Public mining companies are entering the last 4th of 2022 battered and bruised aft 9 months of carnivore marketplace brutality. At the extremity of Q3, the full marketplace values of each U.S.-listed mining companies dropped by implicit $14 cardinal from the commencement of the year, according to information compiled from YCharts. Whether the year’s extremity volition connection a respite for these companies is simply a precise unfastened question arsenic the headwinds from macroeconomic tumult look unabated successful the look of historical ostentation and scrambling cardinal bankers hopeless for speedy fiscal fixes. This nonfiction overviews the downtrend successful stock prices for nationalist mining companies arsenic the last 4th of the twelvemonth begins.

2022 Mining Market Recap

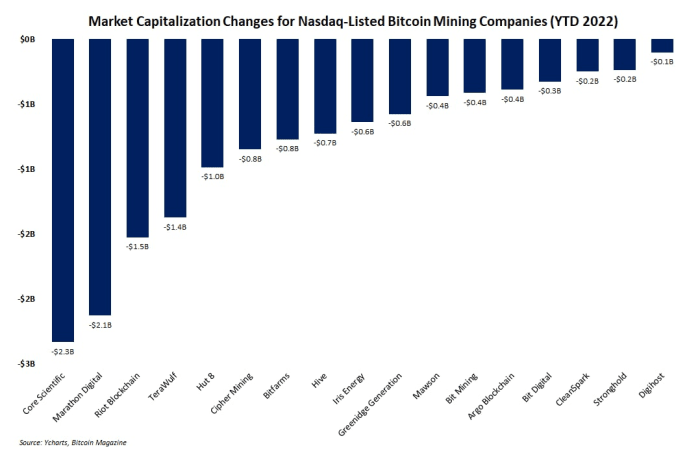

Over fractional of the full $14 cardinal erased from the marketplace values of nationalist mining companies is attributed to conscionable 5 companies, according to information from YCharts: Core Scientific, Marathon, Riot, TeraWulf and Hut 8. The barroom illustration beneath visualizes each company’s alteration successful full marketplace capitalization from the commencement of Q1 to the extremity of Q3 of this year.

This year, $14 cardinal has been erased from the marketplace values of nationalist bitcoin mining companies.

Compared to bitcoin itself, losses suffered by nationalist mining companies are small. Since January 1, bitcoin’s full marketplace worth has slipped from $900 cardinal to beneath $400 cardinal astatine the extremity of September, according to information from TradingView.

Readers should cognize that these charts lone amusement nationalist mining companies that commercialized connected American markets, namely the Nasdaq, 1 of the astir liquid and actively-traded markets successful the world. But different comparatively high-profile nationalist companies successful non-U.S. markets person besides suffered important losses, including Northern Data and Cathedra.

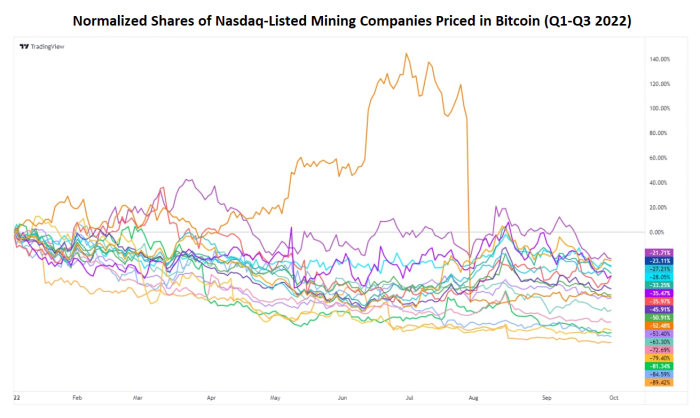

Any aboriginal terms woes for mining companies depends wholly connected bitcoin’s price. Mining stocks are inactive intimately correlated to bitcoin’s price, arsenic this writer noted successful a previous article for Bitcoin Magazine, and proceed to underperform. The enactment illustration beneath visualizes stock prices for each the mining companies included successful the erstwhile barroom graph priced successful bitcoin since the commencement of the year.

Share prices for nationalist bitcoin mining companies priced successful bitcoin since the commencement of the year.

Bullish Hope Springs Eternal

Despite already being 1 of the longest and harshest carnivore markets successful bitcoin’s past — particularly for miners, arsenic difficulty continues to soar to caller heights portion the terms continues dropping — determination is inactive anticipation for the nationalist mining assemblage implicit the agelong term.

For 1 thing, truthful agelong arsenic Bitcoin is bullish, bitcoin mining companies volition besides person a agleam aboriginal contempt intermittent periods of bearish marketplace conditions. Even if immoderate mining companies fail, others volition instrumentality their place.

For another, adjacent the accepted concern analysts spot imaginable successful the mining sector, with immoderate analysts calling for “major upside” among nationalist miners, according to CoinDesk, and others praising the “fantastic” fundamentals of immoderate miners. And those fundamentals — for galore companies — proceed to improve. In September alone, for example, CleanSpark acquired a 36 megawatt tract successful Georgia, Aspen Creek raised $8 cardinal to grow its star mining, Rhodium plans to spell public, and mining seasoned Jihan Wu acceptable up a $250 cardinal money for distressed mining assets. The mining assemblage is acold from dead.

Opportunity From Immaturity

In galore ways, the past mates years represented the precise archetypal marketplace rhythm for a important stock of the mining market, and thing ever goes good during the archetypal clip roundtripping a market’s ups and downs. Losses volition beryllium suffered, valuations volition plummet and immoderate companies volition illness completely.

But winners ever look from periods of marketplace immaturity. And the nationalist mining market’s immaturity is casual to see. For example, each mining stock’s terms continues to determination astir successful lockstep with bitcoin contempt each institution having tremendous differences successful operational strategies, outstanding debts, fig of machines online, and more. This shows that the marketplace cares much astir bitcoin’s terms than the company’s fundamentals. But this immaturity besides means determination is tremendous upside for maturation and maturation. If that isn’t capable crushed to marque you bullish connected mining, thing volition be.

This is simply a impermanent station by Zack Voell. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)