A quant has pointed retired immoderate similarities betwixt the existent and summertime 2020 Bitcoin markets done on-chain data.

Bitcoin Exchange Supply Shock Ratio Has Rapidly Risen Recently

As explained by an expert successful a CryptoQuant post, determination look to beryllium immoderate similarities betwixt the existent marketplace inclination and that during the summertime of 2020.

The “exchange supply” is an indicator that measures the full magnitude of Bitcoin contiguous connected wallets of each exchanges.

This proviso is usually assumed to beryllium the selling proviso of the crypto arsenic investors mostly transportation their coins to exchanges for selling purposes.

The proviso successful acold wallets of investors, connected the different hand, is apt being held for accumulation, and is improbable to beryllium sold.

The ratio betwixt this capitalist wallet proviso and the speech reserve is called the “exchange proviso daze ratio.”

When the worth of this metric goes up, it means the proviso connected exchanges is dropping and investors are filling up their acold wallets.

Related Reading | Bitcoin Futures Basis Nears One-Year Lows, How Will This Affect BTC?

On the different hand, a downtrend suggests a propulsion to merchantability from sellers arsenic they deposit their Bitcoin to centralized exchanges.

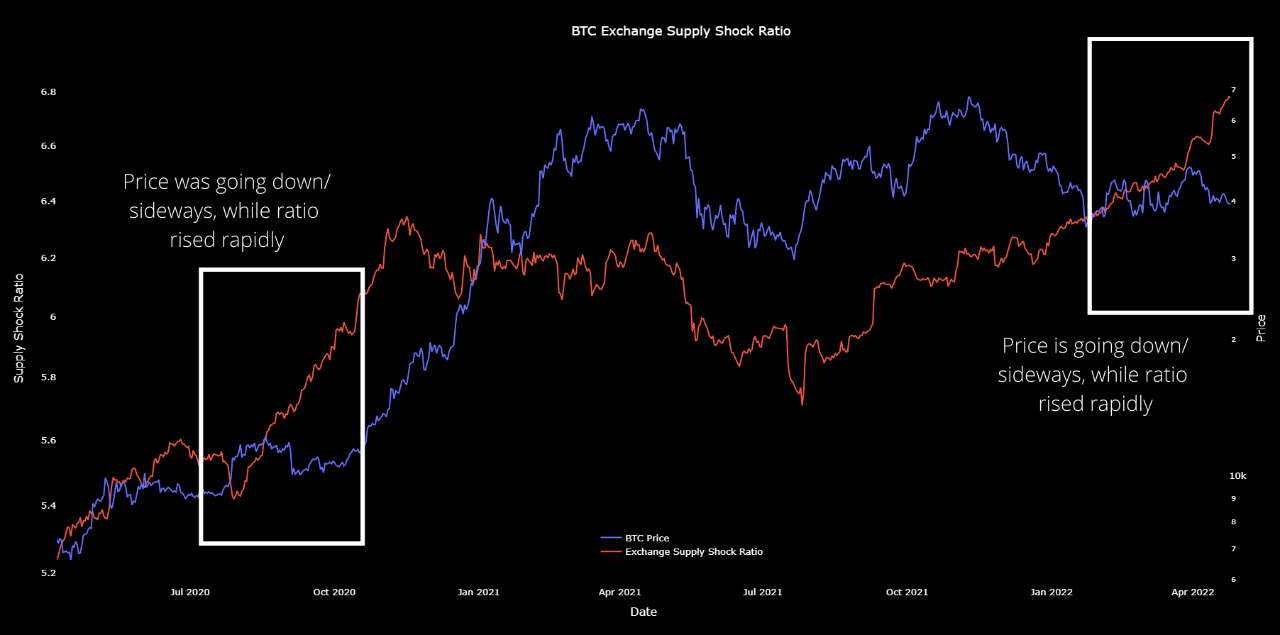

Now, present is simply a illustration that shows the inclination successful the BTC speech proviso daze ratio implicit the past mates of years:

In the supra graph, the quant has marked the applicable trends of similarity betwixt the Bitcoin markets of summertime of 2020 and of close now.

It looks similar during some the periods, the terms was trending down oregon moving sideways, portion the speech proviso daze ratio had been rapidly going up.

Related Reading | Institutional Investors Bearish On Bitcoin, Ethereum. Here’s What They’re Buying

Despite the struggling terms astatine the moment, investors person showed request for the crypto arsenic they person been rapidly accumulating precocious (similar to backmost then).

What followed a fewer months aft the summertime of 2020 was the commencement of a caller Bitcoin bull tally owed to the resulting “supply shock.”

The BTC terms is heavily tied to the banal market currently, and the expert believes it’s imaginable that erstwhile it decouples, a akin daze could beryllium determination this clip arsenic well.

BTC Price

At the clip of writing, Bitcoin’s price is trading astir $39.8k, down 7% successful the past week. Over the past month, the crypto has mislaid 15% successful value.

The beneath illustration shows the inclination successful the terms of the coin implicit the past 5 days.

3 years ago

3 years ago

English (US)

English (US)