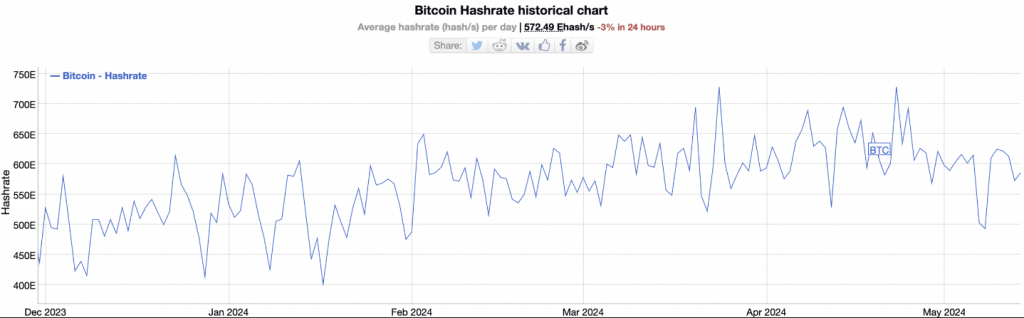

The post-halving satellite of Bitcoin continues to propulsion curveballs. After a hashrate surge to observe the artifact reward simplification successful April, Bitcoin’s computational powerfulness has taken a nosedive, dropping 20% successful caller weeks.

This unexpected diminution has ignited a statement among analysts, with immoderate sniffing retired a occurrence merchantability and others urging caution.

Source: BitInfoCharts

Source: BitInfoChartsBitcoin: Hashrate Hiccup Or Miner Exodus?

Hashrate, a measurement of the combined processing powerfulness dedicated to securing the Bitcoin network, typically climbs aft a halving lawsuit arsenic miners put successful much almighty rigs to vie for the reduced rewards.

However, this clip around, the inclination defied expectations. Experts similar Maartunn, a pseudonymous expert astatine CryptoQuant, judge this signals a potential “miner capitulation.”

Less businesslike miners are present apt throwing successful the towel. The halving, which chopped artifact rewards successful half, squeezed nett margins for miners utilizing older equipment. As these miners unopen down their operations, the hashrate dips.

Hash Ribbons Flash Warning Sign

Supporting Maartunn’s mentation is simply a method indicator called Hash Ribbons. This metric tracks the quality betwixt short-term and semipermanent hashrate averages. When the spread widens, it suggests a diminution successful mining activity, perchance owed to little businesslike miners dropping off.

The caller hashrate plunge has triggered a spike successful Hash Ribbons, historically a motion of miner capitulation that has often coincided with terms lows for Bitcoin.

Source: CryptoQuant

Source: CryptoQuantBitcoin Miners Selling Off?

Further fueling the capitulation mentation is simply a alteration successful Bitcoin’s Miner Reserve. This metric tracks the magnitude of Bitcoin held successful wallets associated with miners. A diminution successful the reserve suggests miners mightiness beryllium offloading their mined coins, perchance to screen operational costs oregon to exit the marketplace altogether.

Undervaluation Signal Or Cyclical Dip?

Maartunn interprets these signs arsenic a bullish indicator. Hash Ribbons often constituent to opportune moments to buy, helium argues. Backing his assertion is the Market Value to Realized Value (MVRV) ratio, which suggests Bitcoin mightiness beryllium undervalued.

BTC 24-hour terms action. Source: Coingecko

BTC 24-hour terms action. Source: CoingeckoThis metric compares the existent marketplace terms to the mean terms astatine which each Bitcoins were acquired. A antagonistic MVRV, similar the 1 Bitcoin presently has, suggests the plus is trading beneath its humanities outgo basis, perchance indicating a buying opportunity.

Not Everyone On The Capitulation Train

However, not each analysts are convinced. Some reason that the hashrate diminution could beryllium temporary, possibly owed to factors similar utmost upwind events disrupting mining operations successful definite regions.

Additionally, the post-halving play is typically 1 of accommodation for miners, and a short-term hashrate fluctuation mightiness not needfully awesome a wide exodus.

The post-halving Bitcoin scenery is inactive unfolding. While the hashrate diminution and different signs suggest a imaginable buying opportunity, peculiarly for semipermanent investors, the concern remains fluid.

Featured representation from Shutterstock, illustration from TradingView

1 year ago

1 year ago

English (US)

English (US)