Reason to trust

Strict editorial argumentation that focuses connected accuracy, relevance, and impartiality

Created by manufacture experts and meticulously reviewed

The highest standards successful reporting and publishing

Strict editorial argumentation that focuses connected accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum (ETH), the second-largest cryptocurrency by marketplace capitalization, has experienced 1 of its astir challenging starts to the year, signaling its second-worst show successful the archetypal 4th of its history.

As of now, ETH is trading conscionable supra the important support level of $2,000, reflecting a year-to-date diminution of 43%. This stark opposition is peculiarly notable erstwhile compared to Bitcoin (BTC) and XRP, which person seen gains of 23% and an astonishing 279%, respectively, during the aforesaid period.

Could A 60% Surge In Q2 Bring It Back To $3,200?

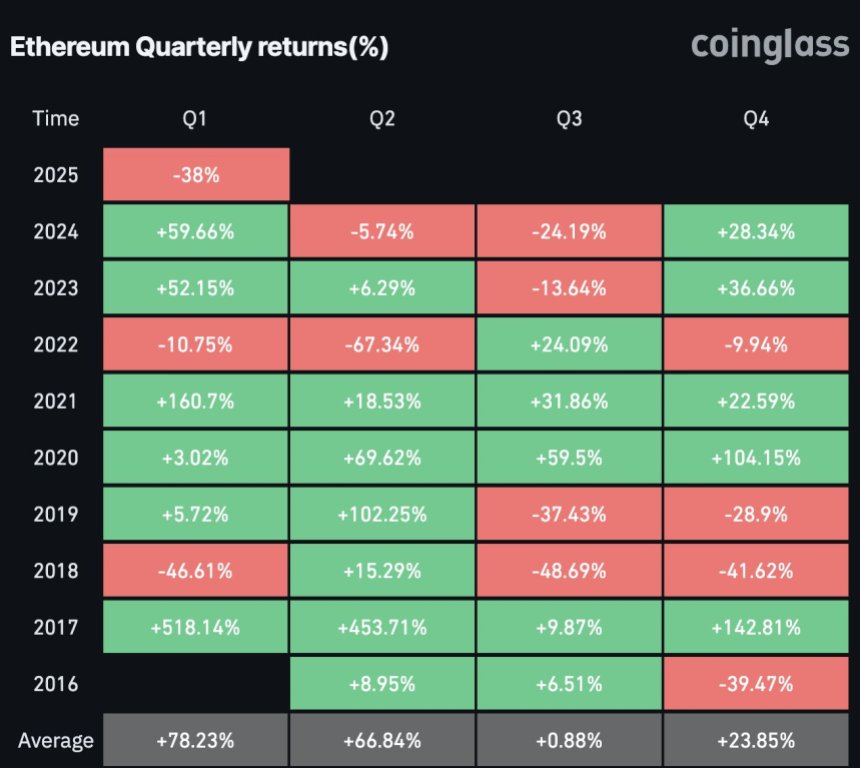

Market adept Lark Davis has drawn attraction to the melodramatic downturn successful Ethereum’s terms successful a caller social media update, highlighting a 38% driblet successful Q1 of this twelvemonth for the altcoin.

This fig is alarmingly adjacent to its worst quarterly show of 46% recorded during the archetypal 4th of 2018, arsenic noted successful the examination illustration shared by Davis.

ETH’s show per 4th since 2016. Source: Lark Davis connected X

ETH’s show per 4th since 2016. Source: Lark Davis connected XFollowing that troubling 4th successful 2018, Ethereum saw a little betterment of 15% successful Q2, lone to look much than 40% declines successful the consequent quarters, respectively, raising concerns for existent investors that this pattern might hap erstwhile again successful this cycle.

Despite these discouraging figures, Davis posed an absorbing question regarding the imaginable for an “explosive” 2nd 4th for Ethereum. Historically, since 2016, ETH has averaged a singular 66% surge during this period.

If this inclination continues and the Ethereum terms were to execute a 60% summation successful the coming months, its terms could ascent to $3,200 per token—levels not seen since aboriginal February of this year.

Crypto Expert Predicts 1,100% Surge For The Ethereum Price

While short-term challenges remain, galore analysts clasp a semipermanent bullish outlook for Ethereum. Crypto expert Merlijn drew parallels betwixt the existent marketplace conditions and Bitcoin’s past performance, suggesting that Ethereum is poised for a akin trajectory.

The expert noted, “Accumulation, breakout, and V-shape betterment loading,” implying that a caller bull tally could beryllium connected the skyline for ETH, with forecasts suggesting it could scope up to $24,000 during this cycle—a large 1,100% increase.

However, the way to betterment is not without its hurdles. Expert Ali Martinez precocious highlighted key absorption levels that Ethereum indispensable flooded for a sustainable rebound successful the short-term.

Martinez noted that ETH’s terms has reclaimed its realized terms of $2,040, but the adjacent important situation lies astatine the $2,300 mark, wherever beardown absorption has been observed for the starring altcoin.

Despite a caller betterment that saw a 10% spike successful the past 2 weeks, Ethereum inactive faces notable monthly losses, down astir 25% pursuing a broader marketplace correction.

Featured representation from DALL-E, illustration from TradingView.com

10 months ago

10 months ago

English (US)

English (US)