The $125 cardinal existent property steadfast wants to connection blockchain-based tokens to clients but is stalled by regulation.

Feb 18, 2026, 10:23 p.m.

Billionaire existent property mogul Barry Sternlicht said his firm, Starwood Capital Group, which manages implicit $125 cardinal successful assets, is acceptable to statesman tokenizing real-world assets but can’t determination guardant owed to regulatory barriers successful the United States.

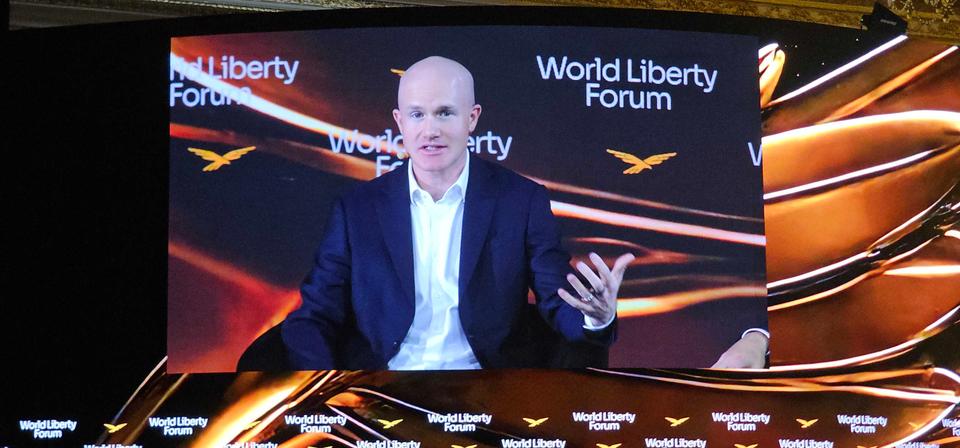

“We privation to bash it close present and we’re ready,” Sternlicht said Wednesday astatine the World Liberty Forum successful Palm Beach. “It’s ridiculous that our clients can’t bash it successful token,” helium said, referring to transacting real-world assets — similar existent property — utilizing blockchain-based tokens.

Tokenization refers to converting ownership of carnal assets, similar existent property oregon art, into blockchain-based tokens that tin beryllium traded. For firms similar Starwood, it could connection a caller mode to rise superior oregon springiness investors entree to antecedently illiquid markets.

Putting existent property connected the blockchain isn't a caller idea, and immoderate different firms are already moving guardant connected a tiny standard to marque the monolithic market, which inactive relies heavy connected manual processes, much efficient.

One specified steadfast is Propy, which laid retired its plans past twelvemonth for $100 cardinal expansion to get mid-size spot rubric firms crossed the U.S., aiming to streamline the manufacture processes.

In fact, consulting elephantine Deloitte said successful a study past twelvemonth that $4 trillion of existent property volition beryllium tokenized by 2035, expanding from little than US$0.3 trillion successful 2024. If that becomes reality, that's a 27% CAGR for tokenized existent estate.

"Tokenized existent property could not lone pave the mode for caller markets and products, but besides springiness existent property organizations an accidental to flooded challenges related to operational inefficiency, precocious administrative costs charged to investors, and constricted retail participation," Deloitte said.

'It's a fantastic thing'

Sternlicht besides seems to stock the imaginativeness that tokenization tin revolutionize the manufacture by praising the monolithic imaginable of the underlying technology.

“The exertion is superior,” helium said. “This is the future.

He went truthful acold arsenic to comparison the existent authorities of tokenization to artificial intelligence, saying it is acold down wherever AI is today.

“This is adjacent earlier successful the carnal satellite than AI is.” Sternlicht called tokenization “exciting arsenic tin be,” saying, “It’s a fantastic happening for the world, the satellite conscionable has to drawback up with it.”

More For You

Kraken continues acquisition streak by buying token absorption steadfast Magna up of IPO push

The woody adds token lifecycle infrastructure to Kraken’s increasing merchandise suite.

What to know:

- Payward, Kraken’s genitor company, has acquired token operations steadfast Magna.

- Magna is utilized by crypto teams to negociate token vesting, claims and distributions. It serves 160 clients and had a highest full worth locked of $60 cardinal connected its level past year.

- Kraken has made a drawstring of acquisitions to grow and raised $800 cardinal past twelvemonth astatine a $20 cardinal valuation.

2 hours ago

2 hours ago

English (US)

English (US)