A quant has breached down however the Bitcoin MVRV MACD oscillator could beryllium utilized to cheque for signals successful the price.

Bitcoin MVRV MACD Oscillator As Price indicator

As explained by an expert successful a CryptoQuant post, this metric tin assistance observe some the lows and the highs successful the price, arsenic good arsenic the greater trends. The “Bitcoin MVRV” is an indicator that measures the ratio betwixt the marketplace headdress and the realized cap.

Here, the “realized cap” is simply a capitalization exemplary for BTC that values each coin successful circulation astatine the terms astatine which it was past moved, alternatively than taking the aforesaid existent BTC terms arsenic the worth of each the coins, arsenic the mean marketplace headdress does.

Since the realized headdress is benignant of a “true” worth exemplary for the coin, its examination with the marketplace headdress (in the MVRV) tin archer america whether the coin is undervalued oregon overvalued astatine the moment. When the MVRV is greater than 1, it means BTC is overpriced close now, portion having values beneath the threshold suggests it’s underpriced.

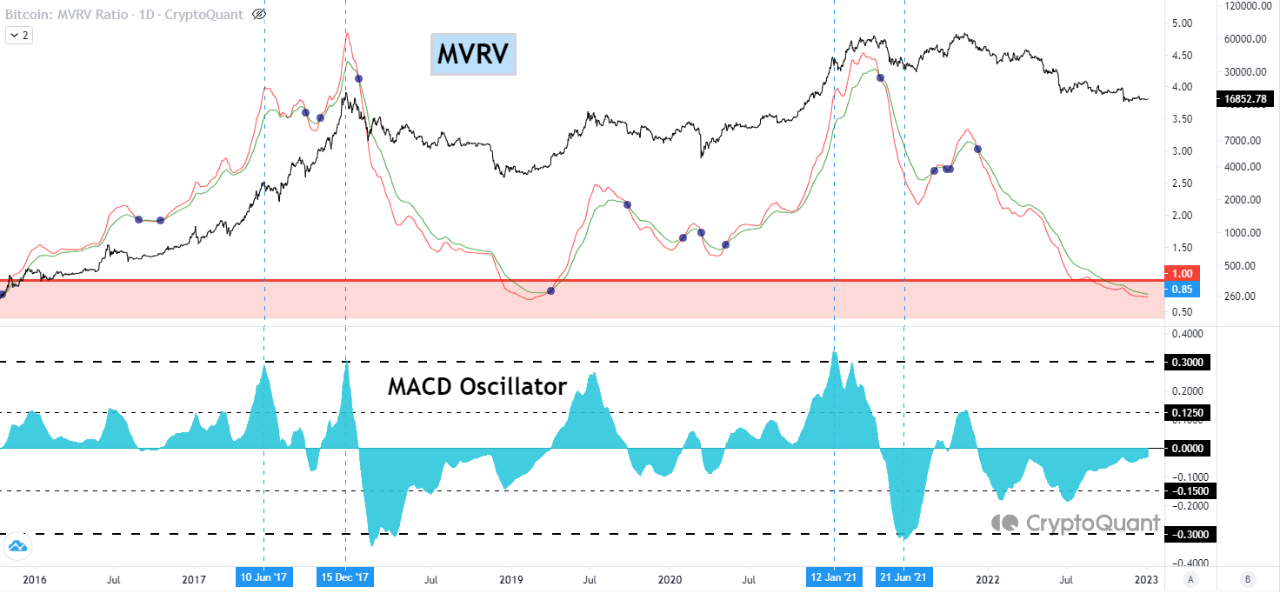

Now, to usage MVRV arsenic a trading tool, the quant has taken the MACD oscillator of the indicator. A MACD oscillator is conscionable the quality betwixt the short-term and semipermanent exponential moving averages (EMA) of the metric successful question. Here, these EMAs are the 50-day and the 100-day versions.

The beneath illustration shows however the Bitcoin MVRV MACD tin beryllium utilized for uncovering tops and bottoms successful the price:

According to the quant, whenever the MVRV MACD has been higher than 0.3, it has been a awesome that BTC is overbought currently. On the different hand, values little than -0.3 person signaled underbought conditions.

From the chart, it’s evident that portion these signals haven’t coincided with the rhythm tops and bottoms, they person inactive correctly indicated immoderate section tops and bottoms.

Now, present is different graph wherever the expert has highlighted however divergences betwixt the terms and the MVRV MACD tin awesome aboriginal trends:

“A divergence occurs erstwhile the absorption of a method indicator and the absorption of the terms inclination are moving successful other directions,” explains the analyst. In the graph, it’s disposable that whenever the MVRV MACD has moved up wrong the antagonistic portion portion the terms consolidates sideways oregon declines, a bullish divergence has formed for Bitcoin.

Similarly, a bearish divergence has taken signifier erstwhile the worth of the crypto has been rising, but the indicator has been going down successful the portion supra zero. At present, nary of these signals person formed successful the existent bear market truthful far.

BTC Price

At the clip of writing, Bitcoin is trading astir $16,800, up 1% successful the past week.

Featured representation from André François McKenzie connected Unsplash.com, charts from TradingView.com, CryptoQuant.com

2 years ago

2 years ago

English (US)

English (US)