Three days into the caller twelvemonth and Bitcoin has already been done a alternatively turbulent period. Bitcoin saw its largest one-day terms drop since the opening of December, marking a 4.7% decrease.

Bitcoin’s driblet from a precocious of $45,500 to $42,800 successful a azygous time triggered astir $700 cardinal successful liquidations, with $170 cardinal of them being Bitcoin-based derivatives.

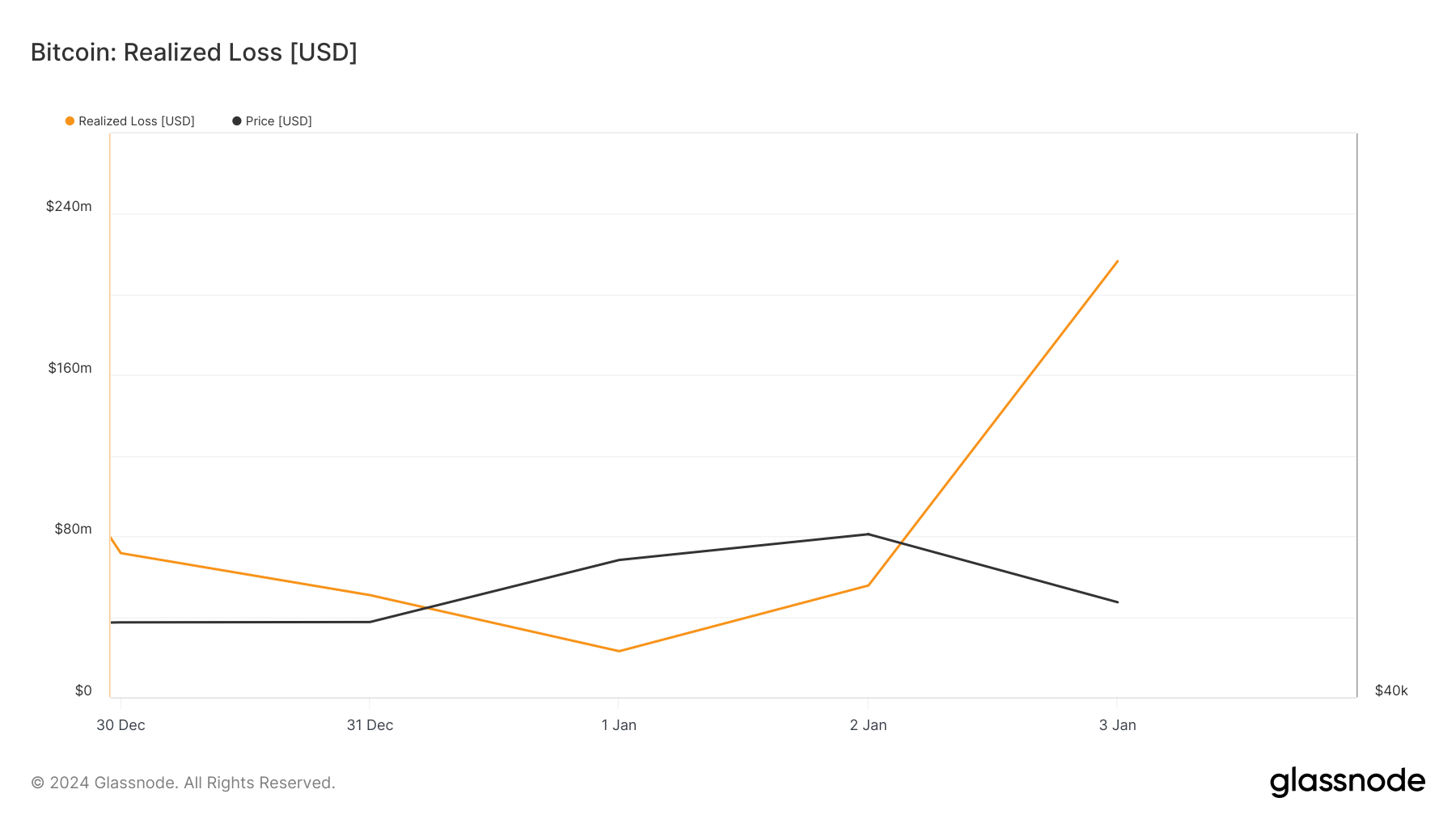

To recognize the interaction of this volatility, it’s important to analyse realized losses. Realized losses hap erstwhile investors merchantability their assets for a terms little than the acquisition price. In the discourse of Bitcoin, realized nonaccomplishment is an highly utile metric erstwhile analyzing the market’s effect to terms fluctuations.

Bitcoin’s important terms driblet connected Jan. 3 led to a important summation successful realized losses, which jumped from $55.52 cardinal connected Jan. 2 to $216.55 cardinal connected Jan. 3. This 290% summation indicates a large-scale selling activity, apt driven by panic oregon the request to chopped losses among investors.

Graph showing Bitcoin’s realized nonaccomplishment from Dec. 30, 2023, to Jan. 3, 2024 (Source: Glassnode)

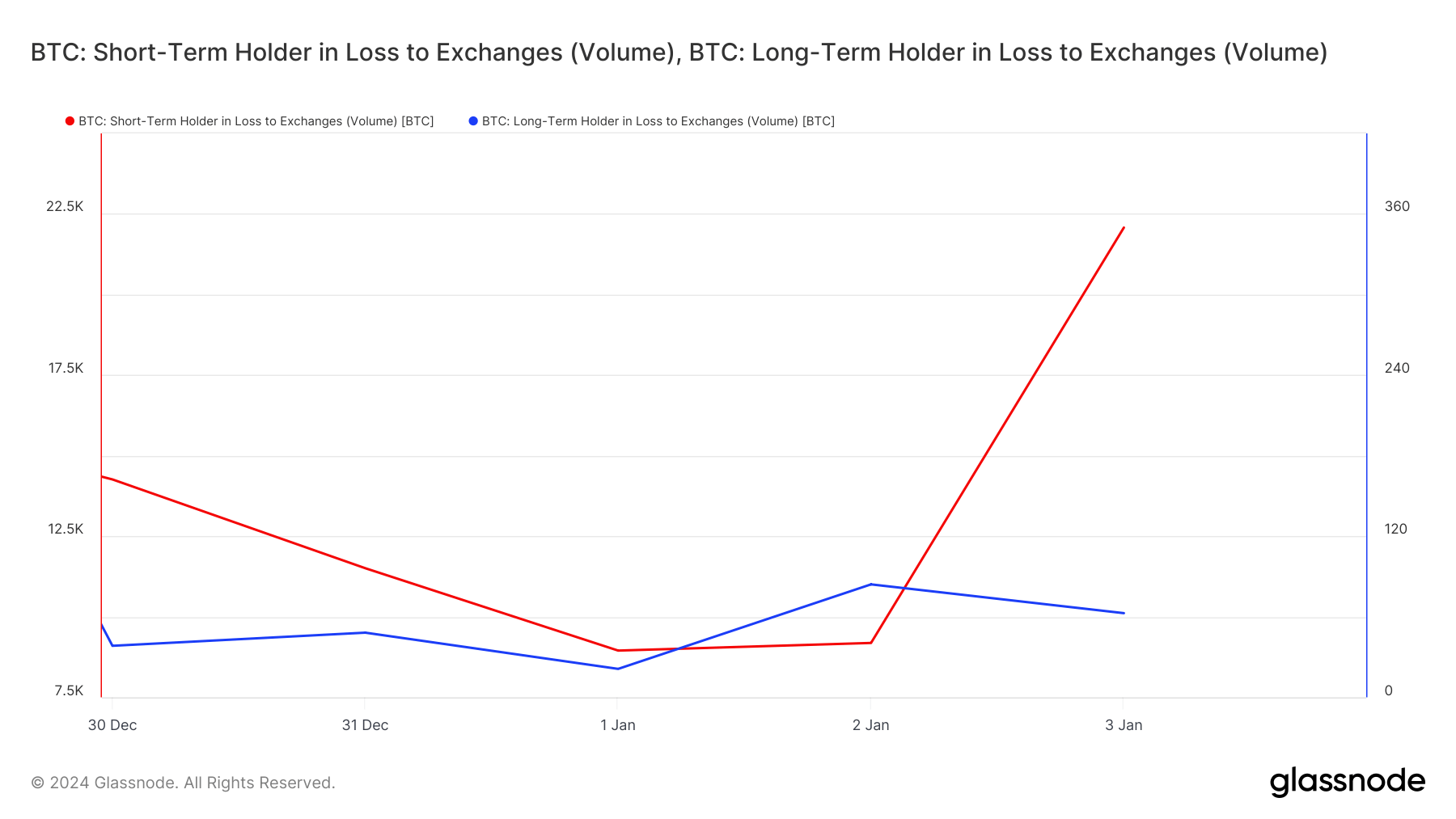

Graph showing Bitcoin’s realized nonaccomplishment from Dec. 30, 2023, to Jan. 3, 2024 (Source: Glassnode)Delving into the information connected semipermanent and short-term holders provides further penetration into who was selling. The measurement of semipermanent holders successful nonaccomplishment to exchanges remained comparatively unchangeable since the opening of the year, with a flimsy alteration connected Jan. 3. This stableness implies that semipermanent holders were little reactive to the terms drop, maintaining their concern strategy contempt the marketplace downturn.

In stark contrast, short-term holders reacted importantly to the terms drop. The measurement of short-term holders successful nonaccomplishment to exchanges much than doubled, expanding from 9,187 BTC connected Jan. 2 to 22,077 BTC connected Jan. 3. This information indicates that short-term holders were the superior sellers successful effect to the terms fluctuation.

Graph showing the semipermanent (blue) and short-term holder (red) transportation measurement successful nonaccomplishment to exchanges from Dec. 30, 2023, to Jan. 3, 2024 (Source: Glassnode)

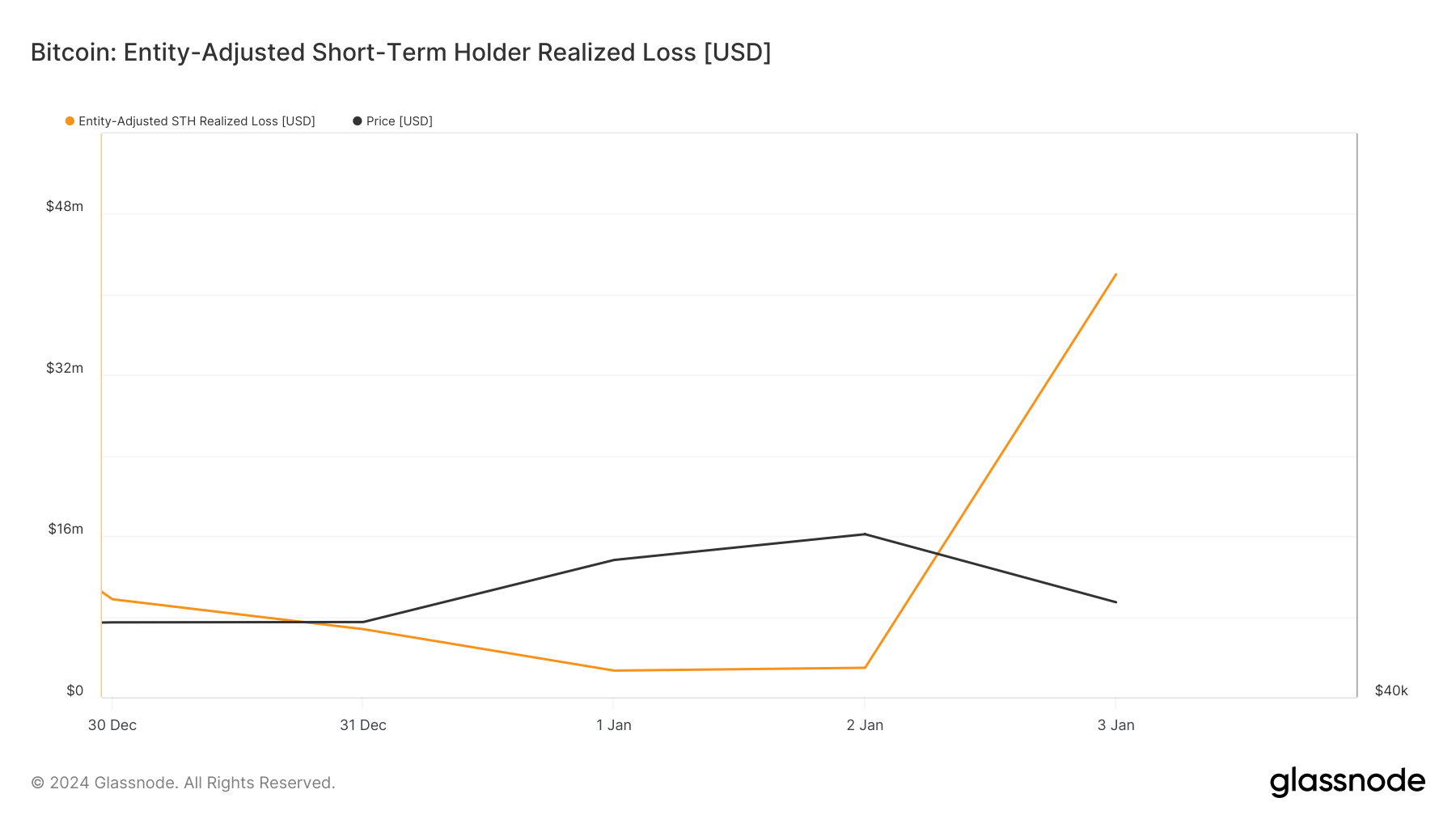

Graph showing the semipermanent (blue) and short-term holder (red) transportation measurement successful nonaccomplishment to exchanges from Dec. 30, 2023, to Jan. 3, 2024 (Source: Glassnode)The entity-adjusted realized losses for some semipermanent and short-term holders further enactment this. Glassnode defines entities arsenic clusters of addresses controlled by the aforesaid web and excludes the measurement transferred betwixt these addresses from this calculation. This helps find the existent realized losses incurred by a peculiar cohort, arsenic it excludes transactions specified arsenic interior speech transfers.

The nonaccomplishment for semipermanent holders was comparatively consistent, remaining astatine astir $5 cardinal connected some Jan. 2 and Jan. 3. In contrast, short-term holders experienced a melodramatic summation successful realized losses. Entity-adjusted short-term holders’ realized nonaccomplishment accrued from $2.93 cardinal connected Jan. 2 to $42 cardinal connected Jan. 3.

Graph showing the entity-adjusted short-term holder realized nonaccomplishment from Dec. 30, 2023, to Jan. 3, 2024 (Source: Glassnode)

Graph showing the entity-adjusted short-term holder realized nonaccomplishment from Dec. 30, 2023, to Jan. 3, 2024 (Source: Glassnode)Overall, the information indicates that the marketplace has been highly reactive to short-term terms movements, peculiarly among short-term Bitcoin holders.

The crisp summation successful realized losses and the measurement of short-term holders selling astatine a nonaccomplishment bespeak a marketplace sentiment skewed towards panic selling and short-term strategies. In contrast, semipermanent holders showed much resilience successful the look of this volatility.

The station Realized losses spiked arsenic Bitcoin saw turbulent commencement to the year appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)