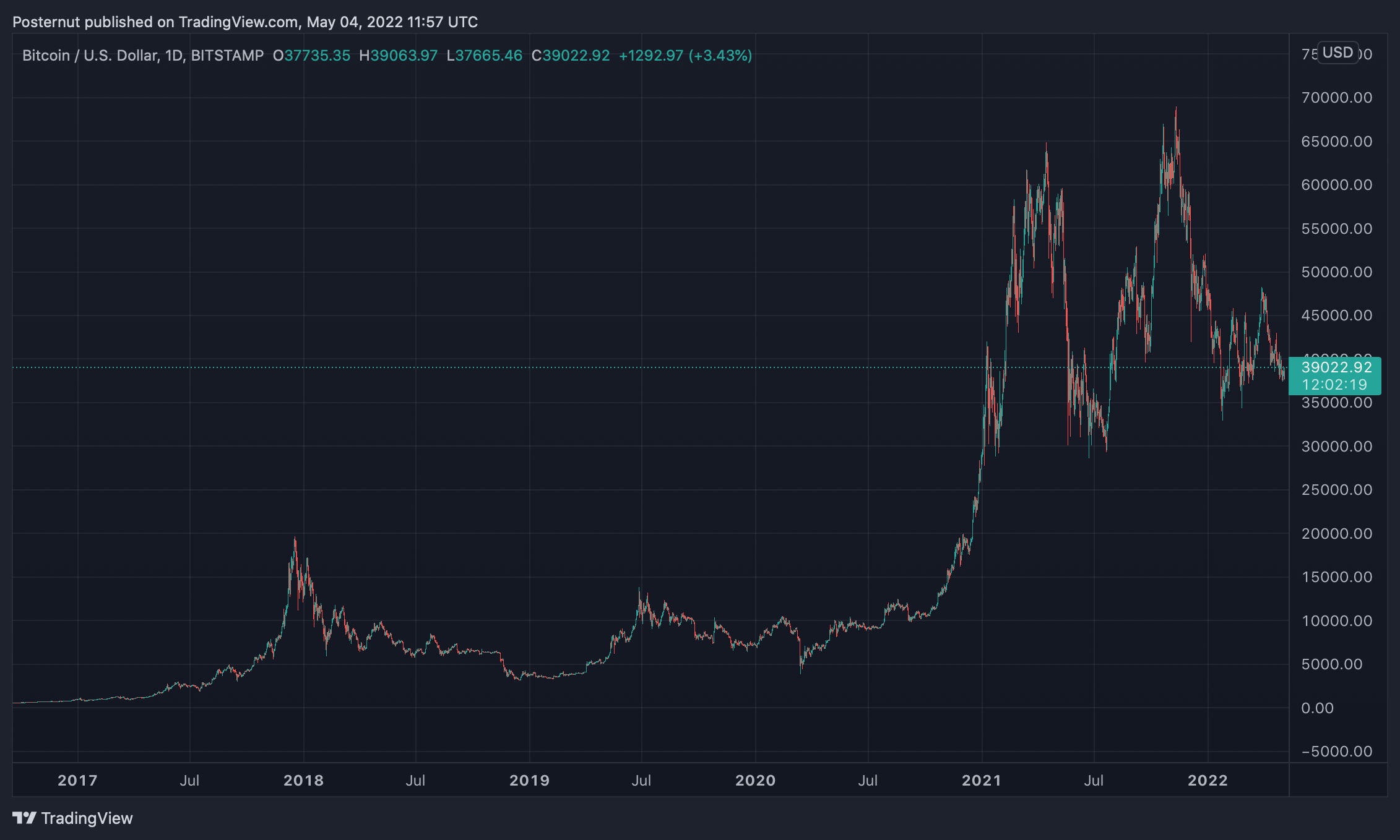

It’s been six months oregon astir 180 days since bitcoin reached an all-time precocious astatine $69K per portion connected November 10, 2021, and bitcoin’s USD worth is down 45% from that point. Typically aft bitcoin’s terms tops, the carnivore marketplace that follows leads to a ample 80% oregon much diminution successful value. However, due to the fact that the caller terms apical resembles the maturation from April 2013 to November 2013, bitcoin’s existent bearish diminution whitethorn not beryllium truthful ample this clip around.

An 80% Drop From Bitcoin’s High Would Lead to $13,800 per Unit

Bitcoin markets person been bearish implicit the past six months aft reaching the crypto asset’s all-time precocious (ATH) astatine $69K past year. While prices are dreary for many, it’s made radical wonderment however agelong the downward rhythm volition last.

Using today’s bitcoin (BTC) speech rates against the U.S. dollar indicates that the starring crypto plus has mislaid 45% truthful far. Usually, erstwhile BTC peaks, the terms drops importantly during semipermanent bearish cycles and aft a fewer circumstantial tops, BTC has dropped much than 80% little than the high.

For instance, successful April 2013, BTC reached an all-time terms precocious astatine $259 per portion but past it slid to $50 a unit, losing astir 82.6% successful value. From November 2013’s all-time precocious of $1,163 per portion to January 2016, BTC’s worth slid by 86.9%. If bitcoin’s USD worth was to shed 80% from the caller $69K precocious six months ago, the terms would driblet to a debased of $13,800 per unit.

The Softer Bear Market Theory

However, there’s a accidental that the existent carnivore rhythm whitethorn beryllium shorter and little impactful this clip around. While BTC has seen astatine slightest 3 80% oregon much drops, it’s seen a batch much 32-51% drops. One crushed bitcoin’s bottommost whitethorn not beryllium truthful harsh is due to the fact that the crypto asset’s highest was not that huge. In fact, the past bitcoin bull tally was longer and saw a overmuch smaller percent summation than erstwhile all-time highs. The crypto advocator and Youtuber ‘Colin Talks Crypto’ discussed the softer carnivore marketplace mentation connected May 1.

From the August 17, 2012 highest ($16) to the April 10, 2013 highest ($259), BTC gained 1,518.75% betwixt that timeframe. Following that cycle, betwixt the April 10, 2013 apical and the November 2013 peak, bitcoin gained 349.03%. Then from the November 2013 highest to December 2017 peak, BTC jumped 1,590.97%.

This clip around, however, the December 2017 highest to the November 2021 apical was lone 250.85%. It’s been the lowest percent summation of each the large bull runs successful the crypto asset’s lifetime. The little leap higher could pb to a softer bitcoin carnivore marketplace that’s overmuch little drastic than an 80% oregon much plunge.

In summation to the smaller ATH, the run-up to the 2021 ATH was implicit 400 days. The bitcoin bull tally anterior (2017) lone lasted 200 days oregon astir fractional the time. This means portion the brunt of the existent carnivore marketplace whitethorn beryllium softer successful a sense, it whitethorn past a batch longer than erstwhile carnivore cycles.

Tags successful this story

What bash you deliberation astir the anticipation of a softer carnivore marketplace that’s little harsh than the erstwhile 80% plunges bitcoin experienced successful the past? Let america cognize what you deliberation astir this taxable successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 5,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

3 years ago

3 years ago

English (US)

English (US)