Self-described Bitcoin maximalist Rob Wolfram has been charting the BTC terms against the Stock-to-Flow model.

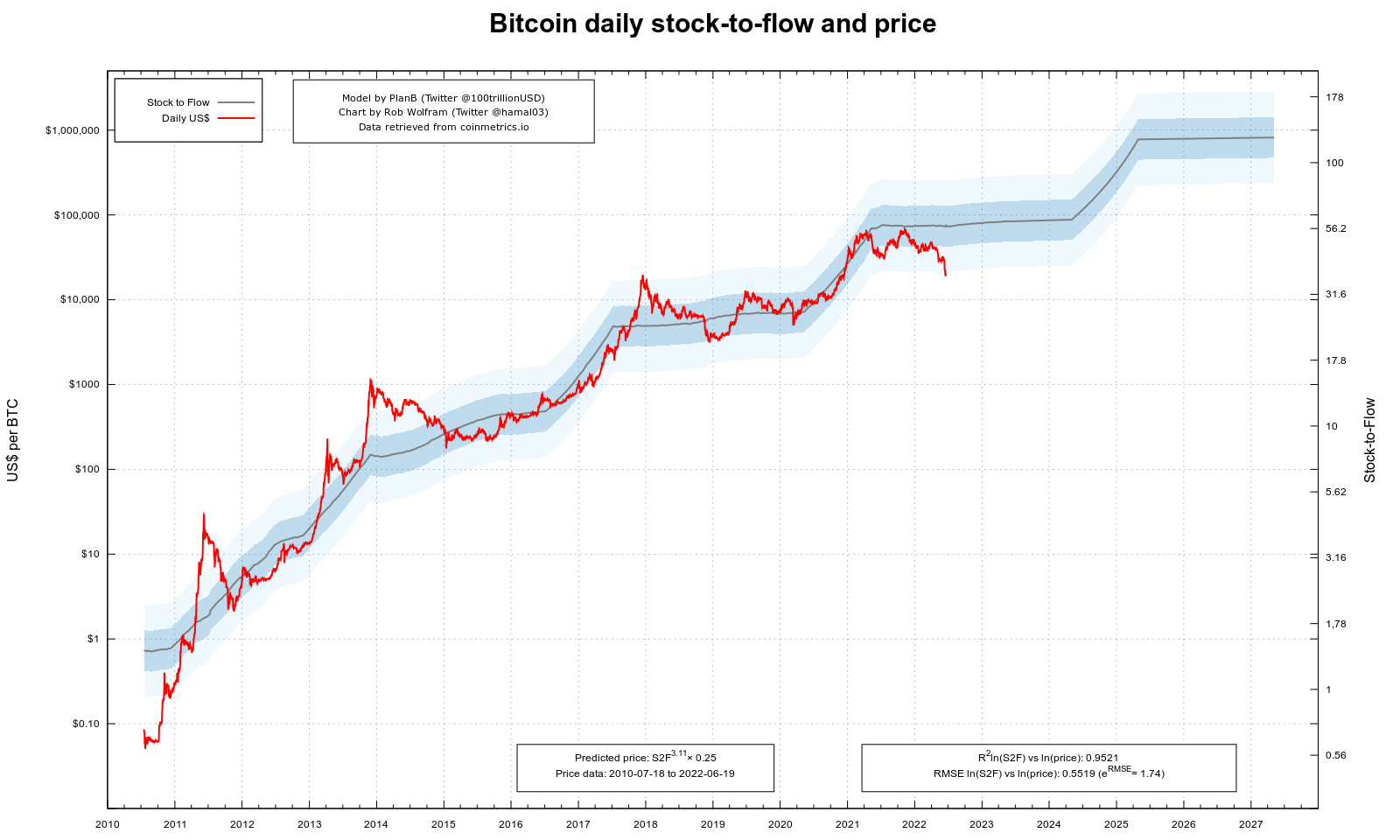

In the illustration below, the IT information adept explained the acheronian bluish country represents 1 modular deviation of mistake from the predicted terms per the S2F model. At the aforesaid time, the airy bluish country covers 2 modular deviations of mistake from the expected price.

Source: s2f.hamal.nl

Source: s2f.hamal.nlHowever, with caller bearish terms action, Bitcoin sunk arsenic debased arsenic $17,600 connected June 18 and breached the little bound airy bluish country for the archetypal time, calling into question the validity of the S2F model.

What is the Bitcoin Stock-to-Flow Model?

The S2F model was created successful March 2019 by the anonymous Twitter relationship @100trillionUSD, besides known arsenic Plan B.

The exemplary uses an existing stock-to-flow exemplary initially formulated for usage with commodities, specified arsenic golden and palladium. The exemplary asserts that it’s imaginable to foretell the terms of an plus based connected its scarcity implicit time.

In different words, this exemplary examines the narration betwixt travel (or mined yearly output of tokens) and banal (or tokens successful circulation).

It predicts the terms of Bitcoin volition scope $100,000 by mid-2024 and $1,000,000 by mid-2025.

Yet by breaching the little bound bounds for the archetypal time, determination is documented grounds that the exemplary is invalid.

The limitations of the Stock-to-Flow model

In the past, critics person pointed retired respective reasons for the model’s limitations. Most pertinent is the presumption that scarcity oregon proviso is the lone operator of value. This doesn’t relationship for different indispensable terms drivers, namely the effect of demand.

Perhaps the astir cardinal mentation connected terms is the narration betwixt demand and supply. In that, erstwhile proviso exceeds demand, prices volition fall. And erstwhile request exceeds supply, prices volition rise.

However, the S2F exemplary skips implicit the power of request for Bitcoin portion overlooking unexpected events, specified arsenic an economical meltdown oregon Black Swan event.

Critics accidental the exemplary lacks technological rigor by focusing lone connected scarcity and drafting from a information acceptable spanning conscionable 13 years.

In effect to the little bound breach, Writer and Mining Analyst Zack Voell tweeted that Bitcoin isn’t dead. But continued by saying the S2F has been exposed arsenic a scam.

Bitcoin isn't dead.

But the Stock-to-Flow scam perfectly is. pic.twitter.com/ZYZ0NR8n92

— Zack Voell (@zackvoell) June 19, 2022

The coming weeks volition uncover whether the breach was an outlier oregon a motion of worse to come.

The station Recent volatility sees Bitcoin Stock-to-Flow exemplary breached for the archetypal time appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)