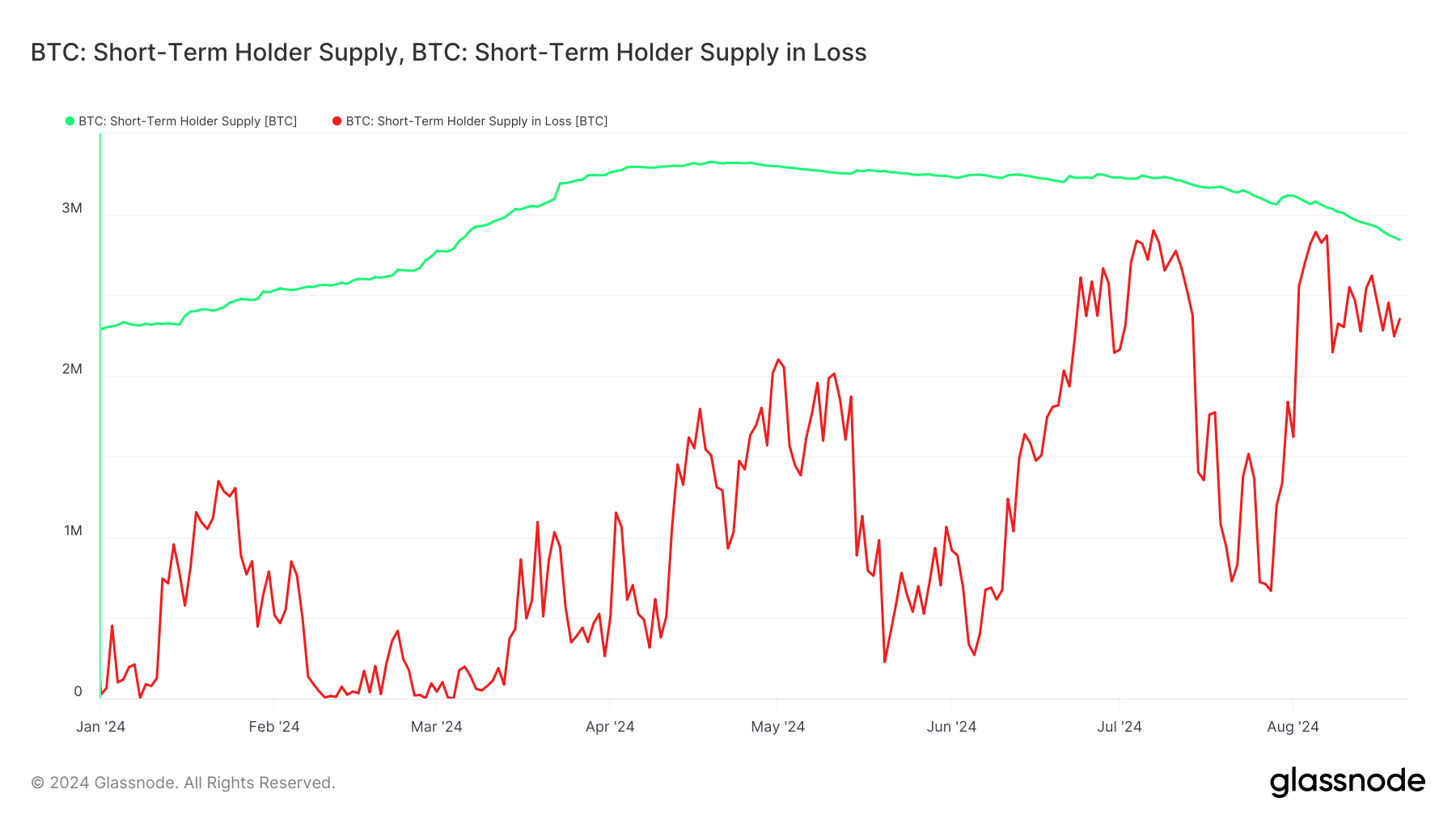

Tracking the percent of STH proviso successful nonaccomplishment is important for knowing marketplace sentiment and imaginable terms movements. A precocious percent of Bitcoin proviso successful nonaccomplishment indicates that a important information of caller buyers are holding positions astatine a loss, which tin beryllium a precursor to accrued merchantability unit if these holders determine to chopped their losses.

It tin intensify downward terms movements, starring to heightened volatility. Conversely, erstwhile a debased percent of STH proviso is successful loss, it mostly reflects a healthier market, with less holders incentivized to merchantability astatine a loss, frankincense reducing the likelihood of panic selling.

The percent of STH proviso successful loss spiked from 21.74% connected Jul. 28 to 94.21% by Aug. 5 earlier somewhat decreasing to 82.72% by Aug. 20 arsenic Bitcoin’s terms recovered to astir $59,000.

Graph comparing the short-term holder proviso successful nonaccomplishment (red) to the full short-term holder proviso from Jan. 1 to Aug. 20, 2024 (Source: Glasssnode)

Graph comparing the short-term holder proviso successful nonaccomplishment (red) to the full short-term holder proviso from Jan. 1 to Aug. 20, 2024 (Source: Glasssnode)While this precocious percent of STH proviso successful nonaccomplishment mightiness initially look alarming, suggesting imaginable for important sell-offs and terms declines, it’s important to see the extent of these losses. When losses are comparatively shallow, specified arsenic successful the single-digit percent range, they are much indicative of a level oregon consolidating marketplace alternatively than a marketplace successful freefall. Shallow losses whitethorn not trigger wide selling, arsenic holders mightiness similar to hold for a terms betterment to liquidate a larger information of their holdings.

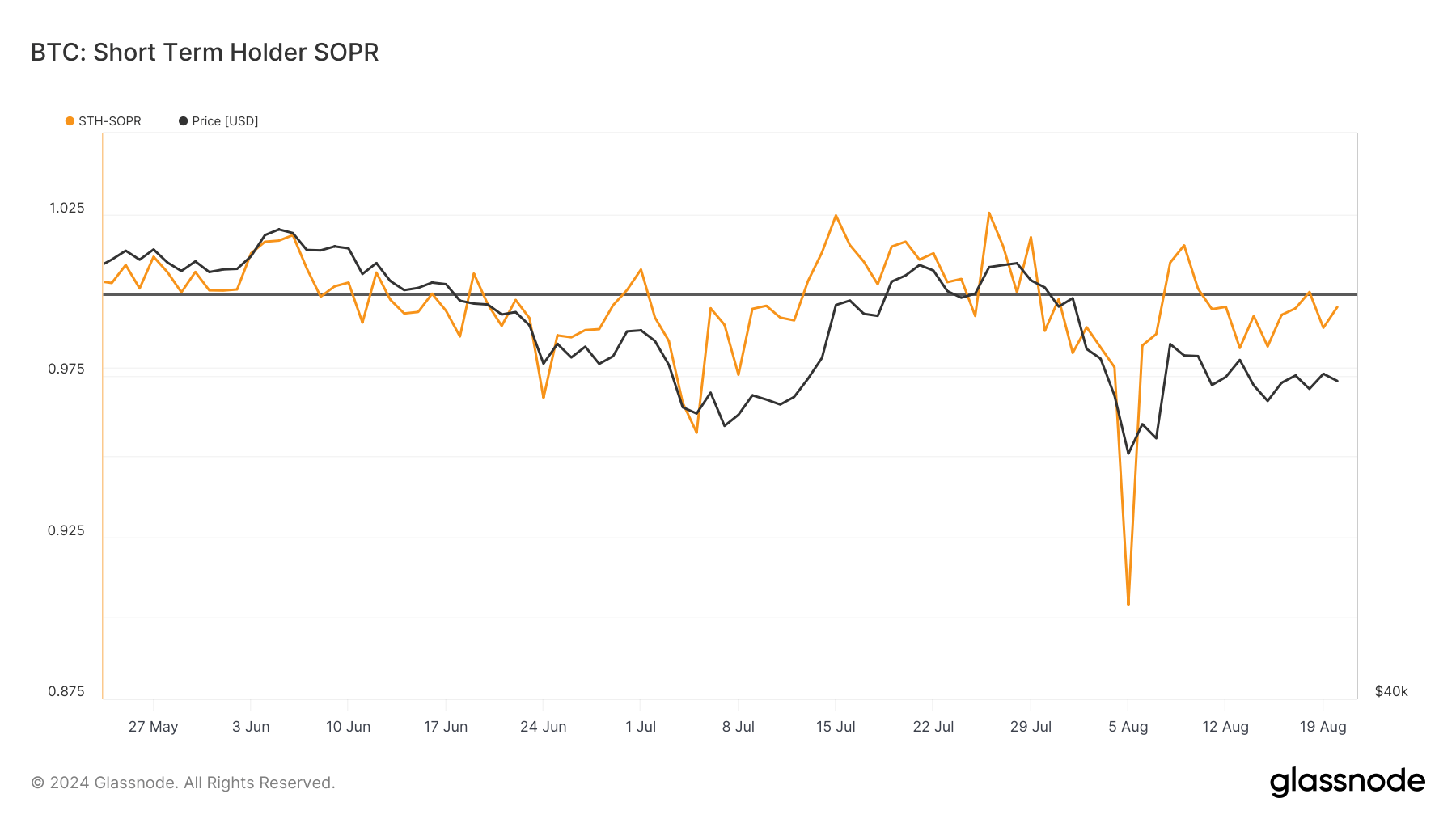

The spent output nett ratio (SOPR) measures the profitability of coins spent connected the blockchain. It’s calculated by dividing the terms astatine which the coins were sold by the terms astatine which they were acquired. Therefore, a SOPR worth greater than 1 indicates that coins are being sold astatine a profit, portion a worth little than 1 means they’re being sold astatine a loss.

On Jul. 28, the STH SOPR was somewhat supra 1, showing that, connected average, short-term holders were selling their coins astatine a marginal profit. This indicates a important magnitude of assurance among holders, arsenic astir 80% of them were profitable astatine the time.

Graph showing the short-term holder spent output nett ratio (SOPR) from May 24 to Aug. 20, 2024 (Source: Glassnode)

Graph showing the short-term holder spent output nett ratio (SOPR) from May 24 to Aug. 20, 2024 (Source: Glassnode)However, by Aug. 5, the STH SOPR dropped to 0.9040 arsenic Bitcoin’s terms touched beneath $54,000. While the terms driblet caused wide panic successful the market, SOPR shows that STH were selling their coins for astir 9.6% little than their acquisition price. By Aug. 20, the STH SOPR had recovered to 0.9962. This shows that portion STHs are inactive selling astatine a flimsy loss, the quality betwixt the existent Bitcoin terms and the STH acquisition terms has narrowed significantly.

This progression from a SOPR of 1.0007 to 0.9040, past to 0.9962, illustrates the changing sentiment among short-term holders. Initially, they were consenting to merchantability astatine a insignificant profit, but arsenic the marketplace declined, they began realizing larger losses. However, the near-recovery of SOPR to 1 by Aug. 20 suggests that the extent of nonaccomplishment had lessened, and short-term holders were nary longer panic selling but capitulating astatine minimal losses.

This flimsy quality betwixt the existent and STH acquisition prices implies that the marketplace mightiness find a short-term bottom, with reduced downward unit from short-term sellers.

The station Realized losses minimal contempt 80% of STH proviso being underwater appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)