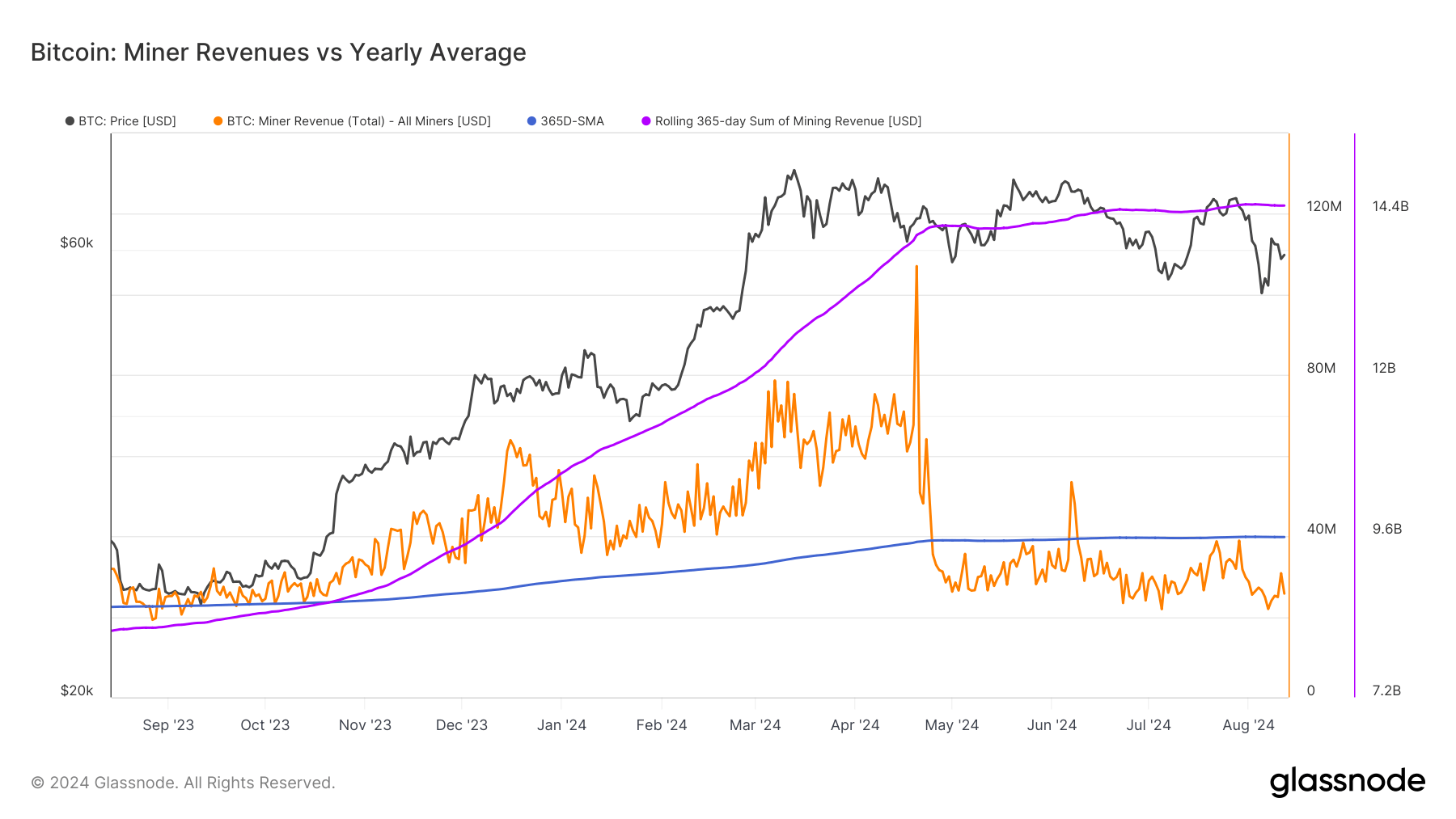

Miner revenues service arsenic a barometer for the wide authorities of the Bitcoin ecosystem, reflecting the delicate equilibrium betwixt mining costs, Bitcoin price, and web difficulty. Since Apr. 24, miner gross has consistently been beneath its 365-day elemental moving mean (SMA), with lone 2 little exceptions successful aboriginal June.

This prolonged play of below-average gross culminated connected Aug. 7, erstwhile miner gross plummeted to its lowest level since September 2023. While this sustained downturn tin beryllium attributed to respective factors, past week’s driblet resulted from a important driblet successful Bitcoin’s price.

Graph comparing the full Bitcoin miner gross to its yearly mean from Aug. 15, 2023, to Aug. 12, 2024 (Source: Glassnode)

Graph comparing the full Bitcoin miner gross to its yearly mean from Aug. 15, 2023, to Aug. 12, 2024 (Source: Glassnode)Bitcoin saw important volatility successful August, dropping from $65,360 astatine the opening of the period to beneath $50,000 connected Aug. 5 earlier partially recovering to $54,000 wrong 24 hours. Significant terms fluctuations similar this straight interaction miner revenue, arsenic the USD worth of each mined Bitcoin decreases with the price.

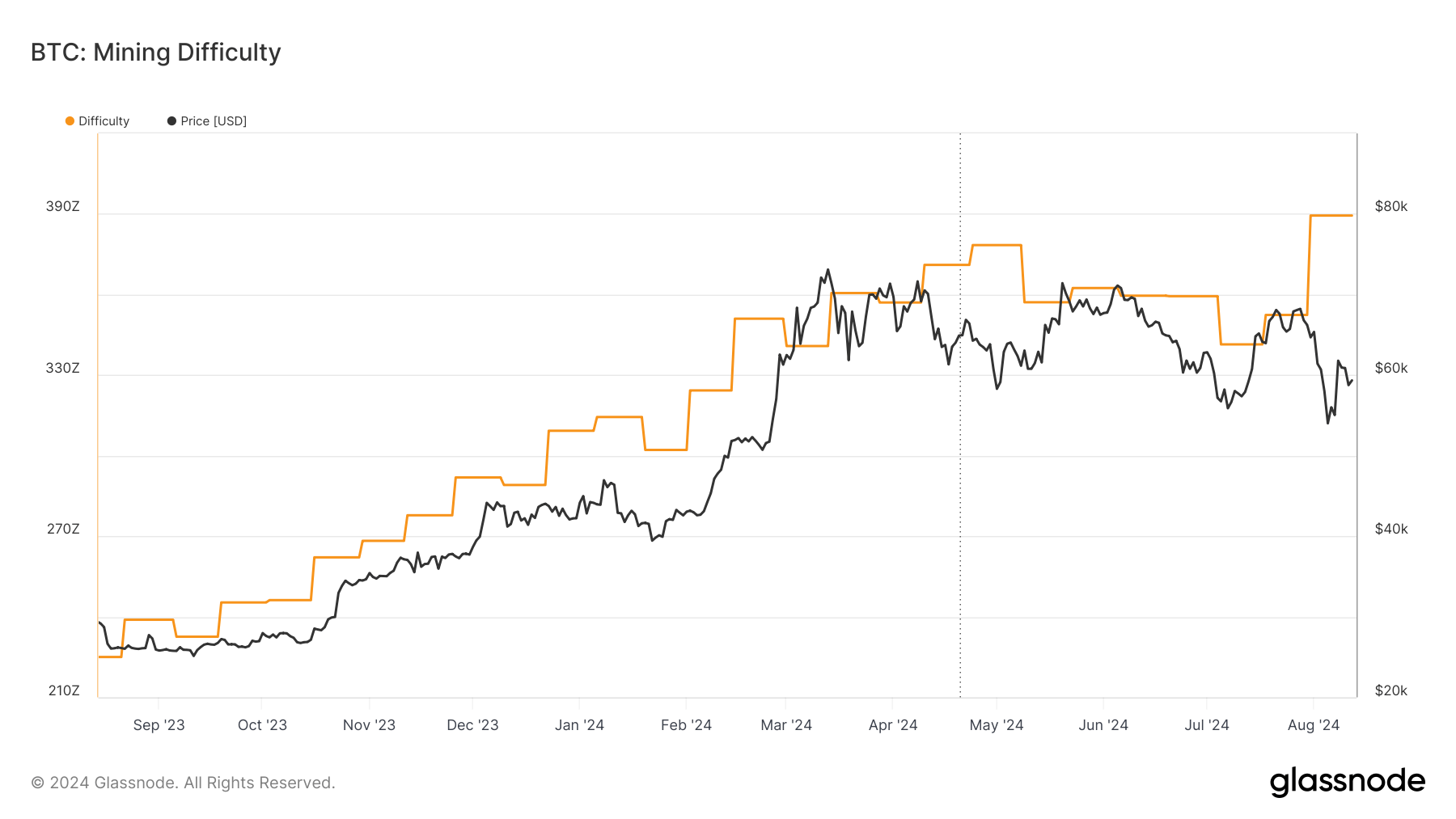

Bitcoin mining trouble has besides been expanding this month, requiring much computational powerfulness to excavation each Bitcoin and further squeezing nett margins.

Graph showing Bitcoin’s mining trouble from Aug. 15, 2023, to Aug. 12, 2024 (Source: Glassnode)

Graph showing Bitcoin’s mining trouble from Aug. 15, 2023, to Aug. 12, 2024 (Source: Glassnode)This short-term volatility is portion of a semipermanent inclination that began with Bitcoin’s halving successful April. The halving reduced the artifact reward from 6.25 BTC to 3.125 BTC, halving the fig of caller Bitcoins entering circulation. This structural alteration has impacted miner revenues and profitability, forcing the manufacture to accommodate to a caller economical world portion juggling short-term volatility.

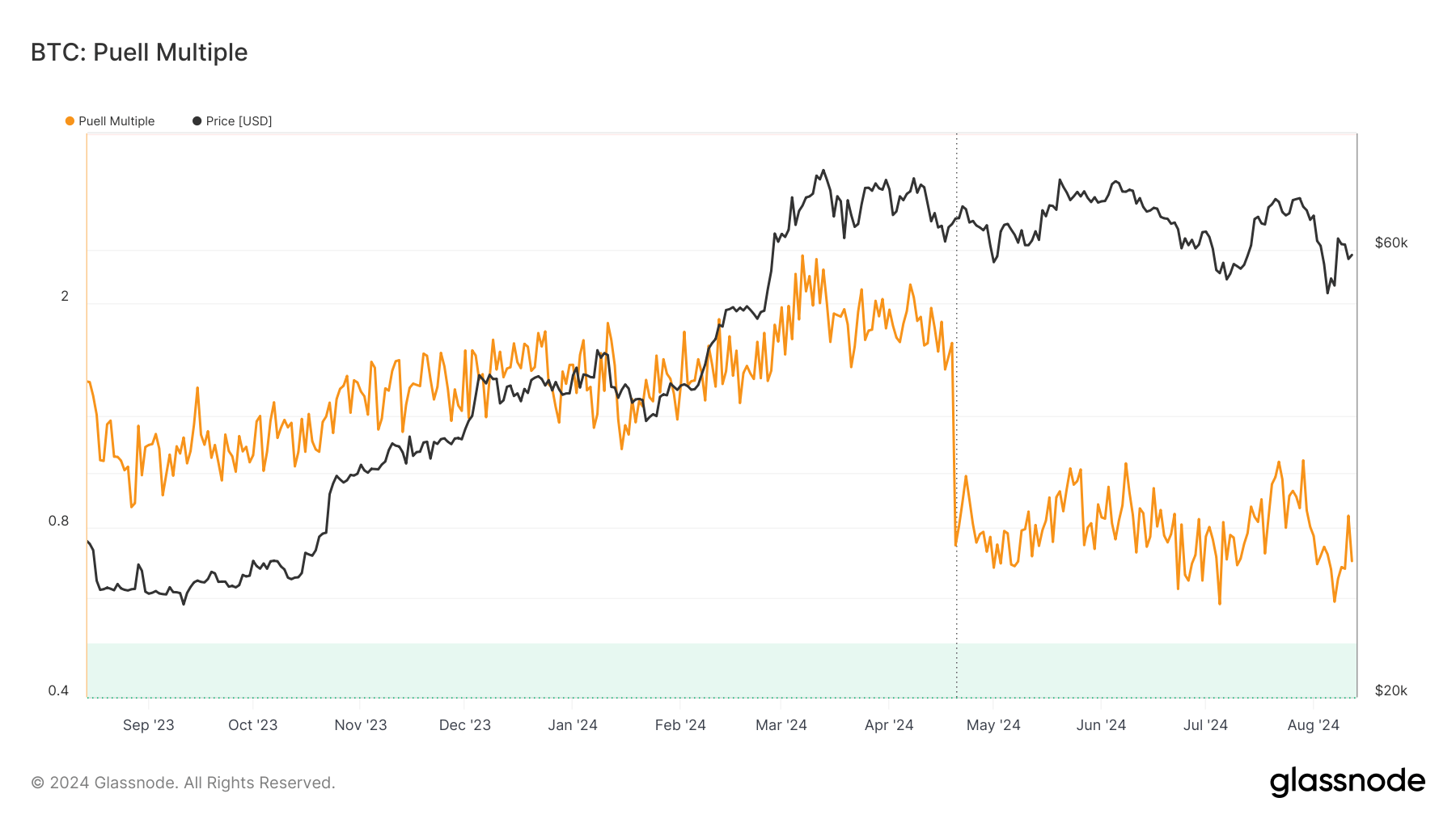

To amended recognize the implications of these changes, we tin crook to the Puell Multiple, a invaluable metric for assessing miner profitability and marketplace conditions. The Puell Multiple is calculated by dividing the regular issuance worth of bitcoins (in USD) by the 365-day moving mean of regular issuance value. This metric helps place periods of miner accent and imaginable marketplace turning points.

On Aug. 5, the Puell Multiple dropped to 0.5910, its lowest level since Jan. 3, 2023. This crisp diminution from 1.0525 connected Jul. 29 indicates that the regular issuance worth fell importantly beneath the yearly average. An adjacent much melodramatic driblet occurred instantly aft the halving, with the aggregate plummeting from 1.6999 connected Apr. 19 to 0.7441 connected Apr. 20.

Graph showing the Puell Multiple from Aug. 15, 2023, to Aug. 12, 2024 (Source: Glassnode)

Graph showing the Puell Multiple from Aug. 15, 2023, to Aug. 12, 2024 (Source: Glassnode)Historically, a Puell Multiple beneath 0.5 has signaled marketplace bottoms and presented charismatic buying opportunities for investors. The existent worth of 0.7, portion not yet beneath this threshold, suggests that miners are nether considerable pressure and that the marketplace mightiness person approached a bottom. However, it’s important to enactment that the caller halving lawsuit has fundamentally altered the issuance, perchance affecting however we construe the Puell Multiple successful the adjacent term.

The operation of below-average gross and a debased Puell Multiple shows important accent successful the Bitcoin mining industry. Miners are presently earning little USD per Bitcoin mined, pushing little businesslike operations towards the brink of unprofitability. The reduced rewards post-halving person intensified contention among miners for the disposable Bitcoin, starring to accrued hash rates and mining difficulty.

If these conditions persist, the marketplace whitethorn spot different capitulation event, wherever miners are forced to merchantability a ample portion of their reserves oregon unopen down operations altogether. This script could summation marketplace volatility arsenic miners liquidate holdings to screen operational costs. However, it whitethorn besides thrust ratio improvements crossed the manufacture arsenic miners question cheaper vigor sources and upgrade to much businesslike hardware.

From a marketplace perspective, the existent authorities of miner revenues and the Puell Multiple carries respective implications. arsenic noted, periods of miner accent and debased Puell Multiples person often signaled a bully buying accidental for semipermanent investors. Additionally, miners operating astatine oregon adjacent breakeven levels whitethorn beryllium little inclined to merchantability their Bitcoin holdings, perchance reducing wide marketplace proviso and supporting prices.

The stress connected the mining ecosystem could pb to a much businesslike and resilient manufacture successful the agelong term, a inclination we’ve already begun seeing among large, nationalist miners. As little businesslike operations are forced retired of the market, those that stay volition apt beryllium amended equipped to upwind aboriginal marketplace fluctuations.

The station Puell Multiple drops arsenic miner revenues deed 10-month low appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

![Why Crypto Market Is Going Up Today [Live] Updates, Reasons & Price Action](https://image.coinpedia.org/wp-content/uploads/2025/11/11142238/Crypto-Market-Today-Bitcoin-Holds-Around-105K-Altcoins-Stay-Cautious-While-UNI-WLFI-TRUMP-Thrive-1024x536.webp)

English (US)

English (US)