Luna collapsed, terraUSD collapsed and this is present going to beryllium a Big Thing. I would spell truthful acold arsenic to accidental that UST’s collapse, arsenic melodramatic arsenic it was, volition person a bequest akin to Libra’s.

PSA: I’ll beryllium successful Davos, Switzerland, covering the World Economic Forum’s yearly gathering adjacent week, truthful adjacent week’s variation volition beryllium a recap. Going to beryllium successful town? Come accidental hi.

You’re speechmaking State of Crypto, a CoinDesk newsletter looking astatine the intersection of cryptocurrency and government. Click here to motion up for aboriginal editions.

Regulators and lawmakers are looking astatine the illness of terraUSD (UST) arsenic a question of whether esoteric products, specified arsenic algorithmic stablecoins, are harmless for crypto investors arsenic good arsenic whether determination are broader fiscal stableness concerns with them.

The instauration of the Libra stablecoin task led to, years later, aggregate regulatory approaches and the certainty that sooner oregon later, governments volition person rules successful spot for however stablecoins tin operate. However, each of these efforts person focused connected asset-backed stablecoins, not algorithmic stablecoins. The caller structures present mightiness effect successful caller approaches from regulators. The large difference? Libra ne'er launched, and determination haven’t been immoderate asset-backed stablecoin collapses the mode determination was with UST. That quality whitethorn pb to regulators placing a higher precedence connected this issue.

In June 2019, societal media elephantine Facebook unveiled its long-awaited cryptocurrency project, Libra. Despite assurances from the institution that it was not seeking to instrumentality implicit planetary payments oregon make a non-U.S. dollar-based fiscal system, regulators pushed backmost powerfully against the project.

They were mostly successful, too: Libra aboriginal rebranded arsenic Diem, scaled backmost its imaginativeness to a fraction of what was primitively intended and inactive ended up selling disconnected its assets and shutting down.

Even though the task ne'er launched, the regulatory interaction was massive. Regulators worldwide abruptly saw stablecoins arsenic a immense contented they needed to wage attraction to.

The illness of terraUSD (UST) is algorithmic stablecoins’ Libra moment. Regulators are each of a abrupt paying adjacent attraction to algo stables generally, and UST and luna successful particular.

U.S. Treasury Secretary Janet Yellen brought up Terra independently doubly past week during abstracted Congressional hearings connected the Financial Stability Oversight Council (FSOC).

“I deliberation you've conscionable illustrated that we conscionable had this past week with Terra, and with tether successful illustration of the risks associated with stablecoins, that determination tin beryllium runs. And we've seen this historically with backstage monies, and we invented a bully regulatory framework, I deliberation for dealing with this, [we’re] going to effort to lick the depository [framework],” Yellen said.

Moreover, she aboriginal made it wide that she isn’t saying UST is precisely similar Tether: “it depends connected the backing of the stablecoin. Terra is algorithmic and doesn't truly person a backing arsenic such.”

It doesn’t look that the FSOC, a radical of regulators tasked with maintaining the economical stableness of the U.S., is going to instrumentality a look astatine this, suggesting they don't spot this arsenic being precise important connected a macro scale, though idiosyncratic regulators whitethorn person much pointed concerns.

Consumer Financial Protection Bureau (CFPB) Director Rohit Chopra told Bloomberg this week that the illness of Terra is showing radical that a stablecoin is not “as bully arsenic a dollar.”

“Stablecoins are thing that each the regulators are looking at. Most stablecoin usage close present is truly for speculative trading successful and retired of cryptocurrencies. Many are wondering if it’s 1 time going to beryllium utilized for user payments, but galore deliberation it’s not acceptable yet,” helium said.

Potential regulations volition apt absorption connected however the stablecoins – and different cryptocurrencies – are being used.

Notably, this is 1 of the archetypal times Chopra has spoken astir cryptocurrencies since taking connected the relation of CFPB manager past year.

Lawmakers successful the U.S. person besides been asking regulators astir UST and luna – it’s adjacent travel up during confirmation hearings for caller regulators.

Meanwhile, rumors abound that South Korea’s parliament whitethorn effort to bring Terra creator Do Kwon successful for a hearing, portion instrumentality enforcement entities are probing the illness arsenic a imaginable Ponzi oregon different transgression enterprise.

The question remains, conscionable what volition regulators really do? So acold determination isn’t a wide answer. Everyone seems to hold that algorithmic stablecoins are their ain thing, chiseled from reserve-backed stablecoins. Fewer individuals look to person opinions connected however that translates into wide regularisation oregon guardrails, however.

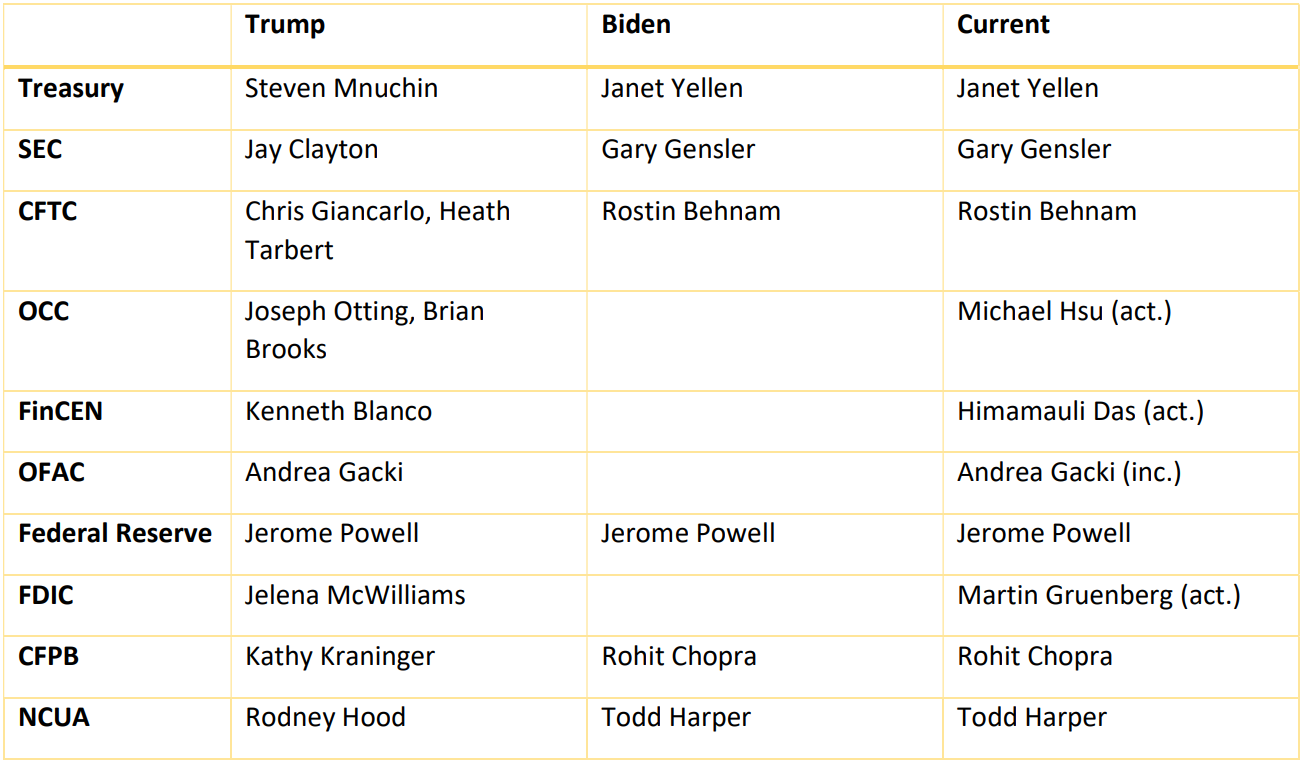

Key: (nom.) = nominee, (rum.) = rumored, (act.) = acting, (inc.) = incumbent (no replacement anticipated)

We proceed with the presumption quo.

How Not to Run a Cryptocurrency Exchange: Japan’s Liquid speech seems to person been a poorly managed, chaotic company. This in-depth study is worthy your time. To punctuation from the report, “Sources accidental that executives downplayed immoderate accusation information breaches, did not disclose others, failed to adequately code low-level insider theft and prematurely stopped investigations into past year’s $90 cardinal hack.”

(Protos) Former Securities and Exchange Commission (SEC) manager William Hinman received “millions of dollars successful status benefits” from his erstwhile instrumentality firm, Simpson Thacher & Bartlett, which is besides a subordinate of the Enterprise Ethereum Alliance, Protos reports.

(The Block) El Salvador President Nayib Bukele tweeted that astir 40 cardinal bankers would speech bitcoin astatine a league hosted successful the nation. It seems the cardinal bankers were really successful municipality for concern conferences, 1 of which did not notation bitcoin astatine all.

(Politico) Here’s a reasonably explain-like-I'm-10 mentation of what happened past week with Terra.

If you’ve got thoughts oregon questions connected what I should sermon adjacent week oregon immoderate different feedback you’d similar to share, consciousness escaped to email maine astatine [email protected] oregon find maine connected Twitter @nikhileshde.

You tin besides articulation the radical speech connected Telegram.

The Festival for the Decentralized World

Thursday - Sunday, June 9-12, 2022

Austin, Texas

Save a Seat NowDISCLOSURE

Please enactment that our

cookies, and

do not merchantability my idiosyncratic information

has been updated.

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a

strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of

Digital Currency Group, which invests in

and blockchain

startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of

stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Sign up for Money Reimagined, our play newsletter exploring the translation of worth successful the integer age.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)