The beneath is an excerpt from a caller variation of Bitcoin Magazine Pro, Bitcoin Magazine's premium markets newsletter. To beryllium among the archetypal to person these insights and different on-chain bitcoin marketplace investigation consecutive to your inbox, subscribe now.

Core Scientific Capitulation

We’ve been highlighting the lawsuit for much nationalist miner capitulation implicit the past fewer months. News shows that Core Scientific, the largest publically traded mining institution by hash complaint and miner fleet, whitethorn look bankruptcy. The highlights from their SEC filing are the following:

- Core Scientific is halting each indebtedness work payments.

- Bitcoin holdings are present 24; they sold 1,027 implicit the past month.

- Cash resources volition beryllium depleted by the extremity of the twelvemonth oregon sooner.

- Core Scientific claims Celsius owes them $5.4 million.

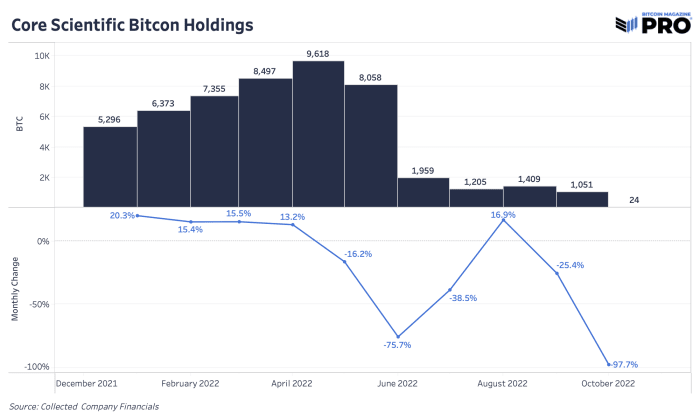

A elephantine successful the mining space, holding implicit 9,600 bitcoin astatine its peak, Core Scientific has present astir depleted its full treasury. Month-over-month maturation successful holdings is present worse than the summertime capitulation and selloff we saw backmost successful June 2022. Yet, successful June the selloff was overmuch larger successful size (6,099 bitcoin). It’s not needfully the Core Scientific treasury we are acrophobic astir present but alternatively the treasuries and holdings of each different bitcoin miners if this is simply a bigger informing motion for the industry.

Core Scientific's bitcoin holdings went from a whopping 9,618 successful May to lone 24 successful October

Core Scientific was capable to thrust higher bitcoin accumulation and stock of the hash complaint by having the largest debt-to-equity ratio successful the abstraction astatine 3.5. Now that indebtedness is coming owed during the worst clip to effort and rise much equity, with depressed prices and deficiency of fiscal appetite successful the market.

Currently, the company’s liquidity concern is babelike connected 2 variables: the bitcoin terms going higher and energy costs coming down. Our presumption is that it volition beryllium incredibly fortunate for either to materialize arsenic a stagnating bitcoin terms continues and energy prices, particularly for hosting bitcoin miners, is lone trending higher. Looking astatine Q2 earnings, Core Scientific’s outgo of revenues went from 67% to 92% compared to past year. Higher powerfulness depletion costs played a important factor.

The biggest hazard associated with mining equities and the rising hash complaint is not lone if companies tin past and get to the different side; immoderate volition and immoderate won’t. Rather, the question you request to inquire yourself arsenic an capitalist is whether your involvement successful the institution volition get importantly diluted on the way.

For now, we deliberation broad-based underperformance of miners comparative to bitcoin itself tin beryllium expected.

Let’s present crook our attraction to the imaginable for a capitulation crossed the ASIC market, arsenic Core Scientific, the world’s largest publically traded mining steadfast by hash complaint faces liquidity/solvency worries.

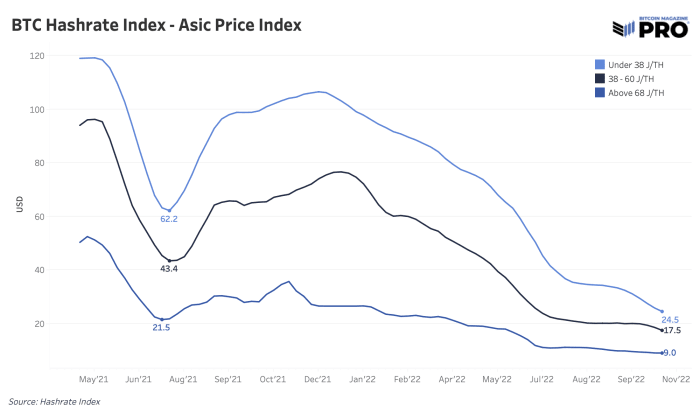

Even without caller developments, ASIC prices were already successful occurrence sale-like territory and are astatine caller all-time lows. Luxor’s Hash Rate Index shows conscionable however depressed prices person go crossed instrumentality ratio types successful the illustration below. As miners person gone to the latest, much businesslike rigs, that’s enactment further downward terms unit connected older mining models. As there’s much request for newer rigs similar the S19 XP and different marque caller hardware to enactment competitive, selling unit rises for older models that are unviable oregon unprofitable adjacent with the cheapest vigor costs. In the worst case, older machines are conscionable fixed distant for free.

Although Core Scientific volition person galore options specified arsenic indebtedness restructuring, Chapter 11 bankruptcy oregon a imaginable merger connected the table; selling disconnected and liquidating a portion of their 130,000 miner fleet whitethorn beryllium different option. Increased selling unit by miners volition lone adhd much strain to depressed prices. Further declines successful ASIC prices besides interaction each miners who are collateralizing oregon financing their ASICs arsenic the worth of ASIC prices tin driblet further. Now, we await what strain this volition person connected hash complaint implicit the mean word and if we’re to spot a important falloff successful hash complaint implicit the adjacent 3 to six months. We bash not judge this rhythm ends without a 20% autumn successful peak-to-trough hash rate.

ASIC prices are successful free-fall mode arsenic hash complaint continues to summation portion terms stays stagnant

Final note: Bitcoin mining is simply a brutal business, and the existent authorities of these conditions is the past remaining carnivore to slay successful regards to the decision of this bear market cycle and the rebirth of the adjacent bull market.

Only the beardown volition survive.

Relevant Past Articles:

- 10/25/22 - This Time Isn’t Different: Miners Are Biggest Risk Facing Bitcoin Market In Repeat of 2018 Cycle

- 10/6/22 - Hash Rate Hits New All-Time High: Implications For Mining Equities

- 7/26/22 - Bitcoin Hash Rate Plummets 17% From All-Time High

- 7/5/22 - Public Miners Start Selling Bitcoin Treasuries

- 6/29/22 - Mining Hash Price Bear Market

- 12/21/21 - On-Chain Mining And Public Miner Performance

3 years ago

3 years ago

English (US)

English (US)