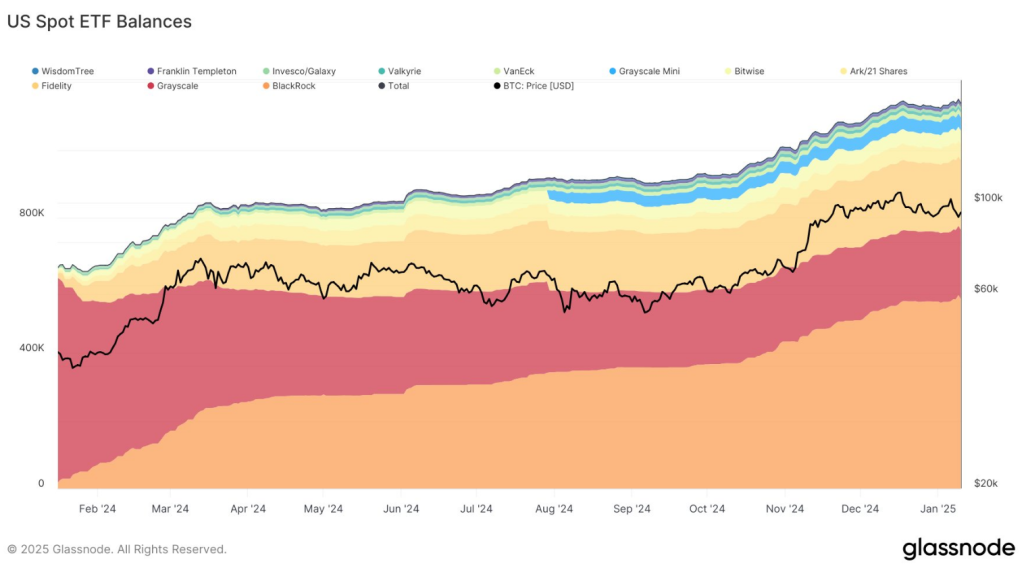

Demand for US Bitcoin ETFs has importantly accrued arsenic we participate 2025, signifying a notable reversal pursuing a lackluster commencement to the year.

Based connected caller figures from Glassnode, nett inflows for the week ending January 6 amounted to 17,567 BTC, equivalent to astir $1.7 billion.

This summation surpasses the play mean inflows of 15,900 BTC documented successful the last 4th of 2024 and indicates a resurgence of capitalist enthusiasm.

A Turbulent Journey Of Inflows

Inflows into Bitcoin ETFs person shown an erratic pattern. These inflows showed notable fluctuations successful precocious 2024. In September, determination was a important diminution arsenic Bitcoin prices dropped beneath $64,000, starring to ample withdrawals.

Nevertheless, things began to alteration by October. Inflows accrued dramatically; successful fewer weeks, they topped 24,000 BTC. With the mean play inflow settling astatine astir 15,900 BTC, the summation continued into November and December, demonstrating the precocious request for Bitcoin investments.

After a dilatory commencement to the year, request for US spot #Bitcoin ETFs has normalized. In the week of January 6, inflows reached 17,567 #BTC ($1.7B), which is somewhat higher than the play mean of 15.9K $BTC ($1.35B) from October to December 2024: https://t.co/0Cpfm8lpak pic.twitter.com/u4FksOSLuZ

— glassnode (@glassnode) January 13, 2025

As the terms of Bitcoin increased, truthful did ETF inflows. In December 2024, the astir fashionable integer plus successful the satellite reached a record-breaking precocious of $108,135.

This relation suggests that arsenic much radical switched to exchange-traded funds, investors’ assurance successful Bitcoin’s worthy grew, starring to a affirmative marketplace sentiment.

Bitcoin ETFs: Who Possesses The Most?

The full holdings of US spot Bitcoin ETFs arsenic of aboriginal January 2025 are astir 1.13 cardinal BTC. Grayscale has 204,300 BTC, Fidelity holds 205,488 BTC, and BlackRock has 559,673 BTC, making it the largest holding.

In 2024, BlackRock’s Bitcoin ETF (IBIT) garnered attraction by accumulating $37.25 cardinal successful assets during its inaugural year, securing the 3rd presumption connected the Top 20 ETF Leaderboard for that year. This important surge highlights the rising organization request for cryptocurrency-backed fiscal solutions.

Will 2025 Be A Good Year For ETFs?

Bitcoin ETFs look similar they volition bash good successful 2025. Experts successful the tract deliberation that this twelvemonth determination whitethorn beryllium a batch of new, innovative offerings connected the market.

There volition beryllium astatine slightest 50 caller bitcoin ETFs this year, according to Nate Geraci of the ETF Store. These volition screen a wide scope of strategies, specified arsenic covered telephone ETFs and Bitcoin-denominated equity ETFs.

Furthermore, determination is conjecture that Bitcoin spot ETFs whitethorn soon transcend carnal gold ETFs successful plus size. This would correspond a pivotal advancement successful the improvement of integer assets arsenic accepted concern instruments.

Such a alteration would item a rising assurance successful Bitcoin arsenic a valid store of worth and concern tool, truthful challenging the long-held presumption of golden arsenic the champion hedge.

As fiscal institutions specified arsenic Vanguard analyse cryptocurrency ETF alternatives, it underscores a wider inclination of acceptance and incorporation of cryptocurrencies into established fiscal systems.

Featured representation from Reuters, illustration from TradingView

11 months ago

11 months ago

English (US)

English (US)