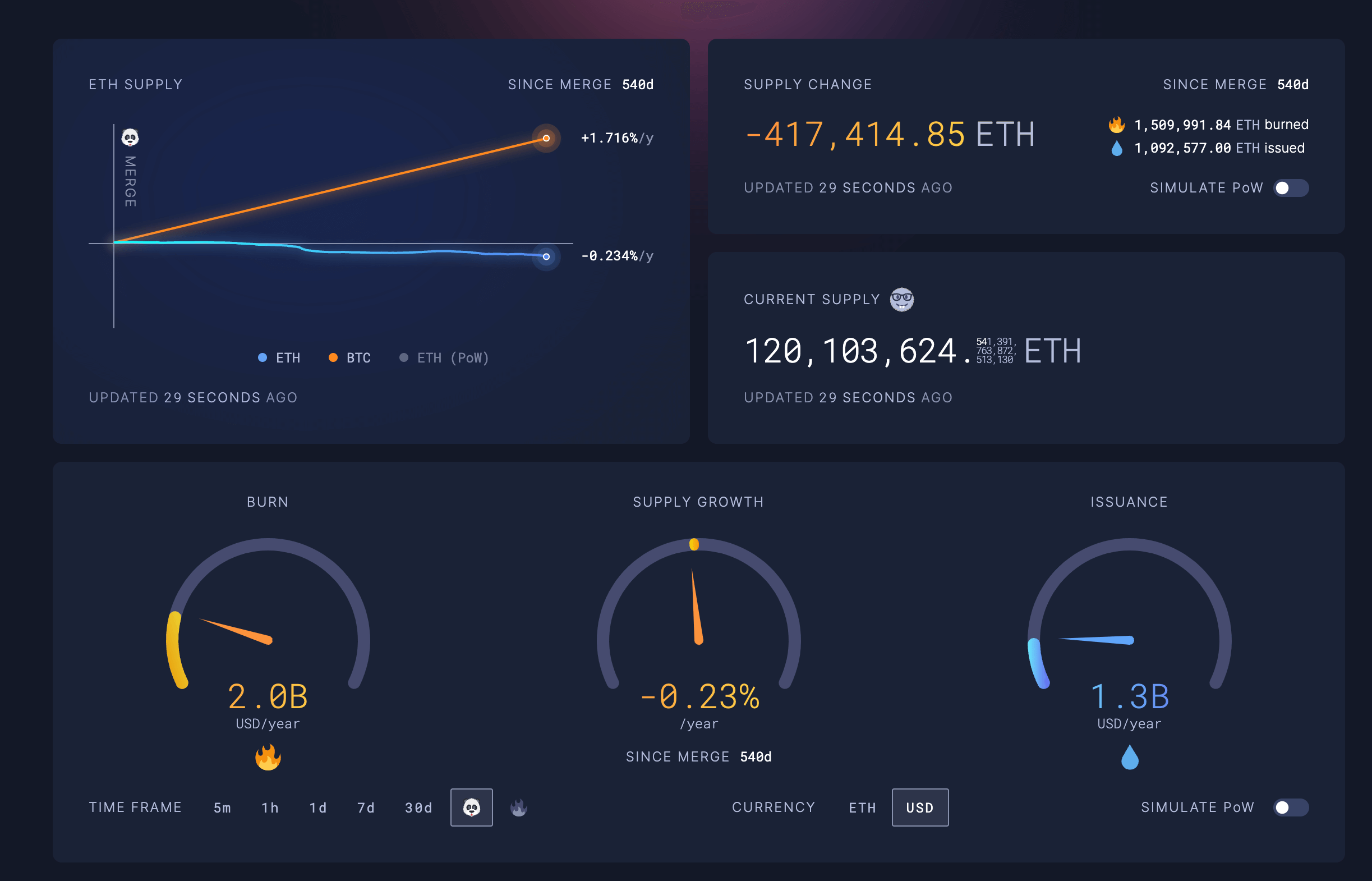

The Ethereum web has seen a simplification of 417,413 ETH successful proviso since transitioning to a Proof-of-Stake (PoS) statement mechanics successful September 2022, per information from ultrasound.money. In the 540 days since The Merge, 1,509,991 ETH has been burned portion the web has issued 1,092,578 caller ETH, resulting successful a nett decrease.

As of property time, the marketplace worth of the ETH removed from the proviso stands astatine $1,653,797,635, marking an yearly ostentation complaint of -0.23%.

Ethereum issuance since The Merge (Source: ultrasound.money)

Ethereum issuance since The Merge (Source: ultrasound.money)In contrast, Bitcoin’s proviso has grown by 1.716% implicit the aforesaid period. This highlights the divergent monetary policies of the 2 largest cryptocurrencies, arsenic Bitcoin maintains a predictable issuance schedule. At the aforesaid time, the equilibrium betwixt staking rewards and transaction interest burning present determines Ethereum’s proviso change.

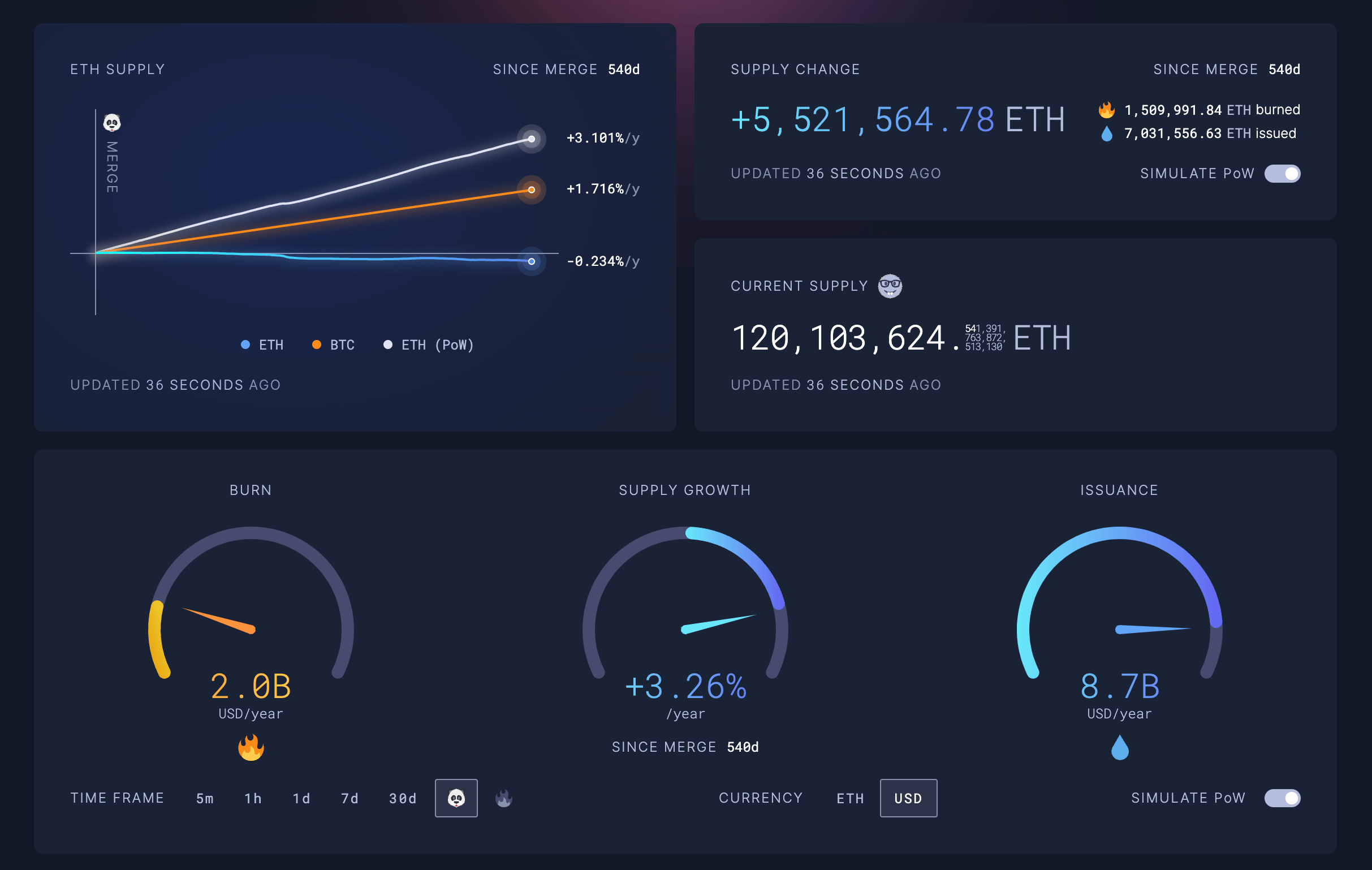

A Proof-of-Work (PoW) simulation connected the ultrasound.money dashboard shows Ethereum’s proviso would person accrued by implicit 5.5 cardinal ETH during the aforesaid play had the web not shifted to PoS. Under the PoW model, the simulation indicates 7,031,556 ETH would person been issued with the aforesaid 1.5 cardinal ETH pain rate, starring to a nett summation of 5,521,564 ETH since The Merge. The worth of the ETH issued nether this simulation would magnitude to $21,865,393,440, representing a theoretical ostentation complaint of 3.26%.

Ethereum issuance PoW simulation since The Merge (Source: ultrasound.money)

Ethereum issuance PoW simulation since The Merge (Source: ultrasound.money)The stark quality highlights the deflationary interaction of Ethereum’s caller statement plan compared to its erstwhile mining-based system. The modulation to PoS has importantly reduced caller ETH issuance, arsenic validators staking ETH present unafraid the web alternatively of PoW miners. This shift, combined with the ongoing pain mechanics introduced successful EIP-1559, has enactment downward unit connected Ethereum’s proviso growth.

According to the real-time data, Ethereum’s full circulating proviso presently stands astatine 120,103,624 ETH. Meanwhile, the PoW simulation estimates the proviso would person reached 125,625,188 ETH if miners were inactive powering the web nether the aged model.

The proviso simplification since The Merge aligns with the Ethereum community’s imaginativeness of making ETH a deflationary plus implicit time, diverging from Bitcoin’s fixed inflationary schedule. Proponents judge the operation of staking rewards and interest burning volition proceed to offset caller issuance, perchance starring to nett antagonistic proviso alteration periods.

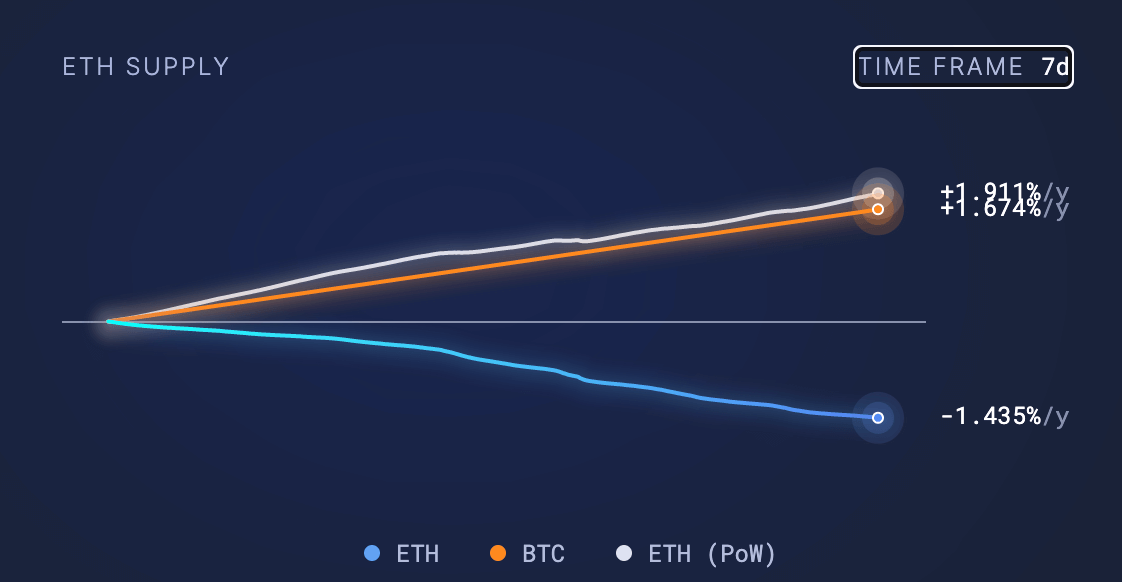

Over the past 7 days, increasing ETH web fees has facilitated an uptick successful deflationary behaviour arsenic it roseate to -1.435%. Moreover, adjacent nether PoW, its ostentation complaint would person fallen to 1.911% owed to the surge successful web enactment and its correlation with the pain mechanic.

Ethereum 7-day ostentation complaint (Source: ultrasound.money)

Ethereum 7-day ostentation complaint (Source: ultrasound.money)However, critics reason the determination to PoS has centralized power of the web successful the hands of large staking entities and exchanges. Some pass that the attraction of staked ETH could undermine Ethereum’s decentralization and information guarantees, successful opposition to Bitcoin’s much distributed mining network.

As Ethereum continues to germinate nether its caller PoS authorities and Bitcoin maintains its established PoW model, observers volition intimately ticker however their respective proviso dynamics and information trade-offs unfold. With Bitcoin’s issuance astir to fractional owed to the upcoming halving, its ostentation complaint volition driblet to 0.8%, which is wrong 1% of Ethereum. Bitcoin, however, has a fixed proviso and volition yet person an ostentation complaint of zero. Ethereum’s ostentation complaint is tied to web enactment and the magnitude burned done web transactions.

Still, the deflationary inclination successful ETH implicit the past 540 days offers an aboriginal glimpse into the imaginable aboriginal of the 2 largest cryptocurrencies up of the archetypal Bitcoin halving since The Merge. The semipermanent sustainability and implications for some networks stay to beryllium seen, with Bitcoin presently thriving astatine a $1.3 trillion marketplace cap and Ethereum adjacent successful enactment astatine $478 billion.

The station Proof of Stake chopped $21 cardinal ETH from circulation arsenic deflation falls to 1.4% appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)