Ethereum, the linchpin of the decentralized exertion ecosystem, finds itself navigating a precarious way this week. The cryptocurrency’s value, having breached the pivotal $2,250 enactment level, present teeters connected the borderline of a decisive crossroads, caught betwixt the imaginable of a resurgence and the looming menace of a much pronounced downturn.

Analyzing the method scenery reveals a cautious narrative, arsenic ominous bearish trendlines look connected the hourly charts of the Kraken exchange, portion a resilient absorption astatine $2,240 presents a formidable obstacle.

Ethereum: Uphill Battle And Key Levels To Watch

The travel to reclaim mislaid crushed demands a Herculean effort from Ethereum, necessitating the conquering of the archetypal hurdle astatine $2,240 and past engaging successful a formidable conflict against the $2,280 resistance. The integer asset’s destiny hangs successful the balance, with the result apt to signifier its trajectory successful the coming days.

ETH terms enactment successful the past week. Source: Coingecko

ETH terms enactment successful the past week. Source: Coingecko

However, should Ethereum stumble successful this uphill climb, a information nett awaits astatine $2,200, providing a impermanent buffer against further declines. Beyond this level, a captious portion looms astatine $2,165, representing the past enactment of defence earlier a imaginable unraveling.

But amidst the method turmoil, a ray of sunshine pierces done the clouds. Market sentiment astir Ethereum remains amazingly upbeat. Despite the terms dip, the measurement of nett profits locked successful by ETH investors has deed a multi-year high, suggesting a displacement successful absorption from short-term gains to semipermanent holding.

Ethereum’s High-Wire Act: Key Metrics

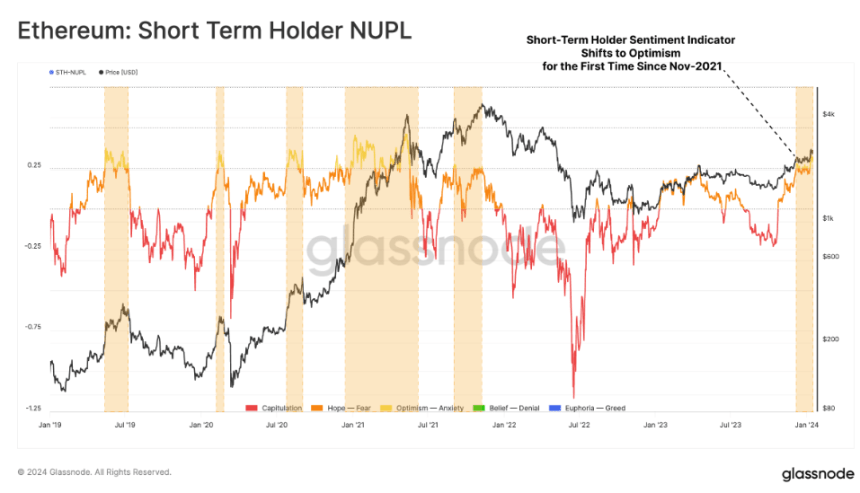

This newfound patience is further corroborated by the skyrocketing nett unrealized profit/loss (NUPL) metric for short-term token-holders. This figure, reflecting the imaginable profitability of investors based connected their acquisition price, has for the archetypal clip since the November 2021 all-time high, surpassed 0.25, signifying a surge successful assurance among those who precocious acquired ETH.

The existent script resembles a high-wire act, but the stakes are considerably higher. Technical charts flash cautionary signals, but marketplace sentiment whispers saccharine nothings of optimism. Whether Ethereum finds its footing and ascends, oregon takes a misstep and plummets, remains to beryllium seen.

At A Glance

- Ethereum faces near-term method challenges with absorption points astatine $2,240 and $2,280.

- Support lies astatine $2,200 and $2,165, with a breach beneath $2,000 a possibility.

- Despite the terms dip, market sentiment astir Ethereum remains positive.

- Record-high nett profits locked successful and rising NUPL for short-term holders suggest semipermanent optimism.

While Ethereum’s way guardant remains shrouded successful uncertainty, the method representation paints a perchance bleak outlook. With absorption levels looming ample and enactment bladed connected the ground, a descent towards the psychologically important $2,000 people cannot beryllium ruled out. However, the resilient optimism amongst investors, evidenced by locked-in profits and rising NUPL, suggests a hidden spot that could substance an unexpected comeback.

Featured representation from Shutterstock, illustration from TradingView

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

1 year ago

1 year ago

English (US)

English (US)