The beneath is from a caller variation of the Deep Dive, Bitcoin Magazine's premium markets newsletter. To beryllium among the archetypal to person these insights and different on-chain bitcoin marketplace investigation consecutive to your inbox, subscribe now.

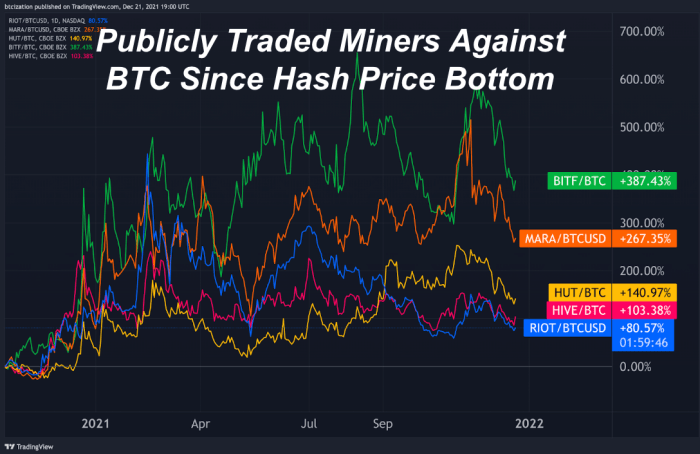

In regards to the show of publically traded miners, we volition beryllium looking astatine their show since the commencement of 2020 successful some USD and BTC terms.

RIOT, MARA, BITF, and HUT volition beryllium examined specifically.

Since the commencement of 2020, these 4 companies person outpaced the show of bitcoin, and there's a fewer cardinal reasons why. Namely, publicly-traded equities are often valued utilizing a aggregate of their existent earnings/cash flows.

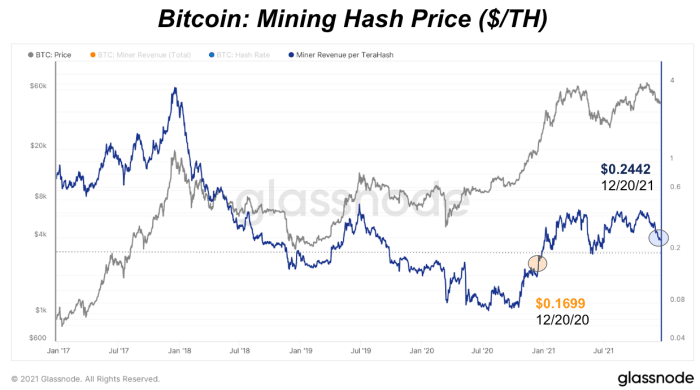

Towards the past 4th of 2020, miner hash terms started to explode, and frankincense the gross and subsequently nationalist miner marketplace capitalizations followed. Hash terms is quantified by dividing hash complaint by miner gross (dollar per terahash successful particular).

Since the hash terms bottomed successful October of 2020, miners person outperformed BTC by a wide margin, owed to hash terms expanding by arsenic overmuch arsenic 400% during the clip period.

What you should stitchery from evaluating the show of publicly-traded miners against bitcoin itself is that owed to the superior operation of their concern and the valuations contiguous successful equity markets, miners tin and apt volition outperform bitcoin implicit periods erstwhile hash terms rises significantly.

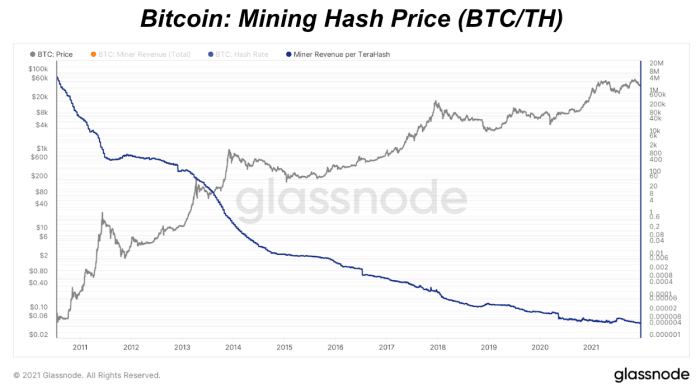

However, implicit the agelong word the gross successful bitcoin presumption for each mining institution is guaranteed to alteration successful bitcoin terms, and owed to the excessively ample net multiples that companies presently commercialized with successful equities markets successful a zero involvement complaint world, adjacent bitcoin mining equities inclination to zero implicit clip successful bitcoin presumption (once again, owed to the equity multiples assigned successful a zero involvement complaint fiat-denominated world).

Bitcoin-denominated hash terms is programmatically trending towards zero arsenic hash complaint rises and arsenic issuance declines with each consequent halving.

4 years ago

4 years ago

English (US)

English (US)