Bitcoin’s realized headdress is simply a nuanced and innovative metric for assessing the valuation of Bitcoin that differs importantly from accepted marketplace capitalization.

Unlike the marketplace cap, which simply multiplies the existent marketplace terms of Bitcoin by the full fig of coins successful circulation, the realized headdress offers a much granular and economically meaningful penetration into the Bitcoin market.

It does this by aggregating the worth of each Bitcoins astatine the terms they were past moved alternatively than the existent price. This attack tin supply a much unchangeable presumption of the market’s valuation, little prone to the volatility associated with speculative trading and short-term marketplace movements.

To cipher the realized cap, 1 indispensable instrumentality the worth of each Bitcoin astatine the clip it past moved and past sum these idiosyncratic values crossed each Bitcoins. This means if a Bitcoin was past moved erstwhile its worth was $10,000, that circumstantial Bitcoin contributes $10,000 to the cap, careless of the existent marketplace price.

The realized headdress reveals things astir the Bitcoin marketplace that are not instantly evident done the marketplace cap.

Firstly, it tin supply insights into the concern behaviour of Bitcoin holders. For example, a rising realized headdress suggests that Bitcoins are moving astatine higher prices, indicating affirmative sentiment among investors. Conversely, a unchangeable oregon declining realized headdress tin awesome that astir Bitcoins are not changing hands, perchance implying holder condemnation oregon a deficiency of caller concern astatine higher terms levels.

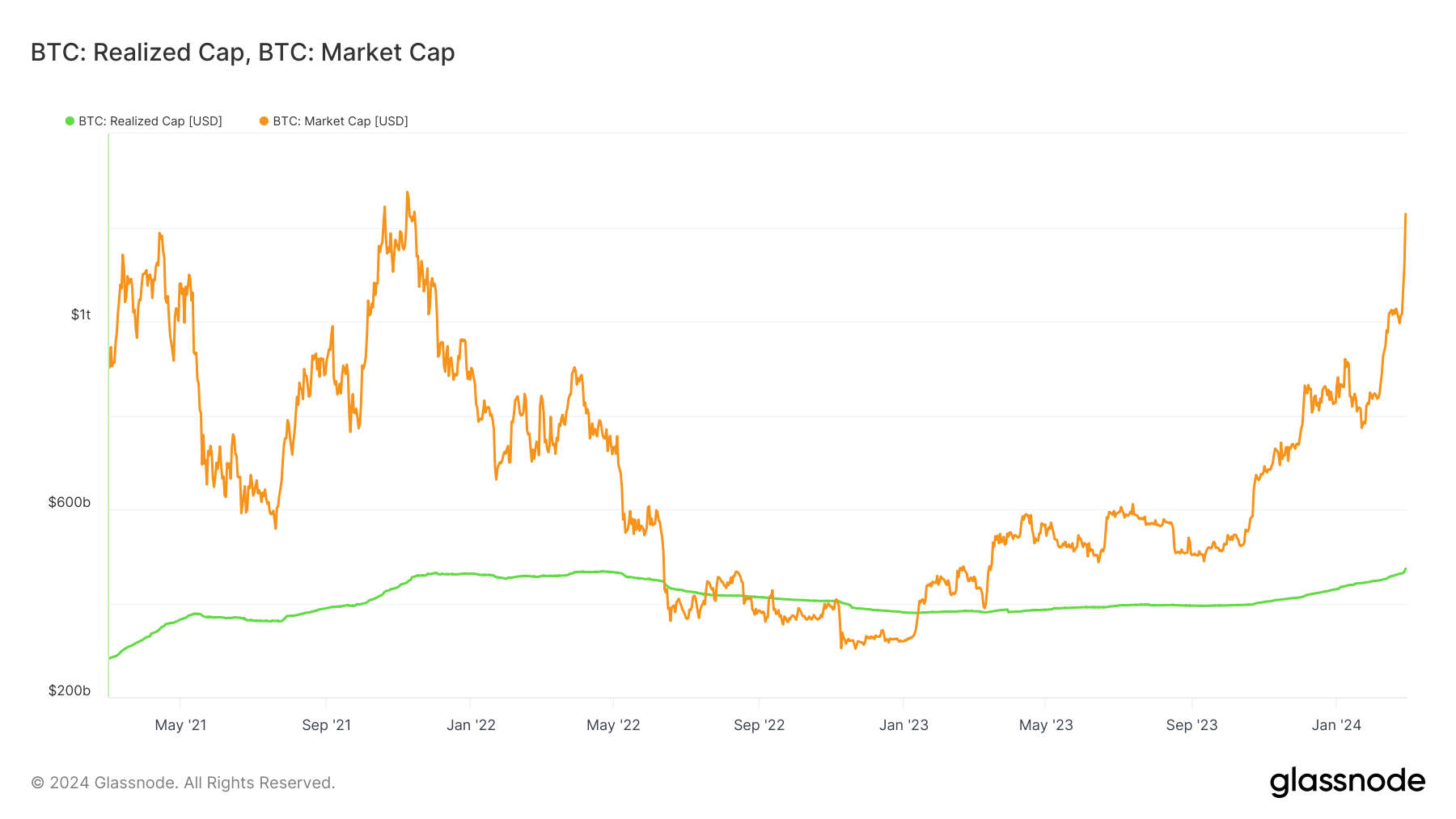

Moreover, it tin service arsenic a proxy for the invested superior that is little delicate to speculative swings. In periods of precocious volatility, the marketplace headdress tin fluctuate wildly, but the realized headdress tends to determination much smoothly, arsenic seen successful the graph below, reflecting a much grounded appraisal of the Bitcoin market’s worth. This stableness makes it a invaluable instrumentality for investors looking to gauge the market’s underlying wellness beyond the sound of regular terms movements.

Graph comparing the fluctuations of Bitcoin’s marketplace headdress and realized headdress from March 2021 to February 2024 (Source: Glassnode)

Graph comparing the fluctuations of Bitcoin’s marketplace headdress and realized headdress from March 2021 to February 2024 (Source: Glassnode)Bitcoin’s realized headdress reached its all-time precocious connected Feb. 28, topping astatine $473.8 billion. This signifies that, connected average, the Bitcoin web and its participants person ne'er been arsenic economically invested successful BTC arsenic they are now, based connected the prices astatine which astir Bitcoins were past transacted.

Reaching an ATH successful the realized headdress indicates a broadening and deepening of the market’s foundation.

Unlike marketplace cap, which tin rapidly inflate with speculative fervor, the realized headdress grows arsenic a effect of transactions that bespeak existent transfers of wealthiness and, by extension, a much durable content successful Bitcoin’s value. Therefore, this ATH could beryllium seen arsenic a much meaningful indicator of Bitcoin’s expanding acceptance and integration into the fiscal portfolios of a wider array of investors.

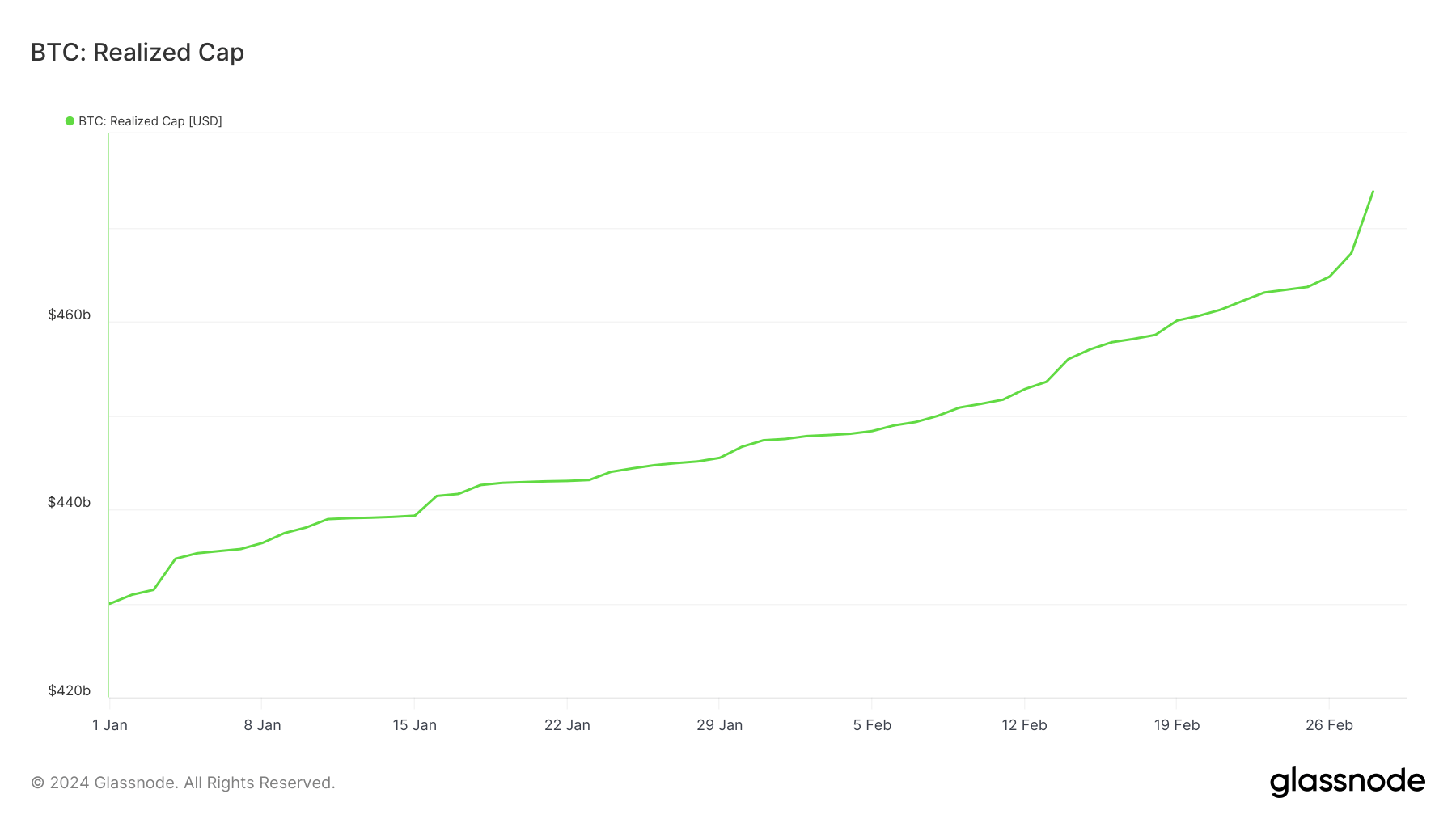

Graph showing Bitcoin’s realized headdress from Jan. 1 to Feb. 28, 2024 (Source: Glassnode)

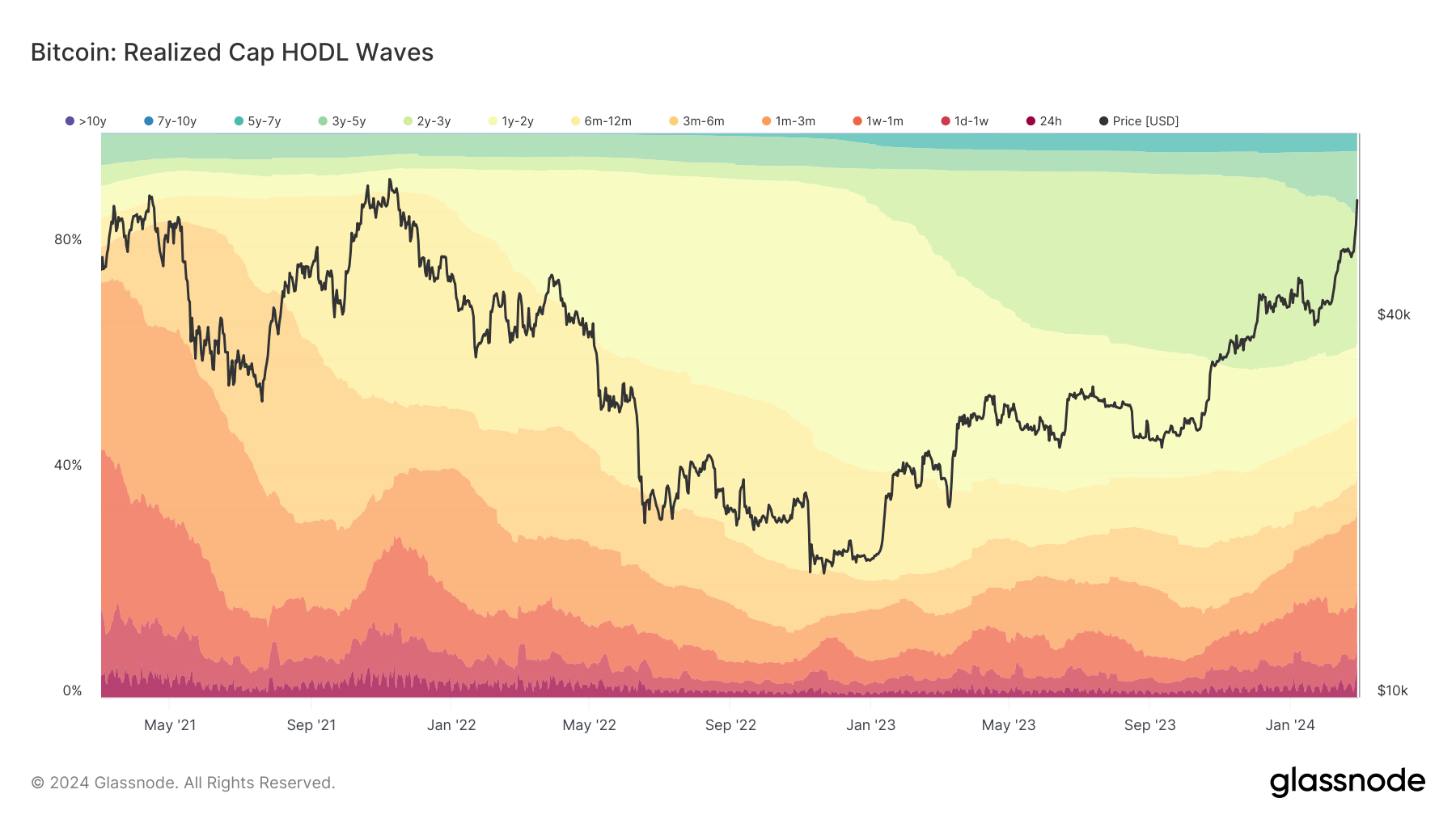

Graph showing Bitcoin’s realized headdress from Jan. 1 to Feb. 28, 2024 (Source: Glassnode)The Realized Cap HODL Waves information provides a fascinating penetration into the behaviour of Bitcoin holders and their publication to the realized cap’s increase. By analyzing the changes successful the organisation of Bitcoin holdings crossed antithetic time-held cohorts successful the past 3 days, we tin find which radical is the astir progressive and however their actions influenced the realized cap.

On Feb. 25, the organisation was arsenic follows:

- Bitcoins held for little than 24 hours accounted for 0.856% of the realized cap.

- Bitcoins held betwixt 1 time and 1 week contributed 5.8%.

- The 1-week to 1-month cohort represented 15.571%.

- Bitcoins held for 3 to 6 months made up 6.318%.

- The 6-month to 1-year radical accounted for 11.818%.

- Finally, Bitcoins held for 1 to 2 years contributed 12.438%.

By Feb. 28, determination was a notable shift:

- The stock of Bitcoins held for little than 24 hours surged to 5.828%.

- Holdings betwixt 1-day and 1-week dropped to 4.851%.

- The 1-week to 1-month cohort decreased importantly to 8.543%.

- The 3- to 6-month radical was somewhat reduced to 6.209%.

- The 6-month to 1-year holdings fell to 11.338%.

- The 1-year to 2-year cohort decreased to 11.975%.

Graph showing the realized headdress HODL waves from March 2021 to February 2024 (Source: Glassnode)

Graph showing the realized headdress HODL waves from March 2021 to February 2024 (Source: Glassnode)From this data, the astir important displacement occurred successful the under-24-hour cohort, which dramatically accrued from 0.856% to 5.828%. This suggests a important influx of caller concern oregon trading activity, wherever a ample measurement of Bitcoin changed hands rapidly and was apt sold oregon transferred astatine higher prices, contributing to the emergence successful the realized cap. Such short-term holding indicates speculative trading oregon contiguous responses to marketplace conditions.

The alteration successful percentages for the 1-day to 1-week and 1-week to 1-month cohorts, alongside flimsy declines successful the longer-term holding categories, suggests a consolidation oregon a displacement from these groups into either the precise short-term holding (<24h) owed to trading oregon into longer-term holdings not specified here. This could bespeak a reallocation of assets wrong the market, wherever immoderate abbreviated to medium-term holders decided to instrumentality profits oregon reallocate their investments, contributing to the realized headdress increase.

Therefore, the emergence successful the realized headdress appears to beryllium importantly influenced by short-term marketplace enactment and trading alternatively than semipermanent holding strategies, arsenic evidenced by the melodramatic summation successful the <24h cohort. While determination is enactment crossed each cohorts, the predominant publication to the realized cap’s emergence successful this play comes from those engaging successful short-term trading.

This behaviour reflects a marketplace wherever terms movements and contiguous trading opportunities power the realized headdress much than the accumulation strategies of longer-term investors.

The station Record precocious realized headdress shows unprecedented economical concern successful Bitcoin appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)