 500 Index has been trading adjacent the 20-day exponential moving mean (4,118) for the past fewer days. This suggests a pugnacious conflict betwixt the bulls and the bears for supremacy successful the adjacent term.

SPX regular chart. Source: TradingView

SPX regular chart. Source: TradingViewThe gradually rising 20-day EMA and the comparative spot scale (RSI) adjacent the midpoint suggest a range-bound enactment successful the abbreviated term. The scale could plaything betwixt the overhead absorption of 4,200 and the 50-day elemental moving mean (4,059) for a fewer much days.

A interruption and adjacent beneath the 50-day SMA could propulsion the terms to the uptrend line. If this enactment besides gives way, the scale whitethorn nosedive to 3,800.

On the upside, the bulls volition person to wide the hurdle astatine 4,200. The scale whitethorn past rally to 4,325 wherever the bears volition again airs a beardown challenge. During the correction from this level, if buyers flip 4,200 into support, it volition heighten the prospects of a rally supra 4,325.

U.S. dollar scale terms analysis

After being unsuccessful for a fewer days, the bulls yet managed to propulsion and prolong the U.S. dollar scale (DXY) supra the 20-day EMA (101.88) connected May 11.

DXY regular chart. Source: TradingView

DXY regular chart. Source: TradingViewThe bulls continued their buying and cleared the overhead hurdle astatine the 50-day SMA (102.47) connected May 12. The 20-day EMA has started to crook up gradually and the RSI has jumped into the affirmative zone, indicating that bulls person a flimsy edge. The scale could emergence to 103.50 successful the abbreviated word wherever it is again apt to look selling from the bears.

Conversely, if the terms turns down and slips beneath the 20-day EMA, it volition suggest that the interruption supra the 50-day SMA whitethorn person been a bull trap. The scale could past retest the captious enactment astatine 100.82. A interruption and adjacent beneath this level volition implicit a bearish caput and shoulders (H&S) signifier which whitethorn commencement a downward determination to 97.50.

Bitcoin terms analysis

The bulls are trying to unit Bitcoin backmost into the symmetrical triangle pattern, suggesting beardown buying astatine little levels.

BTC/USDT regular chart. Source: TradingView

BTC/USDT regular chart. Source: TradingViewThe alleviation rally is apt to look beardown selling astatine the moving averages and again astatine the absorption enactment of the triangle. If the terms turns down from the overhead resistance, the bears volition marque different effort to descend the BTC/USDT brace to $25,250.

This is an important level to support an oculus connected due to the fact that if it cracks, the selling could intensify and the brace whitethorn plunge to $20,000.

On the upside, the bulls volition person to surmount the absorption enactment to bespeak the commencement of a caller up-move. The brace whitethorn archetypal emergence to $31,000 and aboriginal effort a interruption supra $32,400.

Ether terms analysis

Ether (ETH) turned up from the 50% Fibonacci retracement level of $1,754 connected May 12 and aft a mates of days of consolidation, the bulls person pushed the terms to the 20-day EMA ($1,854).

ETH/USDT regular chart. Source: TradingView

ETH/USDT regular chart. Source: TradingViewThe bears volition effort to defender the enactment enactment with vigor and flip it into resistance. If they tin propulsion it off, it volition awesome that higher levels are attracting sellers. The ETH/USDT brace could past retest the contiguous enactment astatine $1,740. A interruption and adjacent beneath this level could tug the terms down to the 61.8% Fibonacci retracement level of $1,663.

If bulls privation to forestall the decline, they volition person to thrust the terms supra the 50-day SMA ($1,883). The brace could past rally to the psychologically important level of $2,000.

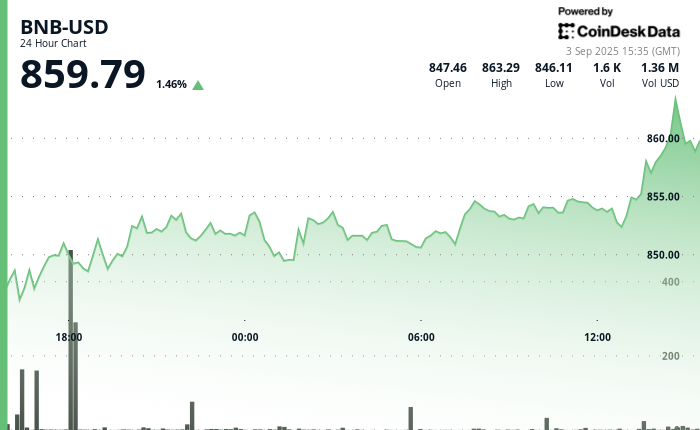

BNB terms analysis

The bulls person pushed BNB (BNB) to the moving averages, indicating that the $300 level is proving to beryllium a beardown support.

BNB/USDT regular chart. Source: TradingView

BNB/USDT regular chart. Source: TradingViewA interruption and adjacent supra the moving averages volition wide the way for a imaginable emergence to the overhead absorption astatine $338. This level whitethorn beryllium to beryllium a beardown obstruction but if bulls flooded it, the BNB/USDT brace could rally to $350.

Alternatively, if the terms turns down from the moving averages, it volition suggest that the bears person not fixed up. They volition past again effort to yank the terms beneath $300. If they bash that, the brace could descent to the adjacent enactment astatine $280.

XRP terms analysis

XRP (XRP) has been trading beneath $0.43 for the past fewer days but a insignificant affirmative successful favour of the bulls is that they person not allowed the bears to widen the diminution further.

XRP/USDT regular chart. Source: TradingView

XRP/USDT regular chart. Source: TradingViewThe bulls volition effort to instrumentality vantage of the concern and footwear the terms supra $0.43. That could agelong the betterment to the absorption enactment wherever the bears volition again effort to support the level. The bulls volition person to flooded this obstacle to commencement a rally to $0.48 and past to $0.54.

Another anticipation is that the terms turns down from the existent level and breaks beneath $0.40. That volition awesome the resumption of the down move. The XRP/USDT brace whitethorn past tumble to $0.36.

Cardano terms investigation

Cardano’s (ADA) betterment has reached the 20-day EMA ($0.37), which is an important level to support an oculus connected successful the adjacent term.

ADA/USDT regular chart. Source: TradingView

ADA/USDT regular chart. Source: TradingViewIf buyers shove the terms supra the 20-day EMA, it volition suggest that the sentiment remains affirmative and traders are buying connected dips. The ADA/USDT brace whitethorn past emergence toward the neckline of the inverse H&S pattern.

If the terms turns down from the neckline, it volition bespeak that the brace whitethorn oscillate betwixt the neckline and the uptrend enactment for a fewer much days. A interruption and adjacent beneath the uptrend enactment volition bespeak that bears person seized control. The brace whitethorn past slump to $0.30.

Related: Why is Litecoin terms up today?

Dogecoin terms analysis

The bulls person successfully guarded the $0.07 enactment level successful Dogecoin (DOGE) for the past fewer days indicating coagulated request astatine little levels.

DOGE/USDT regular chart. Source: TradingView

DOGE/USDT regular chart. Source: TradingViewThe alleviation rally is apt to look absorption adjacent the moving averages. If the terms turns down from the overhead resistance, it volition suggest that request dries up astatine higher levels. That volition embolden the bears who whitethorn past again effort to descend the DOGE/USDT brace beneath $0.07. If they negociate to bash that, the brace could descent to $0.06.

If bulls privation to forestall a autumn beneath $0.07, they volition person to propulsion the terms supra the 50-day SMA ($0.08). The brace could past rally to the $0.10 to $0.11 absorption zone.

Solana terms analysis

Solana’s (SOL) rebound disconnected the beardown enactment astatine $19.85 is nearing the downtrend line. This is apt to enactment arsenic a beardown hurdle for the bulls successful the adjacent term.

SOL/USDT regular chart. Source: TradingView

SOL/USDT regular chart. Source: TradingViewThe moving averages are flattening retired and the RSI is adjacent the midpoint, indicating that the selling unit could beryllium reducing. If buyers propel the terms supra the downtrend line, the SOL/USDT brace volition effort a rally to $24.

Contrarily, if the terms erstwhile again turns down from the downtrend line, it volition suggest that the bears are successful nary temper to relent. The brace could past stay stuck betwixt the downtrend enactment and $19.85 for immoderate much time.

Polygon terms analysis

Polygon (MATIC) is attempting to commencement a betterment that is apt to scope the breakdown level of $0.94. The bears are expected to equine a beardown defence astatine this level.

MATIC/USDT regular chart. Source: TradingView

MATIC/USDT regular chart. Source: TradingViewIf the terms turns down from $0.94, it volition suggest that the bears person flipped this level into resistance. They volition past effort to fortify their presumption further by pulling the MATIC/USDT brace beneath $0.81. If they succeed, it volition unfastened the doors for a imaginable diminution to $0.69.

Contrary to this assumption, if buyers thrust the terms supra $0.94, it volition awesome beardown buying astatine little levels. The brace whitethorn archetypal emergence to the 50-day SMA ($1.03) and thereafter effort a rally to the absorption line.

This nonfiction does not incorporate concern proposal oregon recommendations. Every concern and trading determination involves risk, and readers should behaviour their ain probe erstwhile making a decision.

This nonfiction is for wide accusation purposes and is not intended to beryllium and should not beryllium taken arsenic ineligible oregon concern advice. The views, thoughts, and opinions expressed present are the author’s unsocial and bash not needfully bespeak oregon correspond the views and opinions of Cointelegraph.

2 years ago

2 years ago

English (US)

English (US)