Quick Take

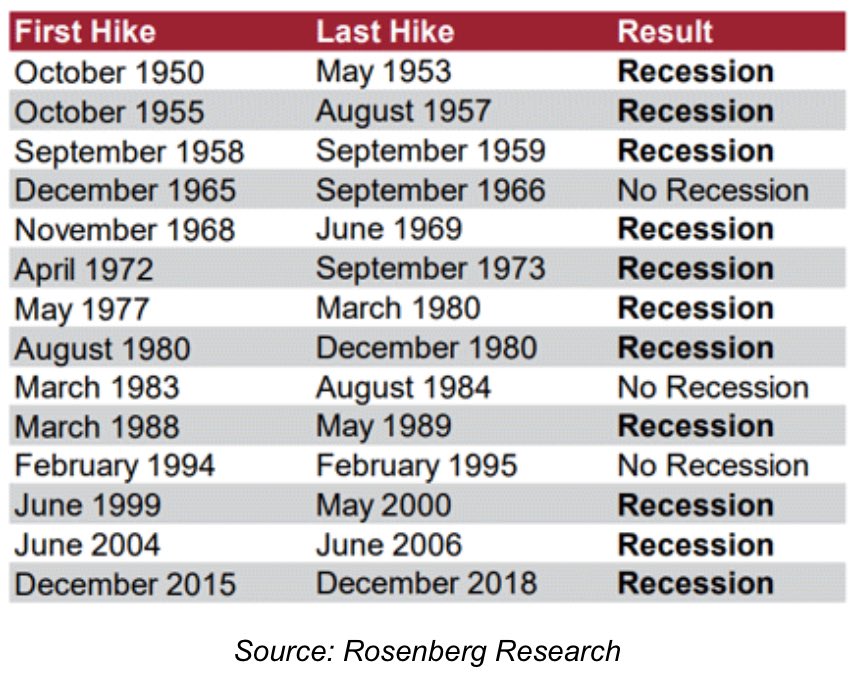

The Federal Reserve and different cardinal banks worldwide are approaching the extremity of a rate-hiking cycle, raising concerns astir a imaginable recession. Historical information from Rosenberg Research, shared by QE infinity, reveals a concerning trend: retired of the past 14 rate-hiking cycles since 1950, the United States has experienced a recession 11 times. Recessions were successfully averted successful 1966, 1984, and 1995.

https://x.com/StealthQE4/status/1786880277249183783

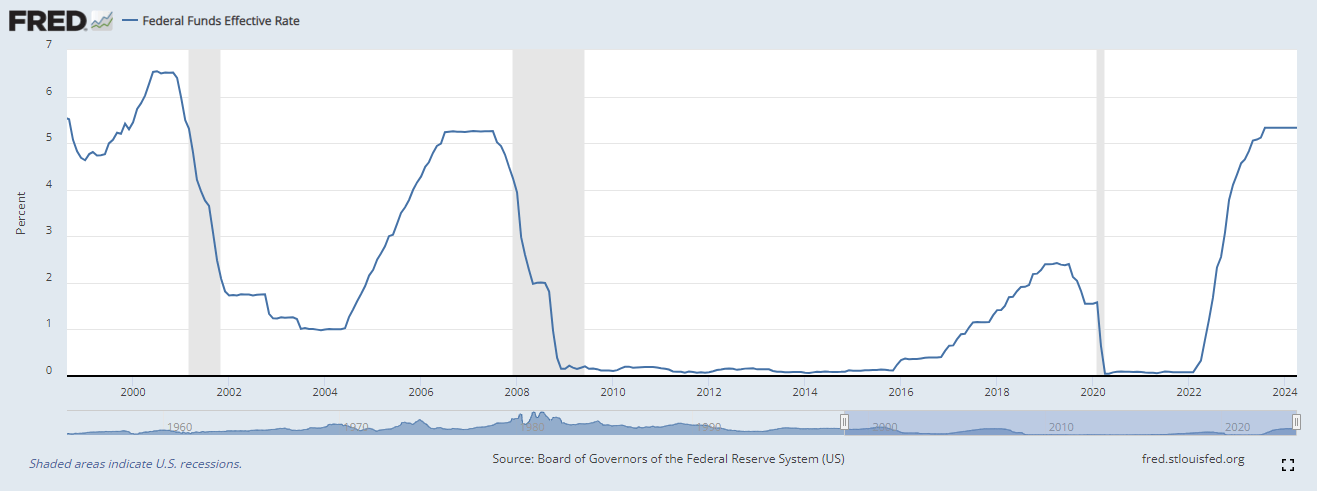

https://x.com/StealthQE4/status/1786880277249183783The existent rate-hiking rhythm has seen the Federal Reserve rise the national funds complaint to 5.33% successful August 2023, and it has maintained this complaint since then, pausing for 9 consecutive meetings. Comparing this to the 2008 recession, the Fed past hiked rates successful June 2006 to 5.25% and held for 12 months earlier the recession hit.

Federal Funds Effective Rate, 2000 done to 2024: (Source: FRED)

Federal Funds Effective Rate, 2000 done to 2024: (Source: FRED)As the Fed and different cardinal banks proceed to navigate the delicate equilibrium betwixt controlling inflation, unemployment, and sustaining economic growth, the CME FedWatch tool is presently pricing successful 2 complaint cuts successful 2024, perchance lowering the national funds complaint to the scope of 4.75% – 5.00% by the extremity of 2024.

While complaint hikes are a modular instrumentality cardinal banks usage to combat inflation, the information suggests that specified measures often travel astatine the outgo of economical contraction.

The station Rate hikes linked to 11 retired of 14 past U.S. recessions, humanities investigation shows appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)