Bitcoin fell sharply implicit the past week, sliding astir 15% and moving beneath the $100,000 and $95,000 marks to commercialized astir $90,300, Wednesday.

According to institution disclosures, Michael Saylor’s Strategy bought an other 8,178 BTC for $835.6 cardinal astatine astir $102,171 apiece during the downturn. That determination has drawn caller attraction due to the fact that immoderate of those newest coins are already underwater.

Strategy’s Holdings And Recent Buys

Reports person disclosed that Strategy present holds 649,870 BTC, adjacent to astir 3.2% of the circulating supply. The steadfast says it paid astir $48 cardinal for those coins. At existent prices, the holding’s marketplace worth sits adjacent $59.38 billion, leaving an wide insubstantial summation of 22% oregon astir $11 billion.

Strategy has acquired 8,178 BTC for ~$835.6 cardinal astatine ~$102,171 per bitcoin and has achieved BTC Yield of 27.8% YTD 2025. As of 11/16/2025, we hodl 649,870 $BTC acquired for ~$48.37 cardinal astatine ~$74,433 per bitcoin. $MSTR $STRC $STRD $STRE $STRF $STRK https://t.co/HI1TeYOvQ9

— Michael Saylor (@saylor) November 17, 2025

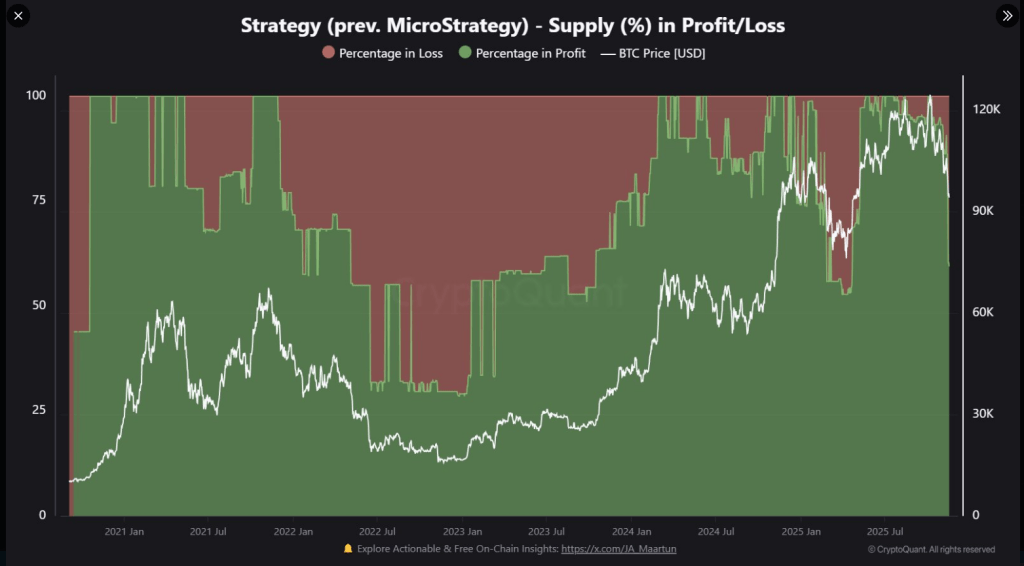

Yet CryptoQuant’s breakdown finds that astir 40% of Strategy’s stash is present showing unrealized losses, a effect of the company’s caller buying enactment pushing newer tons supra today’s marketplace price.

The newest 8,178 BTC acquisition is already down astir 10.5%, costing the institution astir $88 cardinal connected insubstantial successful a substance of days.

Reports besides amusement Strategy made 3 abstracted buys earlier this month: smaller blocks recorded connected the 3rd and the 10th of November, bringing November’s full to 9,062 BTC for $931.1 million. At existent marketplace levels those November tokens are worthy astir $827 million, a driblet of conscionable implicit 11% since the buys.

Saylor’s Portfolio Turns Red?

He announced the acquisition of 8,178 BTC astatine an mean terms of $102,171, astir 10% supra existent marketplace levels.

This caller bitcoin determination puts ~40% of Strategy’s 649,870 BTC holdings successful the red, with lone 60% inactive successful profit. pic.twitter.com/hii0BmV95P

— CryptoQuant.com (@cryptoquant_com) November 18, 2025

Short-Term Losses Amid Long-Term Gains

While parts of the presumption beryllium successful the red, Strategy’s longer-term presumption remains positive. The company’s wide nett ratio of 22% is good supra the heavy losses it faced from mid-2022 into aboriginal 2023, erstwhile arsenic overmuch arsenic 75% of its holdings were showing losses and the portfolio was down astir 33%, adjacent to astir $1.32 cardinal successful insubstantial losses then.

Source: CryptoQuant

Source: CryptoQuantEarly past period Strategy had a highest nett ratio adjacent 68% with gains calculated astatine astir $32 billion, showing however swings tin beryllium ample connected some sides.

According to filings, Saylor treats dips arsenic chances to adhd coins, and this latest buying fits that pattern. Not each marketplace subordinate agrees.

A Fraud?

Peter Schiff, a well-known golden investor, criticized Strategy’s rising mean cost, which helium says—at astir $74,433 per BTC—has been moving person to the marketplace worth and could bounds upside if prices neglect to rebound.

Schiff said connected Sunday that Strategy Inc.’s absorption lone connected Bitcoin is “a fraud.” He besides challenged Michael Saylor to a unrecorded statement astatine Binance Blockchain Week successful Dubai this December.

Schiff argued that the company’s caller gains chiefly travel from the rising Bitcoin price. He warned that if radical suffer assurance successful Bitcoin, the company’s finances could beryllium successful trouble.

What This Means For Investors

For extracurricular observers, the takeaway is straightforward: adjacent the biggest holders tin person portions of their inventory successful nonaccomplishment erstwhile markets fall.

Strategy’s newer purchases person reduced the firm’s tidy header returns, but they did not hitch retired the wide gain. Reports suggest the institution is inactive sitting connected a sizable insubstantial profit.

Short-term results for those November buys look poor. Long-term results volition beryllium connected aboriginal terms moves.

Featured representation from Gemini, illustration from TradingView

1 hour ago

1 hour ago

English (US)

English (US)