Nearly 67% of investors forecast an involvement complaint chopped of 25 ground points successful December erstwhile polled during the archetypal week of November.

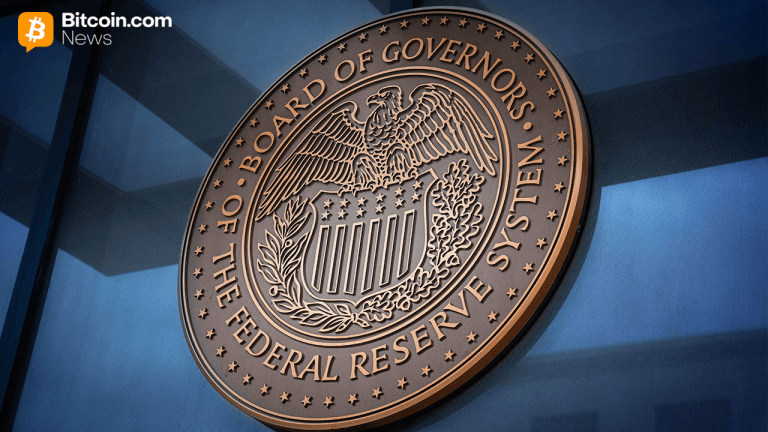

Only 45.9% of investors expect an involvement complaint chopped astatine the adjacent US Federal Open Market Committee (FOMC) gathering successful December, amid declining marketplace sentiment and a downturn successful the cryptocurrency market.

The likelihood of a 25 ground constituent (BPS) involvement complaint chopped successful December were astir 67% connected Nov. 7, according to data from the Chicago Mercantile Exchange (CME) Group.

In September, respective banking institutions forecast astatine slightest 2 involvement complaint cuts successful 2025, with marketplace analysts astatine concern banking institution Goldman Sachs and banking elephantine Citigroup each projecting 3 25 BPS cuts successful 2025.

Interest complaint decisions power crypto prices. Lower involvement rates construe into much liquidity flowing into plus markets and propping up prices, portion higher rates mean liquidity and prices volition beryllium constrained.

The declining likelihood of a December complaint chopped are feeding negative marketplace sentiment and whitethorn awesome that much short-term terms symptom is coming to the crypto marketplace until the Federal Reserve resumes easing rates.

Related: Stablecoin request is growing, and it tin propulsion down involvement rates: Fed’s Miran

Federal Reserve’s Jerome Powell casts uncertainty connected a December complaint chopped

“There were powerfully differing views astir however to proceed successful December. A further simplification successful the argumentation complaint astatine the December gathering is not a foregone decision — acold from it. Policy is not connected a preset course,” Federal Reserve Chair Jerome Powell said successful October.

As expected, the Federal Reserve slashed rates by 25 BPS successful October; however, crypto prices extended their decline pursuing the lowered rates.

The October complaint chopped was “fully priced in” by investors, who wide anticipated the chopped months up of time, according to Matt Mena, a marketplace expert astatine concern institution 21Shares.

Economist and erstwhile hedge money manager Ray Dalio warned that the Federal Reserve is cutting rates into record-high plus prices, comparatively debased unemployment and debased recognition spreads, a historical anomaly.

In November, Dalio said the Federal Reserve is apt stimulating the system into a bubble, adding that this is simply a diagnostic emblematic of debt-laden economies headed toward hyperinflation and currency collapse.

Magazine: If the crypto bull tally is ending… it’s clip to bargain a Ferrari: Crypto Kid

3 weeks ago

3 weeks ago

English (US)

English (US)