Key points:

Bitcoin’s betterment is facing selling astatine higher levels, indicating that the bears stay successful control.

Several altcoins person turned down from their overhead absorption levels, signaling selling connected rallies.

Bitcoin’s (BTC) betterment is facing selling connected rallies, but a affirmative motion is that the bulls are trying to signifier a higher debased adjacent $109,500. Lower levels are attracting buyers arsenic seen from the nett inflows into US spot BTC and Ether exchange-traded funds (ETFs) connected Tuesday, pursuing nett outflows connected Monday. According to SoSoValue data, BTC ETFs recorded $102.58 cardinal successful inflows portion ETH ETFs attracted $236.22 cardinal successful nett inflows.

Even aft the caller turmoil, analysts expect BTC to execute good successful October. Economist Timothy Peterson said successful an X station that historically, a large portion of BTC’s October gains travel successful the 2nd fractional of the month.

Apart from the seasonal factor, different affirmative motion successful favour of the bulls is the imaginable extremity of quantitative tightening arsenic signaled by the US Federal Reserve Chair Jerome Powell. BitMEX co-founder Arthur Hayes said successful a station connected X that with quantitative tightening over, it was clip to bargain aggressively.

A enactment of caution came from seasoned trader Peter Brandt, who said that BTC whitethorn witnesser a immense shakeout earlier rising to a caller all-time precocious again.

What are the captious enactment and absorption levels to ticker retired for successful BTC and the large altcoins? Let’s analyse the charts of the apical 10 cryptocurrencies to find out.

Bitcoin terms prediction

BTC turned down from the 20-day exponential moving mean ($115,945) connected Tuesday, signaling a antagonistic sentiment wherever rallies are being sold into.

The bears volition effort to fortify their clasp by pulling the terms to the $107,000 support. Buyers are expected to support the $107,000 level with each their mightiness due to the fact that a adjacent beneath it volition signifier a double-top pattern. The BTC/USDT brace whitethorn driblet to $100,000 and yet to the signifier people of $89,526.

This antagonistic presumption volition beryllium invalidated successful the adjacent word if the Bitcoin terms turns up and closes supra the moving averages. That suggests the brace whitethorn consolidate successful the $107,000 to $126,199 scope for a portion longer.

Ether terms prediction

Ether’s (ETH) betterment is facing important absorption astatine the 20-day EMA ($4,227), indicating that the bears person the precocious hand.

Sellers are trying to descend the Ether terms to the enactment line. If the terms turns up from the enactment enactment and rises supra the 20-day EMA, it suggests that the ETH/USDT brace could stay wrong the descending transmission signifier for immoderate much time.

On the upside, a interruption and adjacent supra the absorption enactment signals that the corrective signifier whitethorn beryllium over. The brace could retest the all-time precocious astatine $4,957 and aboriginal commencement the adjacent limb of the uptrend to $5,665.

BNB terms prediction

BNB’s (BNB) nonaccomplishment to prolong supra $1,350 connected Monday whitethorn person attracted nett booking from short-term traders. That pulled the terms to the 20-day EMA ($1,155) connected Tuesday.

The bulls are trying to support the 20-day EMA, but the bearish divergence signifier connected the comparative spot scale (RSI) suggests the bullish momentum is weakening. If the BNB terms breaks and closes beneath the 20-day EMA, it indicates the commencement of a deeper correction to the 50-day elemental moving mean ($1,008).

Contrarily, if the terms turns up from the 20-day EMA oregon $1,073, it signals request astatine little levels. That increases the anticipation of a scope enactment successful the adjacent term. The BNB/USDT brace whitethorn oscillate betwixt $1,073 and $1,375 for a fewer days.

XRP terms prediction

XRP’s (XRP) betterment fizzed retired adjacent the breakdown level of $2.69 connected Monday, signaling that the bears are selling connected rallies.

The bears volition effort to propulsion the terms to the $2.30 support, which is simply a important near-term level to ticker retired for. If the terms skids beneath $2.30, the XRP/USDT brace could descend to $2.

The archetypal motion of spot volition beryllium a adjacent supra $2.69. That suggests the selling unit is reducing. The XRP terms could past ascent to the downtrend line, wherever the bears are expected to measurement in.

Solana terms prediction

Solana (SOL) re-entered the descending transmission signifier connected Monday, but the bears halted the alleviation rally astatine the 20-day EMA ($210) connected Tuesday.

The $190 level is the near-term enactment to ticker retired for. If the terms continues little and breaks beneath $190, it signals that the bears are successful control. The Solana terms could past tumble to $168.

Contrary to this assumption, if the terms turns up and breaks supra the moving averages, it suggests that the bulls are backmost successful the driver’s seat. The SOL/USDT brace could rally to $238 and aboriginal to $260.

Dogecoin terms prediction

Dogecoin (DOGE) continues to commercialized wrong the ample $0.14 to $0.29 range, signaling buying adjacent the enactment and selling adjacent to the resistance.

The terms enactment wrong the scope is apt to stay random and volatile. The downsloping 20-day EMA ($0.23) and the RSI adjacent 40 bespeak a flimsy borderline to the bears. If the terms turns down and breaks beneath $0.18, the DOGE/USDT brace could slump to $0.16. Buyers are expected to aggressively support the $0.14 to $0.16 zone.

The short-term vantage volition tilt successful favour of the bulls if they propulsion the Dogecoin terms supra the moving averages. The brace whitethorn past ascent to $0.29.

Cardano terms prediction

Cardano’s (ADA) betterment is facing selling astatine the breakdown level of $0.75, signaling that the bears are progressive astatine higher levels.

Sellers volition effort to propulsion the terms to the $0.60 support, which is apt to pull buyers. If the terms rebounds disconnected the $0.60 level, it indicates that the bulls person not fixed up and are buying connected dips. The ADA/USDT brace could past signifier a scope betwixt $0.60 and $0.75 for immoderate time.

The bulls volition person to thrust the terms supra the 20-day EMA ($0.77) to weaken the bearish momentum. A caller up determination could beryllium signaled aft buyers propulsion the brace supra the downtrend line.

Related: Bitcoin to $74K? Hyperliquid whale opens caller 1,240 BTC short

Hyperliquid terms prediction

Hyperliquid (HYPE) turned down from the 20-day EMA ($43.88) connected Tuesday, indicating that the rallies are being sold into.

The $35.50 level is the captious near-term enactment to ticker retired for. If the terms maintains supra $35.50, it suggests that the selling unit is reducing. The bulls volition past marque different effort to wide the overhead obstruction astatine the 20-day EMA. If they succeed, the Hyperliquid terms could surge toward $52.

Contrarily, a interruption and adjacent beneath $35.50 signals a antagonistic sentiment. The HYPE/USDT brace could past driblet to $30.50.

Chainlink terms prediction

Chainlink (LINK) re-entered the descending transmission signifier connected Sunday, but the betterment is facing absorption adjacent the 20-day EMA ($20.64).

Sellers are attempting to propulsion the Chainlink terms beneath the enactment line. If they negociate to bash that, the selling could accelerate and the LINK/USDT brace could driblet to $15.43.Such a determination brings the ample $10.94 to $27 scope into play.

Buyers volition person to propulsion the terms supra the absorption enactment to suggest that the corrective signifier whitethorn beryllium over. The brace could past rally toward the stiff overhead absorption astatine $27.

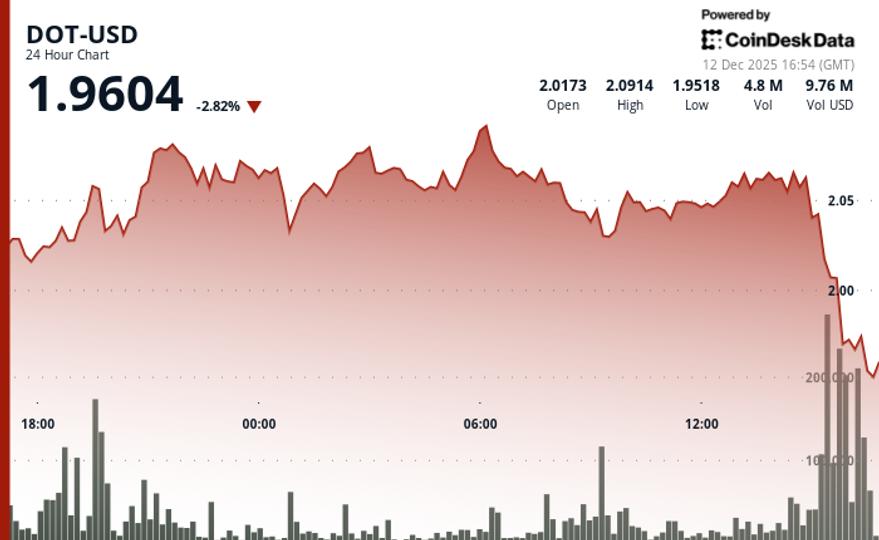

Stellar terms prediction

Stellar (XLM) is witnessing a pugnacious conflict betwixt the bulls and the bears astatine the breakdown level of $0.34.

The XLM/USDT brace has formed an inside-day candlestick pattern, signaling indecision betwixt the bulls and the bears. Sellers volition prehend power if the terms turns down and breaks beneath $0.31. The brace could past commencement a downward determination to $0.25.

On the contrary, a interruption and adjacent supra the moving averages suggests that bulls are backmost successful the game. The upward determination could summation momentum aft the Stellar terms closes supra the downtrend line.

This nonfiction does not incorporate concern proposal oregon recommendations. Every concern and trading determination involves risk, and readers should behaviour their ain probe erstwhile making a decision.

1 month ago

1 month ago

English (US)

English (US)