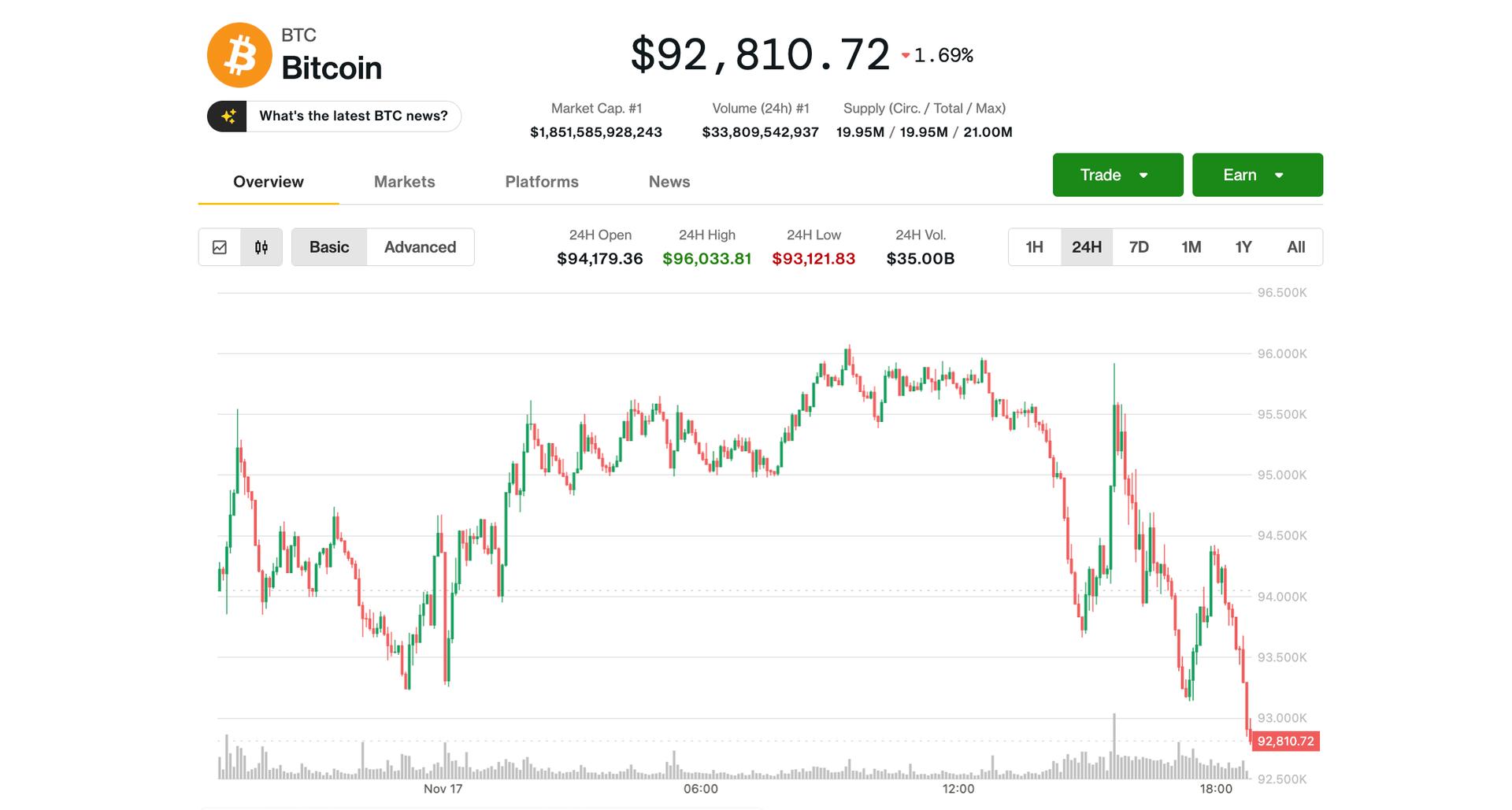

The Bitcoin futures-to-spot ground has fallen into antagonistic territory, signaling a important displacement successful trader sentiment toward de-risking. Futures are present trading beneath the spot terms for the archetypal clip since March 2025, erasing the premium that typically reflects beardown request for leverage.

This modulation into a futures discount signifier suggested that Bitcoin (BTC) traders are progressively unwilling to instrumentality connected risk, alternatively pricing BTC’s short-term outlook lower.

Key takeaways:

Bitcoin futures – spot ground turns negative, signaling caution and de-risking among traders.

Internal speech flows surges person historically marked volatility and liquidity accent for BTC.

Bitcoin futures-spot ground signals 2 antithetic pathways

A antagonistic ground often emerges during periods of presumption unwinding oregon erstwhile markets are preparing for volatility. BTC is presently trading wrong the “Base Zone”, a scope associated with heavier selling unit oregon reduced exposure. Both the seven-day and 30-day moving averages are trending downward, confirming a bearish tilt successful the futures market.

However, the humanities signifier complicates the picture. Since August 2023, each lawsuit of the seven-day SMA turning antagonistic has coincided with a bottom-formation scope during bull phases. If the marketplace has not afloat transitioned into a carnivore cycle, this could again service arsenic an aboriginal betterment marker.

If conditions lucifer those of January 2022, the awesome whitethorn alternatively people the opening of a deeper downturn. A instrumentality supra the 0%–0.5% ground scope would beryllium the archetypal motion of renewed confidence.

Data besides showed the BTC-USDT futures leverage ratio resetting toward 0.3, signaling that the market’s antecedently overheated leverage from Q2–Q3 has yet cooled. A little ratio reflects reduced forced-liquidation hazard and a healthier futures structure.

If bullish momentum returns, this cleaner leverage backdrop could enactment arsenic a affirmative catalyst by giving traders country to re-risk without the fragility seen earlier successful the year.

Related: BTC terms bull marketplace lost? 5 things to cognize successful Bitcoin this week

Search for Bitcoin bottommost continues

Crypto expert Pelin Ay said that the exchange's in-house travel adds further value to the existent downside narrative. This metric measures the measurement of BTC moved betwixt interior speech wallets, typically for operational purposes oregon liquidity balancing. While not a nonstop measurement of selling, crisp spikes often coincide with turbulent periods and large shifts by ample players.

From precocious 2024 to aboriginal 2025, the marketplace experienced monolithic internal-transfer spikes during accelerated terms rallies, followed by steep corrections. The signifier repeated successful May–June 2025 arsenic BTC climbed from $60,000 to $90,000, validating its bullish correlation.

Now, the metric has surged again, rising acold supra its accustomed 5–10 scope successful aboriginal November. This spike aligned with BTC’s crisp diminution from supra $110,000 to $95,000. Historically, specified surges bespeak liquidity stress, heightened volatility, and unit connected price.

Given the operation of antagonistic basis, rising interior flows, and accelerating downside momentum, BTC appears poised to proceed searching for a bottom.

Related: 95% of Bitcoin has present been mined: Here’s wherefore it’s important

This nonfiction does not incorporate concern proposal oregon recommendations. Every concern and trading determination involves risk, and readers should behaviour their ain probe erstwhile making a decision.

2 hours ago

2 hours ago

English (US)

English (US)