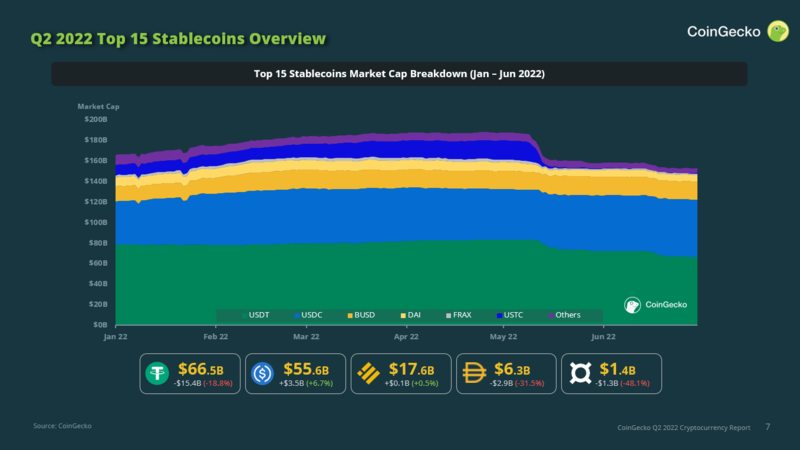

On July 13, the dedicated crypto terms tracking, volume, and marketplace capitalization web portal Coingecko published the company’s “Q2 2022 Cryptocurrency Report” which discusses the past quarter’s crypto marketplace enactment and insights. The 46-page study explains however the Terra UST and LUNA fallout wreaked havoc connected the full crypto ecosystem and the stablecoin economy. Moreover, Coingecko researchers accidental “a alteration successful the stablecoin marketplace stock suggests that a definite magnitude of superior has wholly exited the crypto ecosystem.”

Coingecko’s Data Suggests Q2 Investors Exited Stablecoins Rather Than De-Risking Into Them

Coingecko has published the company’s 2nd 4th cryptocurrency report for 2022 arsenic there’s been a fig of important changes during the past 3 months. The study, published past Wednesday, notes that Q2 2022 was “filled with galore unfortunate events successful the crypto space.”

The crypto firm’s study explains that portion spot marketplace commercialized volumes person remained dependable astatine $100 cardinal daily, “the apical 30 coins person mislaid implicit fractional their marketplace headdress since the erstwhile quarter.” Much of the crypto blunder started from a domino effect caused by the Terra UST and LUNA collapse.

Coingecko details that conscionable earlier UST’s downfall, the stablecoin was the third-largest fiat-based token successful existence, and $18 cardinal was erased successful conscionable a fewer days. The study notes that BUSD managed to go the third-largest stablecoin. Beside’s Terra’s UST, different stablecoin assets saw their valuations endure and Coingecko’s analysts fishy a circumstantial magnitude of funds person near the crypto economy. The researcher’s Q2 2022 survey says:

The flimsy alteration (discounting UST) successful stablecoin marketplace stock suggests that a definite magnitude of superior has wholly exited the crypto ecosystem, successful opposition to past 4th erstwhile investors apt de-risked into stables amidst marketplace uncertainty.

The Terra and 3AC Fallouts Spread, Defi Market Cap Tumbles

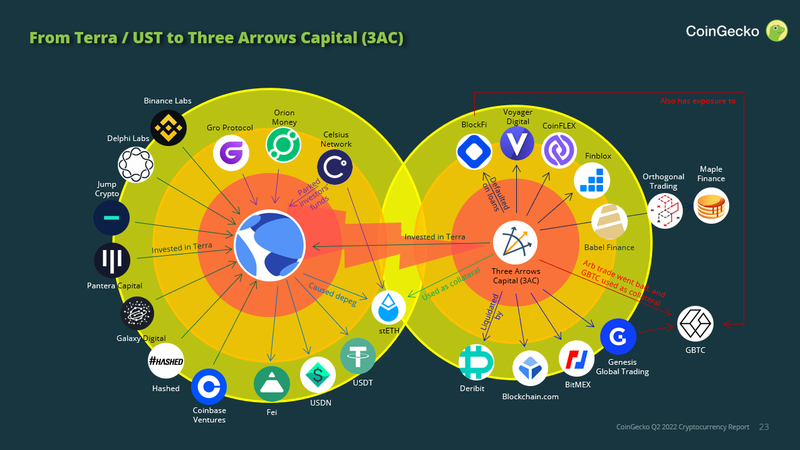

The 46-page study further explains however Lido’s bonded assets were affected by the Terra blowout and the demise of the crypto hedge money Three Arrows Capital (3AC). One circumstantial illustration shared successful the survey shows however 3AC’s fiscal issues affected astatine slightest 12 antithetic crypto companies straight oregon indirectly.

Decentralized concern (defi) was besides hit, arsenic Coingecko’s authors accidental “Due to third-order effects, defi protocols specified arsenic Maple Finance were not spared arsenic immoderate users’ funds were lent to Orthogonal Trading, which successful crook had gone to Babel Finance, 1 of 3AC’s creditors.”

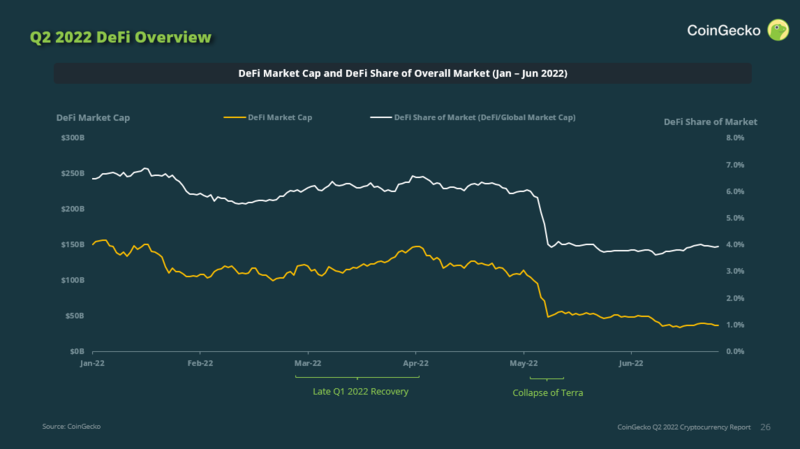

Defi itself suffered a batch and Coingecko’s information shows that the defi marketplace headdress slid from “$142 cardinal to $36 cardinal successful a span of 3 months.” The study again says that overmuch of the worth successful defi was “wiped retired mostly owed to the illness of Terra and its stablecoin, UST.”

Coingecko’s survey covers a wide assortment of subjects that pertain to Q2 2022’s crypto enactment and touches connected topics similar different stablecoins losing their peg, decentralized speech (dex) commercialized volumes, non-fungible tokens (NFTs), and NFT marketplaces. While the 2nd 4th saw a batch of action, Coingecko’s study highlights however astir of it has been bearish and gloomy.

What bash you deliberation astir Coingecko’s study and the enactment recorded successful the 2nd 4th of 2022? Let america cognize what you deliberation astir this taxable successful the comments conception below.

3 years ago

3 years ago

English (US)

English (US)