Market jitters from the FTX illness person triggered grounds quantities of Bitcoin leaving planetary exchanges.

Bitcoin Magazine Senior Analyst Dylan LeClair noted that 136,992 BTC had been withdrawn implicit the past 30 days, adding that the lawsuit was “historic.” The fig equates to 0.7% of the circulating supply.

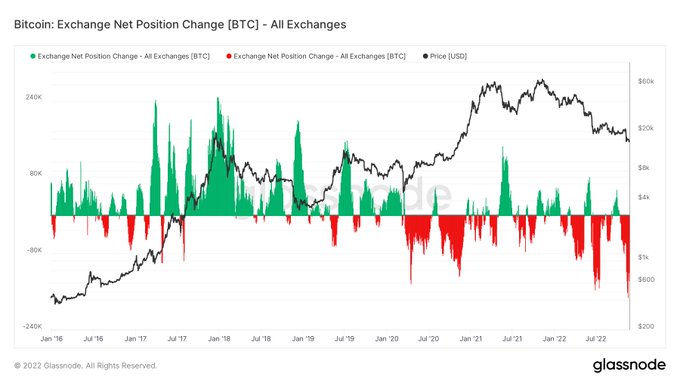

Accompanying the message, LeClair included an Exchange Net Position illustration illustrating the standard of the exodus. The illustration beneath shows nett outflows from planetary exchanges astatine their highest since 2016.

The erstwhile outflow highest was astir June, astatine the tallness of the Terra implosion, which saw astir 120,000 tokens leaving exchanges.

Source: @DylanLeClair_ connected Twitter.com

Source: @DylanLeClair_ connected Twitter.comIn notation to the outflow trend, LeClair further commented, “Drain. Them. All.”

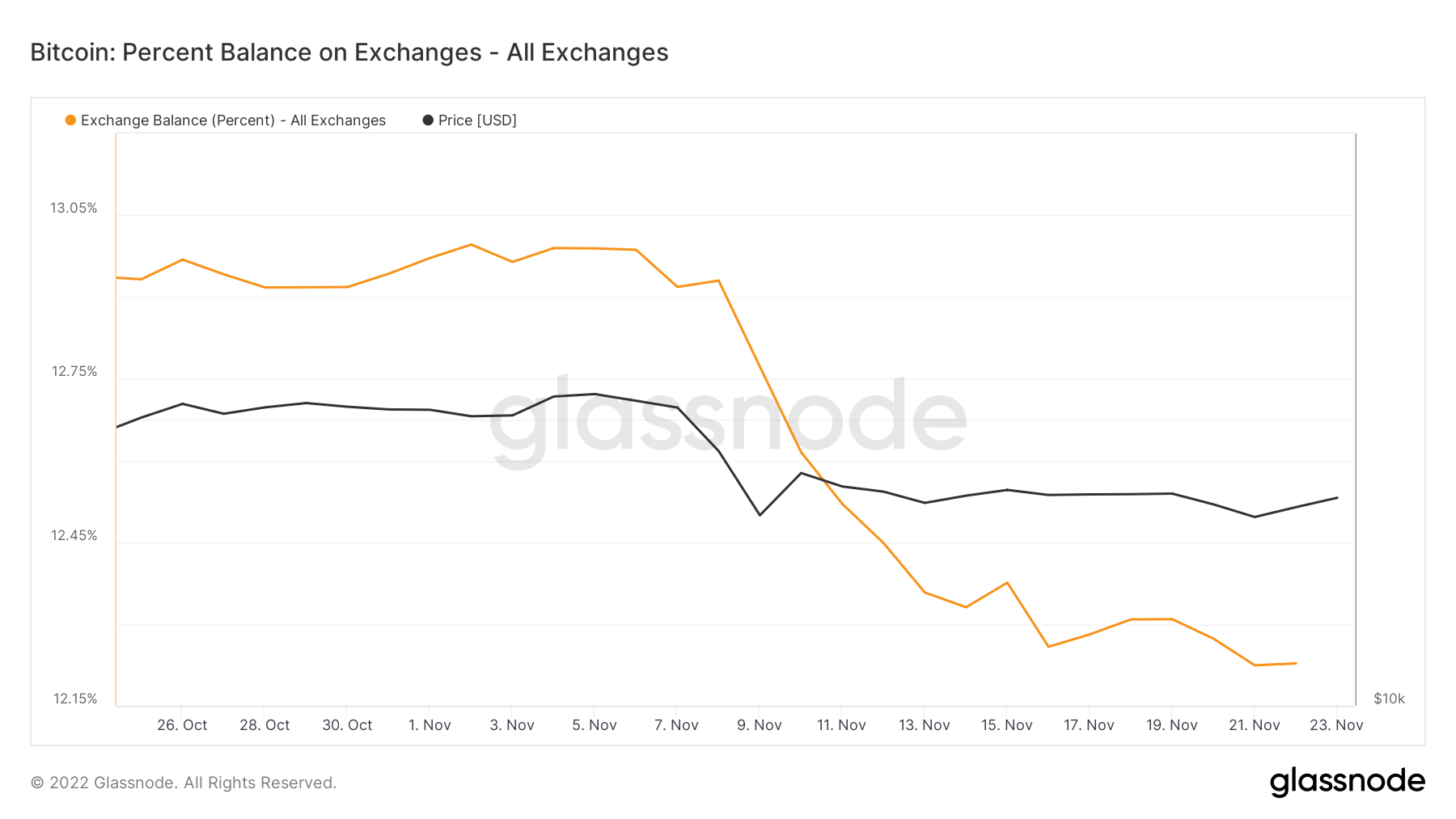

Data per Glassnode shows holders heeding the warnings arsenic the percent of Bitcoin held connected exchanges drops from 13% to 12.2% since rumors of occupation astatine FTX archetypal broke.

Source: Glassnode.com

Source: Glassnode.comCan Bitcoin physique connected caller gains?

As quality of FTX mismanagement filtered into the nationalist domain, the terms of Bitcoin saw crisp sell-offs successful effect to the allegations.

The peak-to-trough question saw a 28% drawdown for the starring cryptocurrency, with a section bottommost of $15,500 deed connected Nov. 21.

Since bottoming, signs of terms betterment person presented, with Tuesday closing 3.8% up connected the day. At the aforesaid time, contiguous saw a continuation of buying unit arsenic BTC grew 5% implicit the past 24 hours astatine the clip of press.

However, macro conditions stay the same, meaning the likelihood of bulls gathering connected existent terms action, to marque a meaningful onslaught backmost supra $20,000 and beyond, is slim.

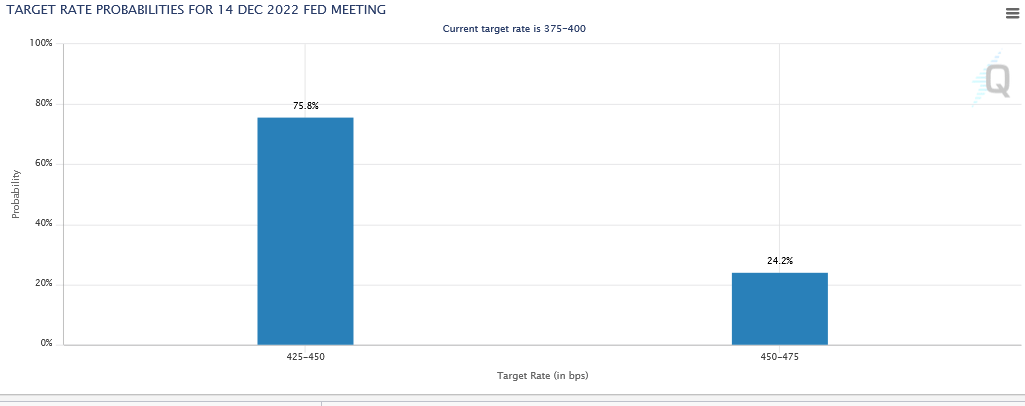

Investors are presently poised for a reversal successful the Fed’s complaint hike policy, earlier deploying capital. Fed Chair Jerome Powell enacted a 4th consecutive 75 ground point hike connected Nov.2, bringing the Federal Funds Rate to 3.75 – 4%.

Markets are presently 3 to 4 successful favour of a 50 ground constituent hike next, frankincense optimistic implicit the Fed easing its gait of complaint increases.

Source: cmegroup.com

Source: cmegroup.comThe FOMC volition denote the result of their adjacent gathering connected Dec. 14.

Contagion risk

Amid the FTX contagion, crypto brokerage Genesis warned that it needs$1 cardinal successful superior to stave disconnected bankruptcy. The steadfast is considered a important Bitcoin OTC desk.

To date, having approached Binance and Apollo for assistance, the struggling brokerage has yet to rise the wealth it said it needed to enactment solvent.

A afloat rundown of what went incorrect is chartless astatine this time. However, Leigh Drogen, the CIO of concern absorption steadfast Starkiller Capital, claimed the root of Genesis’s problems stemmed from a indebtedness statement with genitor institution Digital Capital Group (DCG).

What im fundamentally proceeding from Genesis clients is that Barry did thing akin to Sam, helium made a related enactment indebtedness betwixt genesis and DCG and he’s successful a immense spread now

— Leigh Drogen (@LDrogen) November 21, 2022

Nonetheless, DCG CEO Barry Silbert precocious played down the grade of the liquidity crisis, saying Genesis is owed $575 cardinal from DCG successful May 2023 and radical gross of $800 cardinal is expected this year.

The station Record quantities of Bitcoin permission exchanges successful readiness for contagion fallout appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)