Significant inflows brough overmuch needed alleviation pursuing this week's brutal sell-off. Nonetheless, analysts accidental brace for worse to come.

Cover art/illustration via CryptoSlate

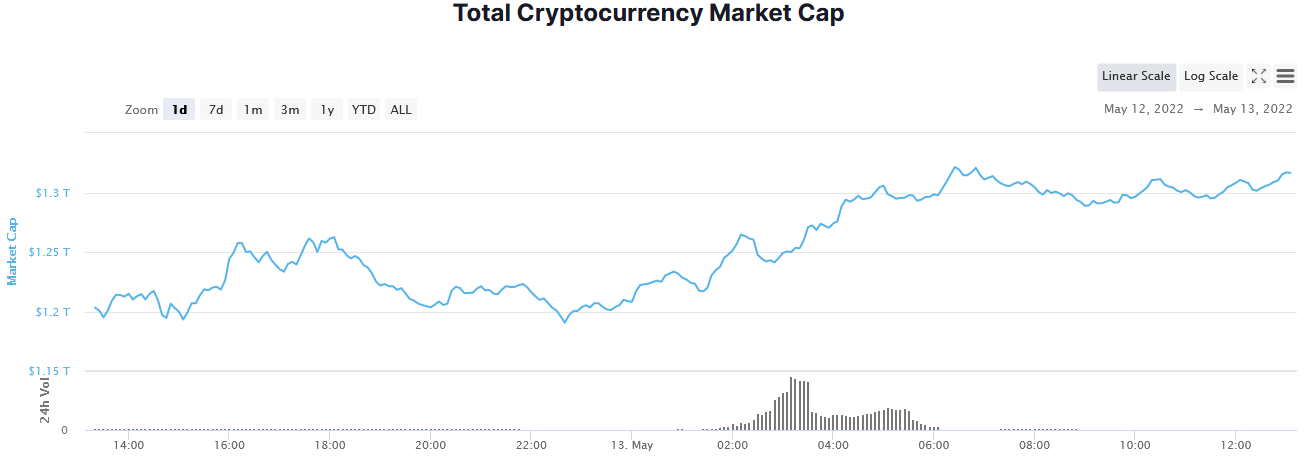

The moving week is acceptable to extremity connected a greenish day, with $113 billion of superior flowing backmost into the full crypto marketplace headdress implicit the past 24-hours.

Altcoins payment from superior inflows

The marketplace headdress illustration investigation shows measurement picking up astatine astir 02:00 (GMT) connected May 13, peaking astatine 10:00. Despite measurement tailing disconnected since then, inflows person continued to climb, suggesting carnivore exhaustion.

Source: CoinMarketCap.com

Source: CoinMarketCap.comYouTuber Lark Davies tweeted that immoderate altcoins person posted 70% gains during this bounce to bring astir immoderate much-needed affirmative sentiment.

BIG bounce here! Some Alts up betwixt 20 and 70%!!!! #crypto

— Lark Davis (@TheCryptoLark) May 13, 2022

In the past 24 hours, the astir prominent top 100 gainers were Gala astatine +57%, STEPN astatine +57%, and Kadena astatine 47%. Meanwhile, the marketplace leader, Bitcoin, swung 8% to the upside recapturing $30,000. Currently, BTC is hovering tentatively adjacent to that level astatine $30,600.

May 11 saw Bitcoin dominance emergence dramatically from 41.6% to 45.2% (a six-month high)over the pursuing 2 days. However, investors person since cycled backmost into altcoins starring to a driblet to 44.5% astatine writing.

Source: BTC.D connected TradingView.com

Source: BTC.D connected TradingView.comWhere present for crypto?

The bounce brought much-needed alleviation from the brutal sell-off triggered by happenings successful the Terra ecosystem. However, adjacent considering this, the full crypto marketplace headdress is inactive down 20% connected the week and 55% from the November 2021 high.

As events unfolded, the communicative shifted from uncertainty, of the existent marketplace cycle, to a carnivore market. Few analysts are calling the caller sell-off a blip successful the bull phase.

Instead, a much somber and antiaircraft code dominates. Will Clemente posits that much symptom is ahead, giving a telephone of low-mid $20k for Bitcoin.

“Based connected the aggregation of these metrics and terms levels; bottommost is astir apt successful low-mid $20Ks, aligning with the mentation of frontrunning erstwhile ATH.“

Meanwhile, gold-bug Peter Schiff warned that Bitcoin’s determination backmost supra $30k should not beryllium taken arsenic a motion it has bottomed.

“It’s apt this country is nary longer support, but resistance. New enactment is overmuch little down.“

Schiff’s tweet besides drew attraction to Bitcoin’s correlation to tech stocks, adding that ‘even if the Nasdaq has a carnivore marketplace rally, it’s apt Bitcoin won’t participate.’

Even though Schiff has nary nonsubjective grounds for that statement, helium is close successful pointing retired that a macro power is successful play. And with immoderate economists predicting a crisp global economical downturn, present is not the clip to widen risk.

3 years ago

3 years ago

English (US)

English (US)