A quant has explained however determination is simply a transportation betwixt the caller trends successful the US banal marketplace volumes and the Bitcoin price.

TradFi Depth Oscillator Has Hit A Low And Is Now Turning Back Up

As explained by an expert successful a CryptoQuant post, the measurement extent successful accepted concern markets has been debased recently.

The “TradFi volume” is simply a measurement of the full magnitude of transactions that buyers and sellers are making connected the US stock market.

There is simply a conception called “market depth,” which is the quality of immoderate marketplace to instrumentality successful ample orders without impacting the terms of the commodity much.

Generally, the much orders determination are successful a market, oregon simply, the higher its volume, the stronger the extent of the asset. However, thing important is that these orders should beryllium dispersed evenly wrong the market, different the extent wouldn’t beryllium arsenic great.

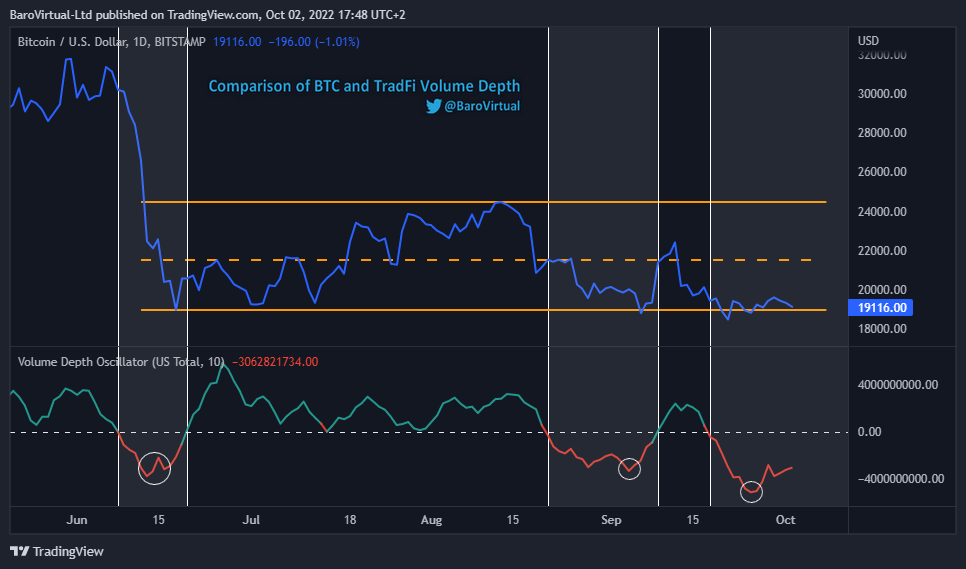

Using an oscillator, the cyclical inclination successful the extent of immoderate plus tin beryllium noticed. Here is simply a illustration that shows however the US banal marketplace measurement extent oscillator has changed its values during the past fewer months:

As you tin spot successful the supra graph, the quant has marked the applicable zones of inclination betwixt the Bitcoin terms and the TradFi measurement extent oscillator.

It looks similar whenever the indicator has transitioned from affirmative to antagonistic values, the worth of the crypto has observed bearish winds.

On the different hand, the metric crossing the zero enactment the other mode has pb to a bullish inclination for the terms of BTC.

Bitcoin has besides seen section bottommost formations astir the points wherever the banal marketplace measurement extent oscillator itself has deed lows.

About a week ago, the indicator deed precise debased values that were comparable to those betwixt February and March 2020. Since then, the metric has started turning backmost up.

The expert believes that this caller inclination enactment could connote that Bitcoin whitethorn spot a respite soon, and bounce to levels betwixt $21.5k to $24.5k.

Bitcoin Price

At the clip of writing, Bitcoin’s price floats astir $19.2k, up 2% successful the past 7 days. Over the past month, the crypto has mislaid 4% successful value.

The beneath illustration shows the inclination successful the terms of the coin implicit the past 5 days.

3 years ago

3 years ago

English (US)

English (US)