Bitcoin whitethorn beryllium successful a bearish market, but the mining manufacture is increasing bigger than ever. Bitcoin mining trouble acceptable a caller grounds precocious for the sixth clip this twelvemonth connected Tuesday, reaching 31.25 trillion, according to mining information from Braiins. The 4.89% accommodation was the third-largest summation this year.

Even though the starring cryptocurrency’s terms has dropped sharply done April and May and continues sitting implicit 50% below its all-time precocious from precocious 2021, the mining industry’s maturation is not slowing. Traditional investors, retail buyers, and adjacent time traders whitethorn beryllium bearish connected bitcoin, but miners are not. This nonfiction unpacks immoderate of the information that demonstrates the mining sector’s maturation contempt bitcoin’s existent bearish marketplace conditions.

Bitcoin Mining Growth Data

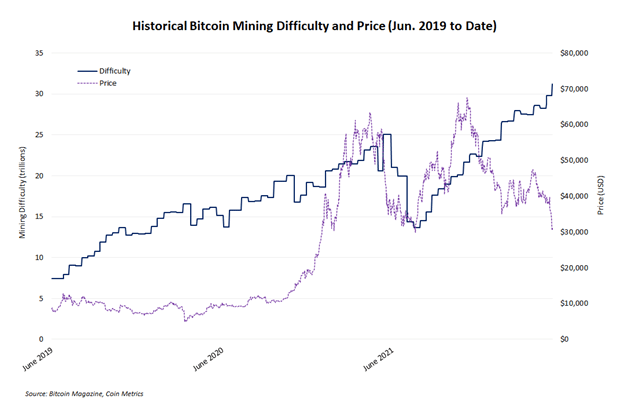

Bitcoin’s terms and mining trouble demonstrated a reasonably beardown affirmative correlation passim astir of 2021. During the bullish periods of aboriginal 2021 followed by the China-ban-related clang successful the summertime and a marketplace rebound to adjacent the year, some metrics moved intimately together. But trouble and terms are typically lone positively correlated during bullish markets erstwhile some metrics summation together. The enactment illustration beneath visualizes terms and trouble information from the past 3 years, and for the past six months arsenic bitcoin’s terms has fallen, mining trouble has continued to surge.

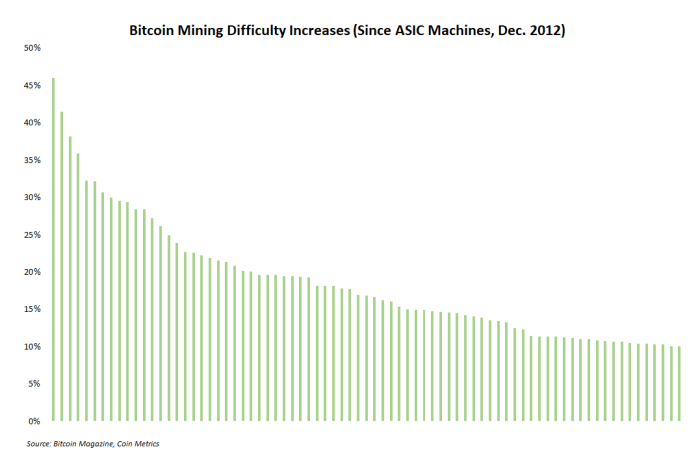

Despite consistently mounting grounds highs this year, each the trouble increases person been reasonably mild connected a percent basis. Difficulty continues grinding upward arsenic much miners deploy caller hash rate, but nary of the increases successful 2022 person been 10% oregon larger. In precocious January, trouble accrued by 9.3%, but each different summation has been astir 5% oregon smaller. The barroom illustration beneath shows a elemental ordering of each humanities trouble increases since ASIC mining hardware entered the marketplace successful precocious 2012. But nary of these adjustments person happened successful 2012.

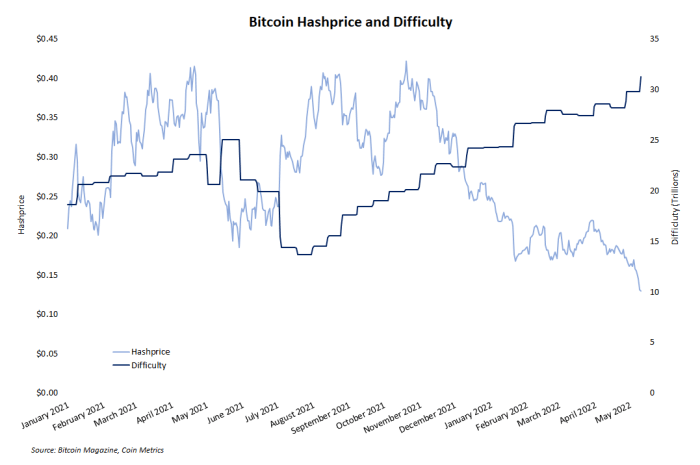

Difficulty increases travel from much hash rate, which means an progressively ample magnitude of computing powerfulness is being spent to process transactions for the Bitcoin web and support the integrity of its distributed ledger. This is objectively a bully happening for Bitcoin. But for the economics of immoderate miners, it’s not ever thing to observe due to the fact that arsenic trouble increases, hash terms drops.

Hash terms is simply a measurement of expected gross per portion of hash complaint a miner contributes to the network. Hash terms goes up erstwhile bitcoin’s terms increases faster than difficulty. It besides goes up erstwhile bitcoin’s terms drops slower than difficulty. But erstwhile trouble increases and bitcoin’s terms drops arsenic is happening nether existent marketplace conditions, hash terms plummets.

The enactment illustration beneath shows hash terms and trouble information since aboriginal 2021 and the steep diminution successful hash terms is evident arsenic trouble soars.

So, adjacent though much miners securing the web is fundamentally bullish, it tin beryllium bearish for mining economics particularly successful a downward-trending market.

Timing Of Bitcoin Mining Growth

To anyone who isn’t intimately acquainted with the dynamics of bitcoin mining, it’s tenable to question wherefore the assemblage continues to turn contempt an ongoing carnivore marketplace phase. A fewer wide reasons connection immoderate mentation for this growth, and the pursuing conception connected wherever maturation is happening present volition adhd much context.

Mining projects, from commencement to afloat deployment, are precise time-consuming and capital-intensive projects. Much of the hash complaint being added to the web present was planned astatine slightest 2 years ago. After battling delays and proviso concatenation disruptions during the planetary COVID-19 response, miners are not ignoring marketplace conditions arsenic overmuch arsenic simply finishing projects they started readying years ago.

Bear markets are often friendlier conditions to commencement caller mining operations anyway. Hardware is cheaper. Hype has dissipated. Focus is easier to maintain. And miners who articulation the manufacture successful the vigor of a bull tally thin to person a importantly higher likelihood of failing oregon being squeezed retired of the marketplace compared to miners who statesman gathering successful bearish markets. And much important for astir miners than existent terms fluctuations is the artifact subsidy schedule. The adjacent reward halving is astir precisely 2 years away, meaning miners are gathering present to capitalize connected arsenic overmuch of the remaining 6.25 BTC play until it ends, and immoderate miners are inevitably squeezed retired of the market.

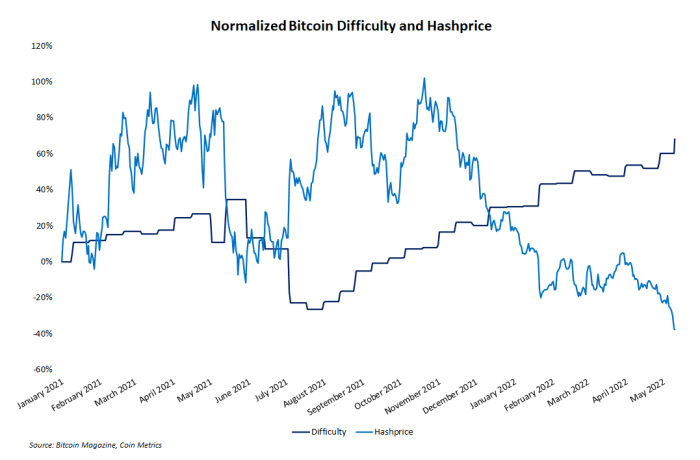

Also, adjacent though this nonfiction has repeatedly referenced the existent “bear market” for bitcoin, it’s worthy noting that determination has astir ne'er been a existent carnivore marketplace play for bitcoin’s hash complaint growth, and by hold for difficulty. China’s mining prohibition caused a historical interruption from the mean up-and-to-the-right maturation inclination for hash rate, but present maturation is backmost connected track. As the enactment illustration beneath shows, hash complaint is astir ever successful a bull market.

Mining Growth Breakdown

So, wherever is the mining sector’s maturation happening? Home and small-scale miners are inactive precise overmuch progressive successful gathering their ain operations and utilizing galore of the new retail-focused products and services that launched during the bull market. Twitter and different societal media are saturated with photos and videos of at-home mining setups.

Public mining companies besides proceed readying large expansions. For example, Riot Blockchain, 1 of the market-leading mining firms, announced a caller one-gigawatt installation planned for Navarro County, Texas successful summation to the 400 MW installation already developed successful Rockdale. Other marketplace leaders like Bitfarms and Core Scientific besides made caller announcements of sizeable growth.

Even cities and section municipalities are entering the mining industry, albeit astatine precise tiny scale. Bitcoin mining start-up MintGreen is working to marque North Vancouver the world’s archetypal metropolis heated by bitcoin mining. And the metropolis assembly successful Forth Worth, Texas voted to pass enactment to motorboat a tiny government-run mining aviator task with some Antminer S9 machines.

Some of the astir breathtaking maturation for wide bitcoin audiences comes from quality of an expanding fig of vigor and utilities companies exploring the mining industry. The Hungarian subsidiary of multi-billion-dollar utilities institution E.ON has been running a mining aviator task for months with plans to expand. Some of the biggest lipid producers successful the U.S. – ExxonMobil and ConocoPhillips – are also gathering partnerships with miners. And miners are saturating the Permian Basin with acquisition efforts to physique partnerships with different vigor producers.

Conclusion

Despite bitcoin’s bearish terms action, the mining manufacture is inactive successful its ain bull market. And adjacent though continued hash complaint maturation contempt downward trending prices means dwindling gross for immoderate miners, the aggregate maturation of the manufacture is simply a beardown awesome for the information of the web and the semipermanent resilience of the full bitcoin economy.

This is simply a impermanent station by Zack Voell. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)