Bitcoin (BTC) is attempting to commercialized supra $27,000 which is simply a affirmative sign. In the past fewer days, Bitcoin’s terms held up supra $26,000 successful adverse conditions erstwhile the United States dollar scale (DXY) was rising sharply and the S&P 500 scale (SPX) was plunging. This suggests that selling dries up astatine little levels.

The determination by the United States Securities and Exchange Commission to delay the spot Bitcoin exchange-traded fund (ETFs) up of docket besides did not dent prices. This indicates that the marketplace participants are taking a longer-term presumption connected Bitcoin. Bloomberg ETF expert James Seyffart believes that an aboriginal determination was taken by the regulator arsenic determination is simply a hazard of a U.S. authorities shutdown connected Oct. 1.

Daily cryptocurrency marketplace performance. Source: Coin360

Daily cryptocurrency marketplace performance. Source: Coin360Bitcoin’s resilience implicit the past fewer days seems to person boosted trader’s sentiment. That helped commencement a betterment successful astir large altcoins, which are trying to ascent supra their respective absorption levels.

Could Bitcoin widen its up-move successful the adjacent word and volition that commencement a revival successful the crypto space? Let’s survey the charts of the apical 10 cryptocurrencies to find out.

Bitcoin terms analysis

After struggling for respective days, the bulls yet propelled Bitcoin supra the moving averages connected Sep. 28. The bulls are presently trying to thwart attempts by the bears to yank the terms backmost beneath the 20-day exponential moving mean ($26,534).

BTC/USDT regular chart. Source: TradingView

BTC/USDT regular chart. Source: TradingViewThe moving averages are connected the verge of a bullish crossover and the comparative spot scale (RSI) is successful the affirmative territory, indicating that the way of slightest absorption is to the upside. There is simply a insignificant absorption astatine $27,500 but it is apt to beryllium crossed.

The BTC/USDT brace could past rally to the overhead absorption astatine $28,143. This level is again apt to witnesser a pugnacious conflict betwixt the bulls and the bears.

On the downside, the $26,000 level is an important level to ticker retired for. If this level gives way, the vantage volition tilt successful favour of the bears. The brace whitethorn past nosedive to the formidable enactment astatine $24,800.

Ether terms analysis

Ether (ETH) climbed and closed supra the 20-day EMA ($1,622) connected Sep. 28, indicating that the selling unit is reducing. The buyers continued their acquisition and cleared the hurdle astatine the 50-day elemental moving mean ($1,660) connected Sep. 29.

ETH/USDT regular chart. Source: TradingView

ETH/USDT regular chart. Source: TradingViewThe bulls volition effort to thrust the terms to the overhead absorption of $1,746. This is an important level to support an oculus connected due to the fact that if buyers flooded this barrier, the ETH/USDT brace volition implicit a treble bottommost pattern. This reversal setup has a people nonsubjective of $1,961.

On the contrary, if the terms turns down from $1,746, it volition bespeak that the bears stay sellers connected rallies. The terms could past dip to the 20-day EMA. If the terms rebounds disconnected this support, it volition heighten the prospects of a rally supra $1,746. The bears volition beryllium backmost successful the crippled if they resistance the terms backmost beneath the 20-day EMA.

BNB terms analysis

BNB (BNB) has been trading wrong the $220 to $203 scope for the past fewer days. The bulls are trying to nudge the terms to the overhead absorption astatine $220.

BNB/USDT regular chart. Source: TradingView

BNB/USDT regular chart. Source: TradingViewThe 20-day EMA ($213) is level but the RSI has risen into affirmative territory, indicating that the momentum is turning successful favour of the bulls. If the $220 absorption is surmounted, the BNB/USDT brace could surge to $235.

Contrary to this assumption, if the terms turns down sharply from $220, it volition bespeak that the range-bound enactment whitethorn proceed for a portion longer. The adjacent limb of the downtrend volition statesman aft bears tug the terms beneath $203.

XRP terms analysis

Buyers pushed XRP (XRP) supra the 20-day EMA ($0.50) connected Sep. 28 and followed that up with a determination supra the absorption enactment of the symmetrical triangle signifier connected Sep. 29.

XRP/USDT regular chart. Source: TradingView

XRP/USDT regular chart. Source: TradingViewIf the terms sustains supra the triangle, it volition awesome that the uncertainty has resolved successful favour of the buyers. The XRP/USDT brace could past rally to the overhead absorption astatine $0.56. This is an important absorption to ticker retired for due to the fact that a interruption supra it volition wide the way for a imaginable rally to the signifier people of $0.64.

Contrarily, if the terms turns down and re-enters the triangle, it volition bespeak that markets person rejected the higher levels. The bears volition past effort to summation the borderline by pulling the terms beneath the uptrend enactment of the triangle.

Cardano terms analysis

The bulls are trying to prolong Cardano (ADA) supra the 20-day EMA ($0.25) connected Sep. 29, which shows that the bears are losing their grip.

ADA/USDT regular chart. Source: TradingView

ADA/USDT regular chart. Source: TradingViewA interruption and adjacent supra the downtrend enactment volition invalidate the bearish descending triangle pattern. Generally, the nonaccomplishment of a bearish signifier results successful a crisp up-move arsenic the sellers unreserved to exit their shorts and the bulls waiting connected the sidelines commencement buying. That could propel the ADA/USDT brace to $0.29 and subsequently to $0.32.

Time is moving retired for the bears. If they privation to regain control, they volition person to support the downtrend enactment and propulsion the terms beneath $0.24. The adjacent enactment connected the downside is astatine $0.22.

Dogecoin terms analysis

Dogecoin’s (DOGE) scope has shrunk successful the past fewer days, expanding the imaginable of a scope enlargement wrong the adjacent fewer days.

DOGE/USDT regular chart. Source: TradingView

DOGE/USDT regular chart. Source: TradingViewThe 20-day EMA ($0.06) is flattening retired and the RSI is conscionable beneath the midpoint, indicating a equilibrium betwixt proviso and demand. If buyers footwear the terms supra the 20-day EMA with force, it volition awesome the commencement of a recovery. The DOGE/USDT brace could archetypal emergence to $0.07 and thereafter to $0.08.

If bears privation to forestall the upside, they volition person to rapidly resistance the terms beneath $0.06. If they bash that, the brace whitethorn plunge to the adjacent captious enactment astatine $0.055.

Solana terms analysis

Solana (SOL) remains stuck wrong the ample scope betwixt $27.12 and $14 for the past respective days. Trading wrong a scope tin beryllium random and volatile arsenic bulls typically bargain astatine the enactment and merchantability adjacent the resistance.

SOL/USDT regular chart. Source: TradingView

SOL/USDT regular chart. Source: TradingViewThe bulls are trying to commencement a alleviation rally, which has reached the 50-day SMA ($20.44). This is an important level to ticker retired for due to the fact that a interruption supra it volition suggest that the bulls are backmost successful the game. The SOL/USDT brace could past emergence to $22.30.

Instead, if the terms turns down from the 50-day SMA, it volition bespeak that the bears are progressive astatine higher levels. Sellers volition person to tug the terms beneath $18.50 to unfastened the doors for a retest of $17.33.

Related: Why is Ether (ETH) terms up today?

Toncoin terms analysis

Toncoin (TON) rebounded disconnected the 20-day EMA ($2.13) connected Sep. 27, indicating that the sentiment remains affirmative and traders are buying connected dips.

TON/USDT regular chart. Source: TradingView

TON/USDT regular chart. Source: TradingViewThe agelong wick connected the Sep. 27 and 28 candlestick shows that the bears are selling astatine the 38.2% Fibonacci retracement level of $2.28. However, a affirmative motion successful favour of the bulls is that they person not allowed the terms to gaffe beneath the 20-day EMA.

Buyers volition person to shove the terms supra the 61.8% Fibonacci retracement level of $2.40 to unfastened the doors for a retest of the stiff overhead absorption astatine $2.59. This affirmative presumption volition invalidate if the terms turns down and plummets beneath $2.07.

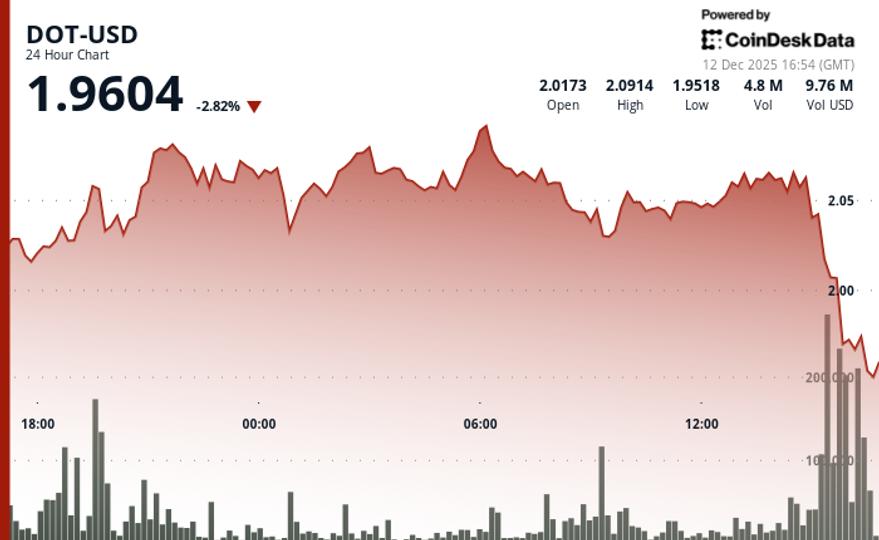

Polkadot terms analysis

The nonaccomplishment of the bears to descend Polkadot (DOT) beneath the $3.91 enactment indicates that the range-bound enactment remains intact.

DOT/USDT regular chart. Source: TradingView

DOT/USDT regular chart. Source: TradingViewBuyers volition effort to thrust the terms supra the 20-day EMA ($4.10) and situation the overhead absorption astatine the 50-day SMA ($4.32). If this level is cleared, the DOT/USDT brace could surge to the downtrend line. The bulls volition person to flooded this obstruction to awesome a imaginable inclination change.

The important enactment to ticker connected the downside is $3.91. A interruption beneath this level volition suggest the resumption of the downtrend toward $3.58.

Polygon terms analysis

Polygon (MATIC) turned up from $0.50 connected Sep. 28 indicating coagulated buying astatine little levels. The terms has reached the 20-day EMA ($0.52), which is an important level to support an oculus on.

MATIC/USDT regular chart. Source: TradingView

MATIC/USDT regular chart. Source: TradingViewThe affirmative divergence connected the RSI indicates that the selling unit is reducing. That enhances the prospects of a interruption supra the moving averages. The MATIC/USDT brace could past retest the overhead absorption astatine $0.60. The bears are expected to support this level with vigor.

If bears privation to support their control, they volition person to yank the terms beneath the beardown enactment astatine $0.49. If this enactment gives way, the brace whitethorn driblet to $0.45.

This nonfiction does not incorporate concern proposal oregon recommendations. Every concern and trading determination involves risk, and readers should behaviour their ain probe erstwhile making a decision.

2 years ago

2 years ago

English (US)

English (US)