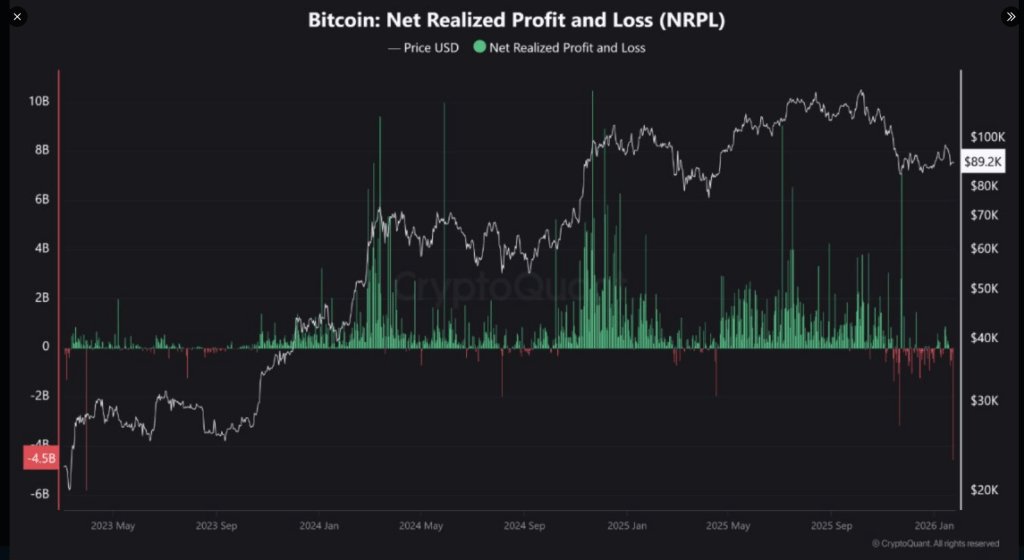

Reports enactment that Bitcoin holders realized ample losses arsenic prices slid, and the header fig is hard to ignore. According to on-chain tracker CryptoQuant, astir $4.5 cardinal successful nett losses was recorded connected January 23.

That fig reflects moved coins sold astatine prices little than erstwhile they were bought. It is simply a large transportation of insubstantial symptom into existent losses.

Realized Losses Spike

While the dollar fig grabs attention, the meaning is what matters. Many who bought precocious successful the tally higher are choosing to merchantability alternatively than clasp done much decline. That behaviour shows frustration.

Reports accidental the Net Realized Profit and Loss metric tallies this by comparing merchantability prices to acquisition prices, and a antagonistic speechmaking this ample signals a question of capitulation.

Some larger, semipermanent holders person been quieter. Their enactment appears muted portion smaller and mid-term participants marque the day-to-day moves.

According to expert posts connected CryptoQuant, this premix — quiescent large holders and progressive smaller sellers — is communal during corrective stretches. It does not automatically mean the marketplace is broken; it means sentiment has shifted toward caution.

$4.5 Billion successful Realized Loss connected Bitcoin

“Highest magnitude of realized losses successful 3 years. The past clip this occurred successful Bitcoin, the terms was trading astatine $28,000 aft a little correction play that lasted astir a year.” – By @gaah_im pic.twitter.com/OJ7bbL3RSC

— CryptoQuant.com (@cryptoquant_com) January 26, 2026

Bitcoin Price Action

Midway done the week, Bitcoin traded astir the mid-$80,000s, good beneath the $90,000 people that immoderate investors had eyed arsenic a cardinal level.

Market chatter shows traders watching macro cues similar the US Federal Reserve and ostentation information for guidance.

Volatility has not disappeared; it has simply go much tied to broader economical signals than to isolated crypto headlines.

Whale addresses appeared to measurement successful astatine times, helping to clasp section terms floors. But galore traders stay cautious.

Reports enactment that geopolitical headlines tin origin speedy swings, yet the existent question looks much similar dilatory digestion of nett and repositioning than explosive panic selling.

Activity connected spot exchanges and ETF flows has been variable, reflecting the mixed temper crossed the market.

Capitulation Has Come Before

Similar nonaccomplishment spikes were seen successful March 2023, erstwhile realized losses reached adjacent to $6 billion, and successful November 2022, erstwhile losses deed astir $4.3 billion.

These events were followed by consolidation and past eventual recovery. Based connected reports from analytics firms and marketplace observers, spikes successful realized losses tin people the precocious stages of selling pressure, aft which the marketplace sometimes finds a base.

Featured representation from Pexel, illustration from TradingView

1 hour ago

1 hour ago

English (US)

English (US)