ProShares has confirmed plans to motorboat a acceptable of XRP futures-based exchange-traded funds (ETFs) by April 30, according to an updated April 15 filing with the US Securities and Exchange Commission (SEC).

According to the filing, the plus absorption steadfast plans to present 3 futures-based funds: the ProShares UltraShort XRP ETF, the ProShares Ultra XRP ETF, and the ProShares Short XRP ETF.

These funds volition not clasp XRP straight but volition trust connected futures contracts and swap agreements to summation vulnerability to the asset.

Meanwhile, this update’s timing is notable, considering it comes little than a week aft the US saw its archetypal XRP-based fiscal concern conveyance spell live.

Launched connected April 9, the Teucrium 2x Long Daily XRP ETF (XXRP) delivers doubly the regular show of XRP utilizing swap contracts.

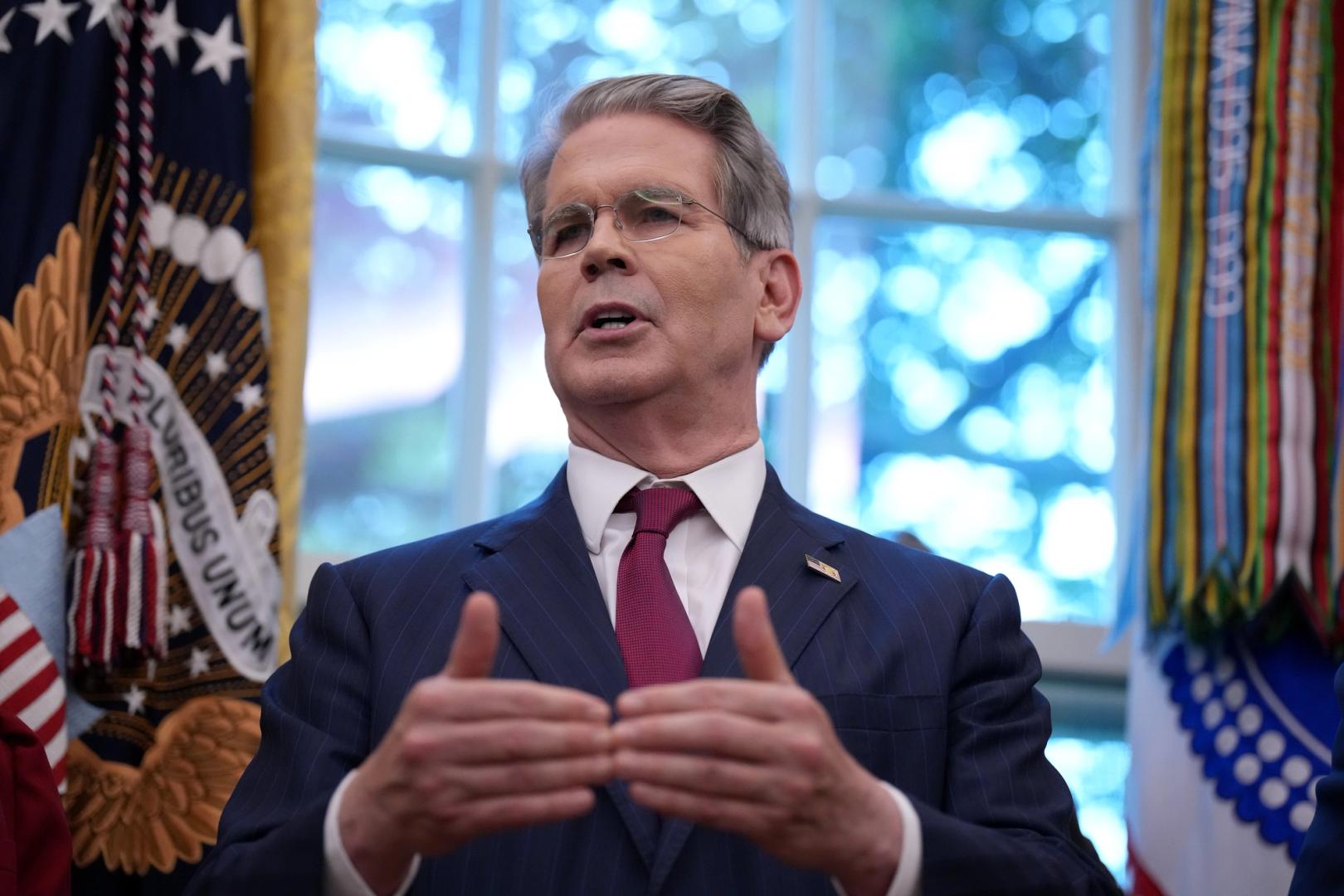

Sal Gilbertie, CEO of Teucrium, reported that the money experienced the strongest debut for immoderate fund regarding first-day trading activity.

XRP positions for spot ETF

ProShares’ introduction into the XRP ETF marketplace adds momentum to the asset’s increasing organization narrative.

Crypto analytics steadfast Kaiko precocious highlighted XRP arsenic the astir promising altcoin campaigner for spot ETF support successful the US.

In its latest analysis, Kaiko pointed to a noticeable emergence successful US spot trading measurement for XRP and the caller instauration of leveraged funds arsenic signs of maturing marketplace conditions. The steadfast believes these developments spot XRP up of different altcoins successful the contention for regulatory approval.

According to Kaiko:

“Since [XRP] leveraged ETF relies connected returns from European ETPs and swap agreements to warrant doubly the regular returns of XRP, its hard to spot however a spot merchandise is much risky and truthful diminishes astir arguments for denying these applications.”

This bullishness is besides evident successful prediction markets similar Polymarket, wherever crypto bettors estimate a 75% accidental of a spot ETF support earlier the extremity of this year. Should that materialize, analysts forecast imaginable superior inflows into the products could scope arsenic precocious arsenic $8 billion.

The station ProShares taps into XRP’s momentum with caller futures ETFs acceptable for April 30 launch appeared archetypal connected CryptoSlate.

6 months ago

6 months ago

English (US)

English (US)