Asset absorption and hazard absorption are captious components of immoderate concern strategy, and the integer plus abstraction is nary exception. With the volatility and complexity of the crypto market, it is indispensable for investors to show their investments and measure their hazard vulnerability carefully.

CryptoCompare, a starring integer plus information provider, has released its monthly Digital Asset Management Review, which provides an overview of the planetary integer plus concern merchandise landscape.

Methodology

The study tracks the adoption of integer plus products by analyzing assets nether management, trading volumes, and terms performance. The reappraisal drew information from assorted sources, including Financial Times, 21Shares, Coinshares, XBT Provider, Grayscale, OTC Markets, HanETF, Yahoo Finance, 3iQ, Purpose, VanEck, ByteTree, Nordic Growth Market, Bloomberg, and CryptoCompare.

Key Findings

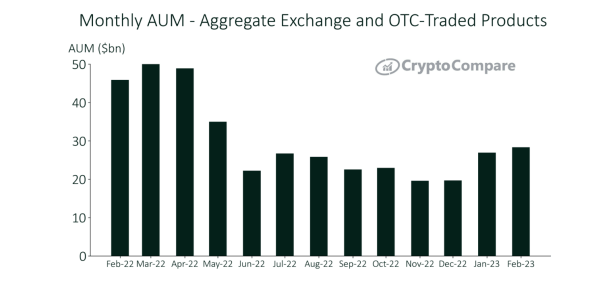

Digital plus investments continued their upward inclination successful February, with the full assets nether absorption (AUM) for integer plus concern products reaching a caller precocious of $28.3 billion.

This represents a 5.25% summation from January, the 3rd consecutive monthly summation successful AUM. The AUM surge signals investors’ bullish sentiment and a increasing appetite for integer assets.

(Source: Crypto Compare)

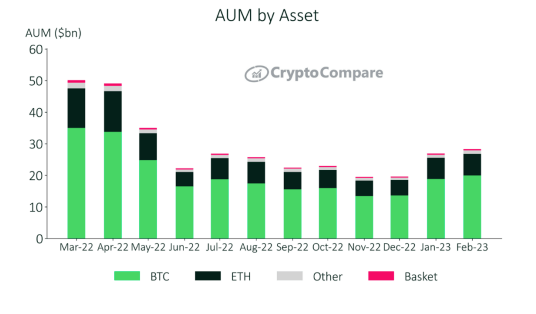

(Source: Crypto Compare)Bitcoin and Ethereum-based products experienced accrued assets nether absorption (AUM) successful February. BTC-based products saw a emergence of 6.06%, bringing the full AUM to $20.0 billion, portion ETH-based products saw a 1.72% increase, bringing the full AUM to $6.80 billion. As a result, BTC and ETH products present relationship for 70.5% and 24.0% of the full AUM marketplace share, respectively.

(Source: Crypto Compare)

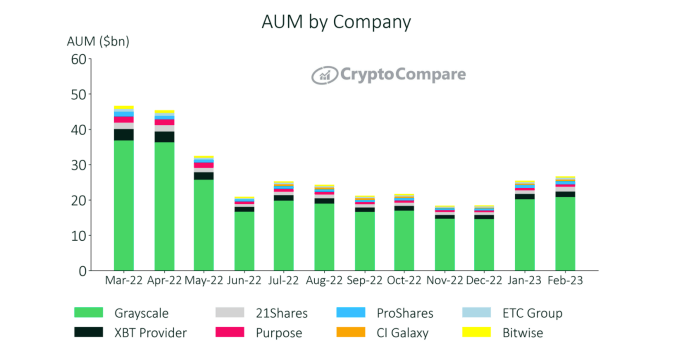

(Source: Crypto Compare)During February, CI Galaxy had the highest summation successful assets nether absorption (AUM), with a emergence of 37.7% to $460 million. Following intimately was 21Shares, which saw a 33.4% summation to $1.38 billion. Despite these gains, Grayscale continued to clasp the ascendant position, with products signaling a full AUM of $20.8 billion, representing a 3.02% summation compared to the erstwhile month. XBT Provider ($1.54 billion) and 21Shares ($1.38 billion) followed Grayscale arsenic the market’s 2nd and third-largest players.

(Source: Crypto Compare)

(Source: Crypto Compare)According to the latest study for February 2023, the mean regular aggregate merchandise volumes crossed each integer plus concern products saw a flimsy diminution of 9.39% to $73.3 million.

Compared to December 2022, volumes person accrued by 21.5%. Despite this improvement, volumes are inactive down by 80.1% compared to February 2022, indicating the volatile quality of the market.

BTC-based products remained ascendant successful presumption of play nett flows, with some BTC-based products and Short BTC products signaling affirmative flows of $5.3 cardinal and $4.6 million, respectively.

DCG’s determination to merchantability its positions successful Grayscale Trust Products was driven by its request to rise funds. One of the astir important income was astir 25% of its Ethereum Trust (ETHE) astatine a discount of astir 50% of the trust’s price, according to a study from the Financial Times cited successful the report.

The afloat CryptoCompare’s Digital Asset Management Review study tin beryllium recovered here.

The station Record-high integer plus investments successful February 2023: CryptoCompare’s Monthly Review appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)