Bitcoin · Ethereum › Investments

Last week’s large outflows derived from North America–highlighting regulatory concerns arsenic a apt origin of antagonistic capitalist sentiment.

Cover art/illustration via CryptoSlate

After 7 consecutive weeks of inflows, crypto concern products recorded important outflows past week, according to the latest study by organization crypto money manager CoinShares.

The study which analyzes play flows into cryptocurrency funds suggests regulatory concerns and geopolitical turmoil person diminished capitalist involvement successful some the Americas and Europe.

$80 cardinal of the outflows derived from North America

Beginning astatine the commencement of past week, $80 cardinal of the outflows derived from North America could beryllium interpreted arsenic a response to the US Presidential Executive Order to analyse the crypto sector, according to the report.

“Given determination has been small terms effect and that outflows of $30 cardinal were besides seen successful Europe, highlights the reasons are unclear,” the organization crypto money manager noted, adding that some regulatory concerns and geopolitical unrest played a portion successful corroding the involvement successful crypto assets successful the week ended March 11.

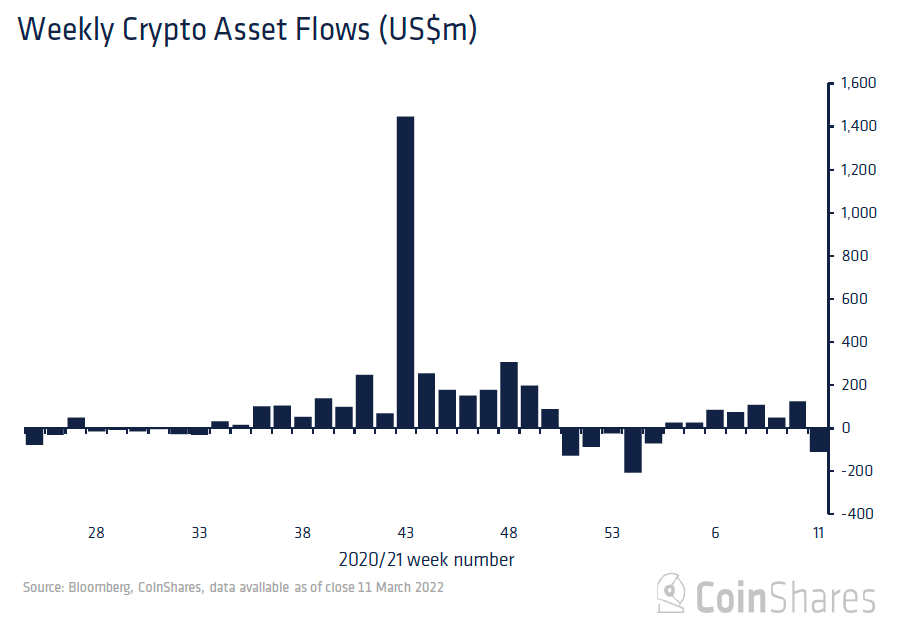

Chart showing play crypto-asset flows (CoinShares)

Chart showing play crypto-asset flows (CoinShares)Bitcoin recorded $70 cardinal successful outflows past week–” disconnected the backmost of debased volumes”– the study noted.

According to CoinShares:

“Investment products traded $1 cardinal past week compared the mean $1.24 billion, representing conscionable 5% of full Bitcoin trading volumes.”

Multi-asset concern products stay popular

On a comparative basis, Ethereum concern products saw the largest outflows past week–totaling $51 million.

Ethereum outflow volumes year-to-date correspond 1.2% of assets nether absorption (AuM), the study pointed out.

Meanwhile, altcoin concern products flows were mixed past week.

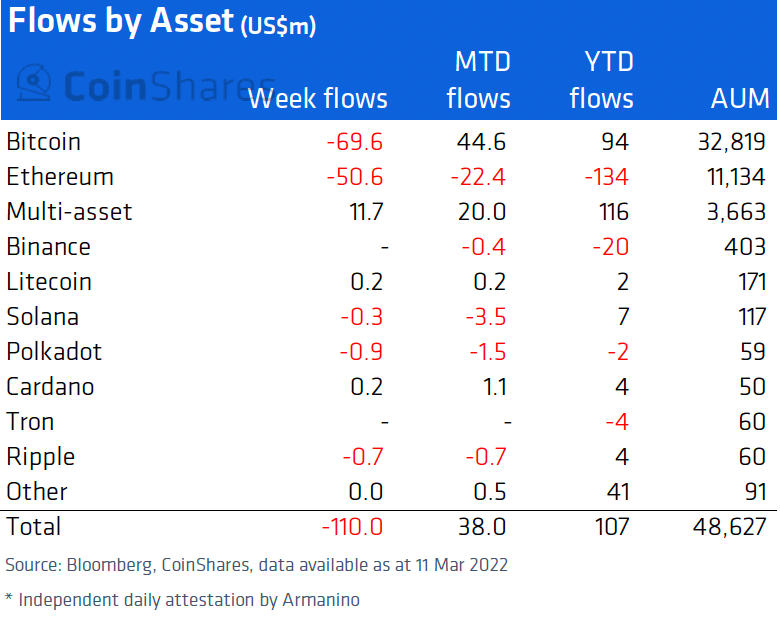

Table showing play integer plus money flows by plus (CoinShares)

Table showing play integer plus money flows by plus (CoinShares)Zooming into idiosyncratic plus funds revealed that Solana, XRP, and Polkadot each recorded insignificant outflows–totaling $0.3 million, $0.7 million, and $0.9 cardinal respectively.

At the aforesaid time, Cardano and Litecoin concern products saw insignificant inflows of $0.2 million.

That said, multi-asset concern products saw inflows totaling $12 million, portion blockchain equity concern products attracted $4.1 million.

According to CoinShares, some multi-asset and blockchain equity concern products persist arsenic “the astir fashionable amongst investors”– with inflow volumes representing 3.2% and 6.7% of AuM respectively.

Get your regular recap of Bitcoin, DeFi, NFT and Web3 quality from CryptoSlate

It's escaped and you tin unsubscribe anytime.

Get an Edge connected the Crypto Market 👇

Become a subordinate of CryptoSlate Edge and entree our exclusive Discord community, much exclusive contented and analysis.

On-chain analysis

Price snapshots

More context

3 years ago

3 years ago

English (US)

English (US)