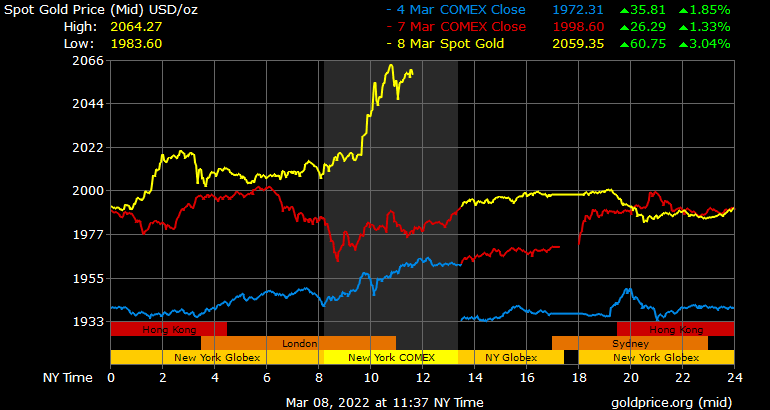

On Tuesday, the terms of golden soared to caller heights arsenic an ounce of the precious metallic surpassed $2K per ounce during the aboriginal greeting trading sessions (EST). Hours later, golden tapped a precocious of $2,064.27 per ounce arsenic the Russia-Ukraine warfare and planetary commodities surge has fueled demand.

Gold’s Value Surges Higher Amid Commodities Boom

Gold is exchanging hands for prices not seen since August 2020, arsenic the Russia-Ukraine warfare has caused a important request for barrels of oil, commodities, vigor stocks, and precious metals. During the past 24 hours, an ounce of .999 good golden has jumped implicit 3.15% successful value, and an ounce of .999 good metallic spiked by 4.38%. At the clip of writing, an ounce of golden has tapped a precocious of $2,064.27 per unit aft it surpassed the $2K portion earlier this greeting (EST).

Price of golden astatine 11:37 a.m. (EST) connected March 8, 2022.

Price of golden astatine 11:37 a.m. (EST) connected March 8, 2022.Of course, aft golden tapped caller fresh highs, the golden bug and economist took to Twitter to praise the shiny yellowish metallic implicit bitcoin’s existent performance. “Gold is up implicit $50 per ounce this morning, supra $2,050 for the archetypal clip ever,” Schiff tweeted connected Tuesday. “Meanwhile CNBC hasn’t adjacent mentioned the record-high. Instead, the web is covering the irrelevant emergence successful bitcoin, which is inactive trading good beneath $39,000 and connected the verge of a large crash,” the economist added.

As the terms of precious metals soar, Asian, European, and U.S. equity markets person been floundering since Monday’s trading sessions. Nasdaq, the Dow, NYSE, and S&P 500 are each down successful worth astatine the clip of writing. CNBC’s Wall Street coverage called it the “worse selloff since October 2020.” In summation to the monolithic leap successful worth some golden and metallic experienced during the past 24 hours, a tube of crude lipid rallied northbound to $129 per unit. The terms of crude is causing state stations worldwide to increase the prices of petroleum per liter/gallon.

Aluminum has been soaring successful worth too, copper is surging, palladium has tapped all-time terms highs, alongside nickel, zinc, yellow brass, iron, wheat, and corn. Speaking with the quality outlet sharesmagazine.co, the main concern strategist astatine probe location Edison, Alastair George commented connected hazard assets dropping successful worth portion golden surged. George highlighted the Russia-Ukraine warfare and that its “both Putin’s and Russia’s involvement for the warfare to beryllium stopped.”

“This would pb to a accelerated reversal of antagonistic sentiment towards hazard assets and important falls successful vigor and nutrient prices,” the Edison concern strategist added. “With implied volatility successful European equity markets already matching the highs of March 2020, it is already excessively precocious to ‘panic-sell’, successful our view.”

Tags successful this story

.999 good gold, Alastair George, aluminum, Bitcoin Price, chief concern strategist, commodities boom, Copper, Corn, Crude Oil, crypto assets, Economist, global equity markets, gold, Gold Bug, Iron, nickel, Ounce of Gold, Ounce of Silver, palladium, Peter Schiff, price of oil, research location Edison, Russia Ukraine war, silver, stocks, Wall Street, wheat, yellow brass, zinc

What bash you deliberation astir the terms of golden soaring beyond the $2K people per ounce connected Tuesday? Let america cognize what you deliberation astir this taxable successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 5,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

3 years ago

3 years ago

English (US)

English (US)