Over the weekend, algorithmic stablecoin TerraUSD (UST) broke its peg. It broke it again connected Monday, and has yet to recover. Regulators whitethorn person to instrumentality a person look astatine this peculiar exemplary of stablecoin.

You’re speechmaking State of Crypto, a CoinDesk newsletter looking astatine the intersection of cryptocurrency and government. Click here to motion up for aboriginal editions.

TerraUSD, a dollar-pegged stablecoin, mislaid its peg doubly implicit the past fewer days and hasn’t regained it since its past decoupling.

The TerraUSD illness whitethorn airs a fig of risks, ranging from investor/retail to institutional. While this is simply a comparatively small-cap cryptocurrency and its footprint is comparatively contained, it inactive has immoderate large implications for the sector, peculiarly if it spooks lawmakers oregon regulators already acrophobic astir stablecoin collapse.

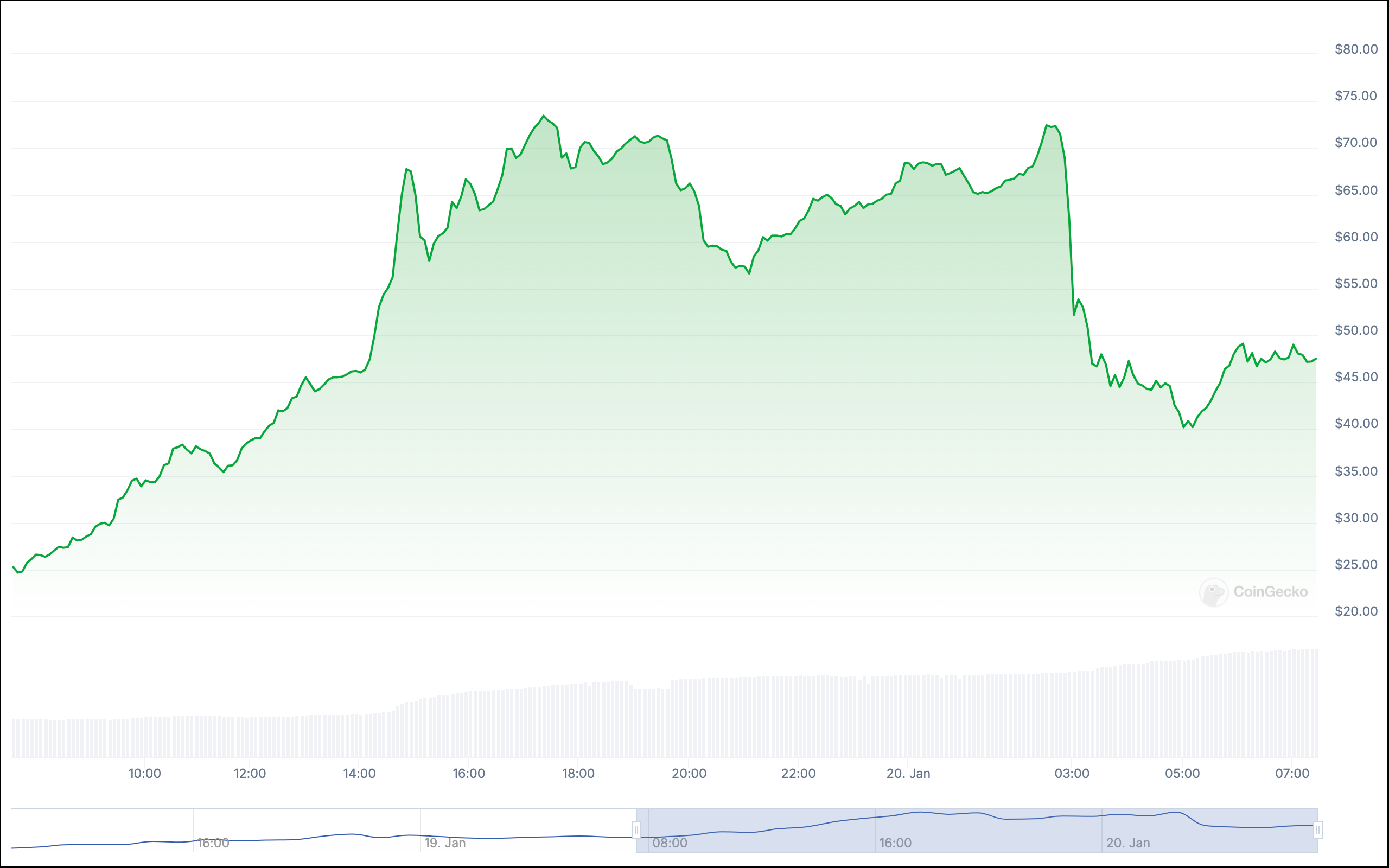

TerraUSD ($UST)’s terms fell to 23 cents and has a 24-hour precocious of 92 cents. This would beryllium a somewhat mean magnitude of crypto volatility, but the added twist present is TerraUSD is expected to beryllium a stablecoin, meaning its terms should beryllium 1:1 to the U.S. dollar.

If you’re heavy into crypto and/or person followed this communicative closely, spell up and leap down to the “Outside Impact” subheading.

For caller readers of this newsletter, oregon for those who don’t usually travel stablecoins that in-depth, the thought is you person a cryptocurrency whose worth is unchangeable comparative to different asset, specified arsenic the dollar, which you tin past usage arsenic an intermediate portion of speech oregon to bargain goods and services utilizing crypto without having to interest astir marketplace volatility.

There's a fewer ways to execute this benignant of terms stability. Stablecoins similar Tether ($USDT), USDC ($USDC) and the Binance Dollar ($BUSD) are backed by reserves. The issuers accidental that for each portion of their respective stablecoin successful circulation, determination is simply a matching U.S. dollar successful a slope relationship somewhere.

Stablecoins similar the now-defunct Diem (formerly Libra) intended to beryllium issued by an enactment launched by Meta (formerly Facebook) would person been backed by a handbasket of antithetic assets. In the archetypal Libra’s case, this would person been a handbasket of assorted currencies.

Algorithmic stablecoins are different. Rather than being backed 1:1 by dollars, the thought is you person 2 tokens, the stablecoin itself and a sister token that is issued (created) oregon burned (destroyed) arsenic needed to support the stablecoin’s price.

This sister token (confusingly called Terra with the ticker $LUNA; I’m conscionable going to notation to it arsenic luna for the purposes of this newsletter) tin beryllium invested successful tools that marque the Terra ecosystem much valuable. In theory, UST should ever beryllium redeemable for luna astatine the terms of $1 per UST.

According to the Luna Foundation Guard, a Singapore-registered non-profit entity meant to enactment UST’s terms stability, arbitraging trades is 1 mode that luna tin beryllium utilized to support its peg.

“Unlike different stablecoins that are backed by fixed deposits of the pegged fiat currency oregon over-collateralized successful different DeFi asset, the worth of Terra’s household of stablecoins is maintained done a strategy of arbitrage incentives, unfastened marketplace operations, and dynamic protocol levers that support robust peg stableness and scalability of its proviso without the centralized power oregon capital-inefficient designs of incumbents,” the Luna Foundation Guard’s website says.

What it should look like: The unchangeable enactment connected the left. What it has looked similar the past fewer days: That portion connected the right.

So yeah, the peg broke a small bit.

It’s worthy noting that the 24-hour precocious – 85 cents – means UST hasn’t regained its peg successful implicit a time (since Monday really).

A batch of radical mislaid oregon are losing wealth connected UST and/or luna. Institutions are apt successful a akin boat, and determination are broader marketplace implications arsenic well.

LFG was rumored to beryllium seeking up to $1.5 cardinal successful backing to assistance prop up UST’s peg, adjacent arsenic the Guard loaned adjacent to $1.4 cardinal successful bitcoin (BTC) for the aforesaid purpose.

So I person to ideate regulators are paying adjacent attention. Treasury Secretary Janet Yellen already brought UST up during a Senate Banking Committee proceeding arsenic a typical of the Financial Stability Oversight Council (FSOC).

“I would enactment that determination was a study conscionable this greeting … that a stablecoin known arsenic TerraUSD had experienced a tally and had declined successful value,” Yellen told Senator Pat Toomey (R-Pa.) connected Tuesday. “I deliberation that simply illustrates that this is simply a rapidly increasing merchandise and determination are risks to fiscal stableness and we request a framework.”

Toomey himself seems to disagree astir the hazard aspect: He told reporters connected Wednesday that due to the fact that UST is not backed by reserves successful the aforesaid mode afloat backed stablecoins are, they don’t station the aforesaid benignant of fiscal stableness risk.

Still, it does look that immoderate is happening with luna and UST is having immoderate power connected the broader crypto market.

The question is which regulator adjacent has jurisdiction implicit this sector.

There's an statement that the 2 tokens whitethorn person immoderate securities instrumentality implications.

Back successful 2018, a task called Basis raised implicit $130 cardinal to make an algorithmic stablecoin with a two-token structure, akin to luna and UST.

The task refunded investors aft the Securities and Exchange Commission warned that the institution mightiness violate national instrumentality if it did not bounds itself to accredited investors.

As an aside, this task was resurrected successful 2020 by immoderate anonymous developers who felt that being anonymous would insulate them from regulators. One of these anonymous individuals was none different than Do Kwon, the look of the Terra ecosystem and the laminitis of Terraform Labs, which initially launched the coins.

What’s more, we cognize the SEC has Kwon connected its radar – officials with the regulatory bureau famously served him a subpoena during a league successful 2021 tied to Mirror Protocol, different task he’s portion of.

Banking regulators oregon those tasked with overseeing the fiscal institutions that backed luna whitethorn besides person questions, peculiarly if the companies nether their purview are abruptly heavy down connected their investments. Furthermore, determination whitethorn not beryllium immoderate azygous national regulator capable to oversee immoderate of the institutions that invested successful luna, which could beryllium bully oregon atrocious depending connected whether they’ve mislaid important amounts of their investors’ wealth – immoderate of the earlier investors whitethorn person made important returns if they closed their positions retired oregon sold immoderate equity they whitethorn person gained done aboriginal backing rounds.

Congress volition apt wage attraction astatine immoderate constituent arsenic well.

Ron Hammond of the Blockchain Association said portion stablecoins person been connected Congress’s radar for a portion now, each the bills addressing this assemblage of the crypto satellite person focused connected asset-backed stablecoins.

“That's wholly changed,” helium said. “It's changed a batch of conversations.”

Algorithmic stablecoins are present decidedly things lawmakers are paying attraction to, but however they mightiness attack this is unclear.

Moreover, it’s going to instrumentality immoderate clip to fig retired precisely what happened, what the risks are, and whether determination are further risks

This is the benignant of concern that mightiness enactment unit connected Congress though conscionable the information that existent radical are getting wounded by this situation.

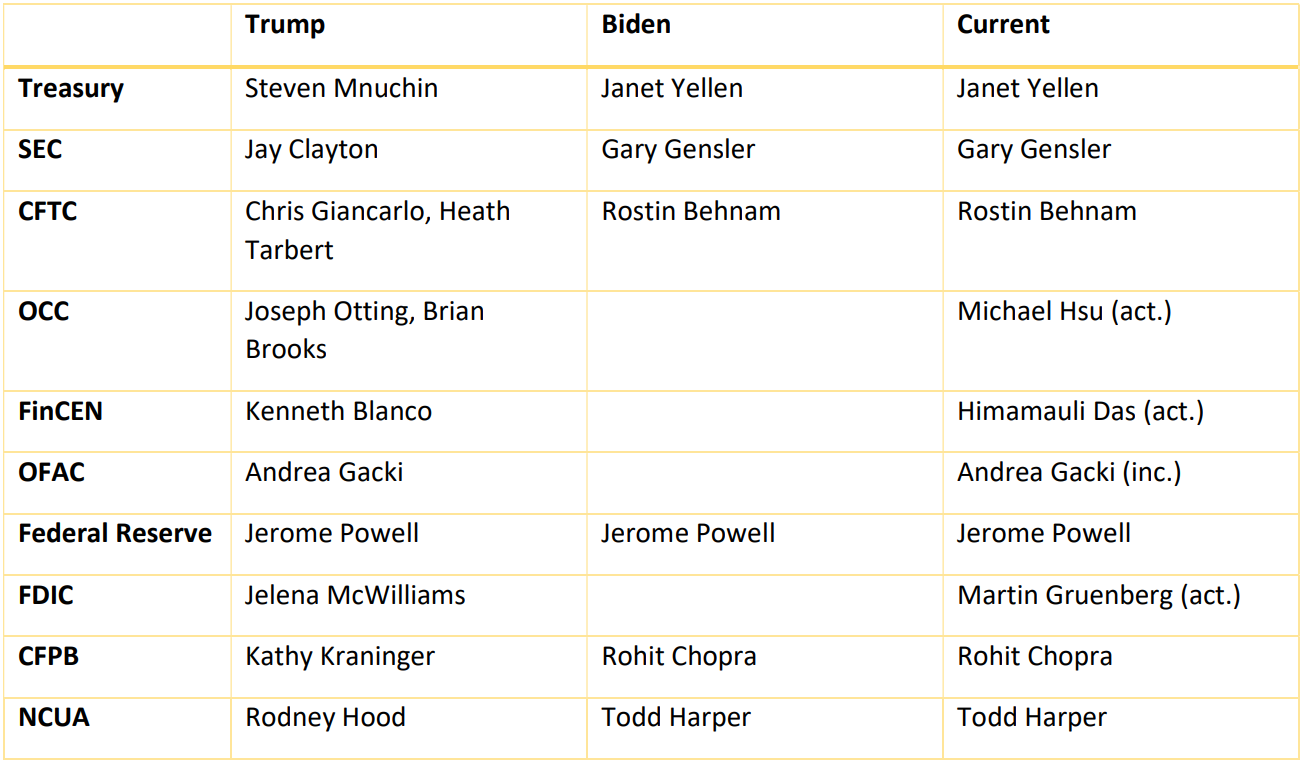

Key: (nom.) = nominee, (rum.) = rumored, (act.) = acting, (inc.) = incumbent (no replacement anticipated)

Lisa Cook has officially been confirmed to beryllium a subordinate of the Federal Reserve’s Board of Governors.

In Estonia, the Party’s Over for 'Hippie' Crypto Firms: Estonia enacted a caller crypto licensing instrumentality requiring section exchanges and different businesses to abide by immoderate strict caller rules, including superior reserve requirements, know-your-customer requirements and governance structures. Something similar 90% of the country’s crypto firms whitethorn permission arsenic a result.

Typo Moves $36M successful Seized JUNO Tokens to Wrong Wallet: Juno is simply a crypto task that airdropped tokens to investors and, successful what whitethorn person been a genuinely caller governance episode, decided to penalize 1 airdrop recipient who whitethorn person gamed the strategy to summation much tokens than helium should have. This was each precise decentralized and past the confiscated tokens were sent to a wallet nary 1 tin entree by mistake.

(BuzzFeed News) Sometimes I work thing and deliberation “yeah that makes sense.” This was not 1 of those times.

(Vice) The Centers for Disease Control and Prevention (CDC) purchased determination information connected “tens of millions” of phones successful the U.S. to way people’s compliance with COVID-19 lockdowns and place patterns, Vice reported. The information came from information brokers similar SafeGraph, a Peter Thiel-backed steadfast that aggregates this benignant of information.

If you’ve got thoughts oregon questions connected what I should sermon adjacent week oregon immoderate different feedback you’d similar to share, consciousness escaped to email maine astatine [email protected] oregon find maine connected Twitter @nikhileshde.

You tin besides articulation the radical speech connected Telegram.

2 years ago

2 years ago

English (US)

English (US)