Ever since Celsius paused withdrawals connected June 12, the institution has been the absorption of attraction owed to the lender’s fiscal hardships. A period later, Celsius filed for bankruptcy successful the U.S. by leveraging the Chapter 11 process. Two days aft the bankruptcy filing, a study disclosed that 2 radical acquainted with the substance allege that the backstage lending level that owes Celsius $439 cardinal is Equitiesfirst.

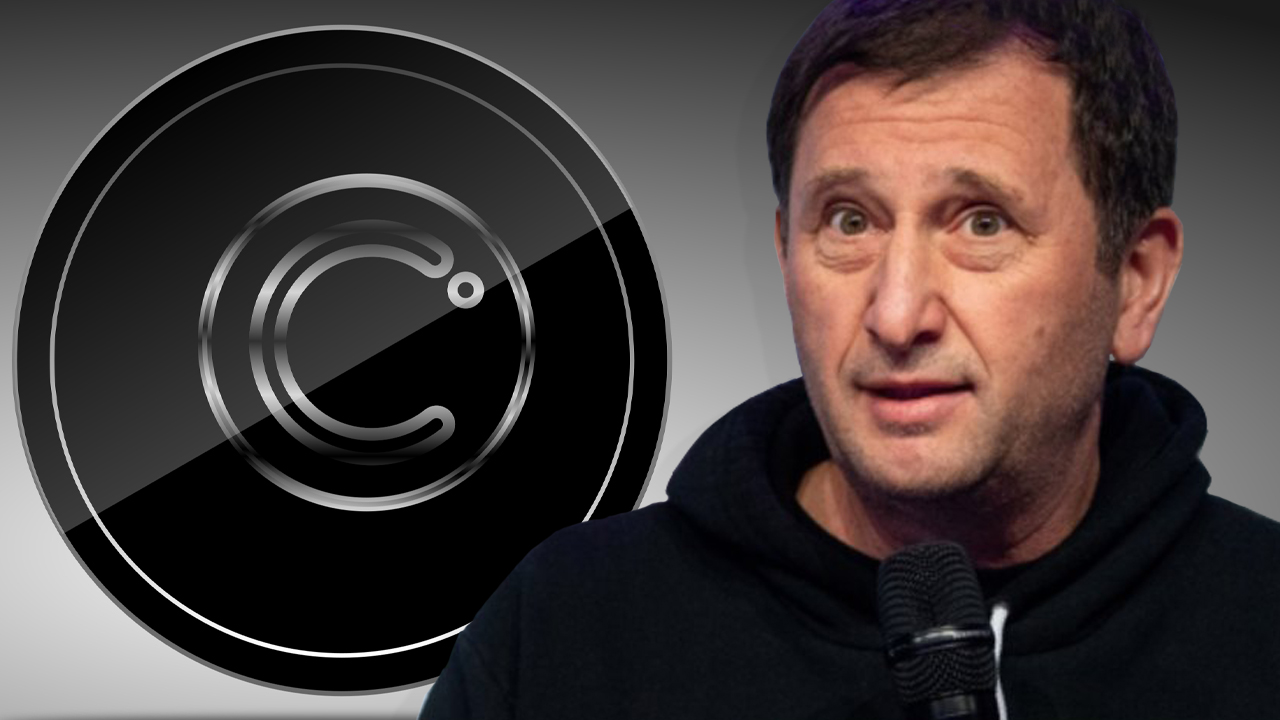

FT Sources Allege Private Lending Platform That Owes Celsius $439M Is Equitiesfirst

During the past fewer weeks, bankruptcies, liquidations, and insolvencies person been a precise blistery taxable successful the crypto world. Three good known crypto companies person filed for bankruptcy extortion which includes the integer currency speech Voyager Digital, the crypto lender Celsius, and the crypto hedge money Three Arrows Capital (3AC). Celsius filed for bankruptcy connected July 13, 2022, oregon 31 days aft the institution froze withdrawals.

Prior to the bankruptcy filing successful July, determination was speculation during the 2nd week of June that said Celsius had funds locked into circumstantial decentralized concern (defi) protocols that needed contiguous accommodation oregon important collateral would beryllium liquidated. A fewer days earlier Celsius filed for bankruptcy, the company’s wallets reportedly transferred millions of usd coin (USDC) astatine different times to wage down loans successful Compound and Aave.

When Celsius filed for bankruptcy protection, the filing elaborate that Celsius was owed a ample sum of funds. On July 15, the Financial Times (FT) reported that “Equitiesfirst [has been] revealed arsenic [the] mysterious debtor to troubled crypto steadfast Celsius.” The study claims 2 radical acquainted with the substance disclosed that Equitiesfirst is the ostensible borrower that owes the crypto lender $439 million.

Founded successful 2002, Equitiesfirst is an concern steadfast that “specializes successful semipermanent asset-backed financing,” according to the company’s website. While Equitiesfirst manages stocks, it has besides been dealing with prime cryptocurrencies since 2016. The managing manager and caput of Equitiesfirst Singapore, Johnny Heng, spoke astir cryptocurrencies successful April 2022.

“We utilized to beryllium axenic equities, until immoderate six years ago, we started to connection loans against cryptocurrency arsenic well, and that enactment has truly taken disconnected [in] the past twelvemonth oregon two,” Heng told hubbis.com successful an interview. Speaking with FT, an Equitiesfirst spokesperson said: “Equitiesfirst is successful [an] ongoing speech with our lawsuit and some parties person agreed to widen our obligations.”

Meanwhile, celsius web (CEL) token investors tried to abbreviated squeeze the company’s autochthonal token good earlier the institution filed bankruptcy. However, aft the bankruptcy filing, CEL slipped by 58% against the U.S. dollar earlier it rebounded. Statistics recorded connected July 16, 2022, bespeak that contempt CEL’s marketplace volatility, the crypto plus has gained much than 30% during the past 30 days.

What bash you deliberation astir the study that says Equitiesfirst has been revealed arsenic the enigma debtor that owes Celsius millions? Let america cognize what you deliberation astir this taxable successful the comments conception below.

3 years ago

3 years ago

English (US)

English (US)