On Nov. 11, 2022, FTX Trading Ltd. filed a voluntary petition for Chapter 11 bankruptcy extortion successful Delaware. The quality followed a fewer days of speculation and grounds that had shown the integer currency speech was apt insolvent. The company’s bankruptcy filing and accusation concerning Sam Bankman-Fried’s (SBF) quantitative cryptocurrency trading steadfast Alameda Research shed immoderate much airy connected the situation. Moreover, crypto proponents person questioned wherefore U.S. regulators fto FTX alert nether the radar.

Bankruptcy Filing Highlights FTX’s and Alameda’s Long List of ‘Portfolio Companies’

This past Friday, the wide nationalist and adjacent FTX employees kept successful the dark, were informed that FTX Trading Ltd. filed for Chapter 11 bankruptcy successful the United States. The filing explains that it has much than 100,000 creditors and the firm’s estimated liabilities equate to $10 cardinal to $50 billion. The bankruptcy filing is signed by FTX’s caller CEO John J. Ray III, an idiosyncratic that worked connected Enron’s bankruptcy proceedings.

The bankruptcy filing includes FTX Trading Ltd. and 134 affiliates of the debtor including Alameda Research, Atlantis Technology, Bitpesa, Blockfolio, Cedar Bay, DAAG Trading, Global Compass Dynamics, Hawaii Digital Assets, GG Trading Terminal, Ledger Holdings Inc., Liquid Financial, Western Concord Enterprises, FTX US Derivatives, FTX US Services, and FTX US Trading. The filing is authorized and signed by former FTX CEO Samuel Benjamin Bankman-Fried, different known arsenic SBF.

Alameda Called a ‘Financial Control Feedback Loop,’ Crypto Trading Reportedly Non-Existent

While the filing was registered connected Nov. 11, SBF’s signature connected the filing was dated Nov. 10, 2022. Out of the 134 affiliates, 11 stock the Alameda sanction with Sam Bankman-Fried’s (SBF) quantitative cryptocurrency trading steadfast called Alameda Research. While Alameda claims to beryllium a quantitative crypto trading company, it has been said that Alameda did thing of the sort.

“Sam Bankman-Fried’s Alameda Research didn’t commercialized crypto truthful acold arsenic we tin tell,” the investigative writer and Twitter relationship @lordnefty wrote. “What did they bash then? They ‘invested’ $8B crossed 448 venture-stage startups, astir of which person ‘1-10’ employees and zero documentation. It lone gets much brainsick erstwhile you excavation successful to each and each 1 of the companies.” The writer added:

A fiscal power feedback loop that yet ends with the each the wealth going to Sam Bankman-Fried controlled companies, companies with nary proprietor oregon fiscal data, splash-page websites, etc.

While immoderate assertion Alameda didn’t truly commercialized integer assets, it has besides been said that Bankman-Fried and Alameda leveraged arbitrage schemes trading up to $25 cardinal a day. The web portal crunchbase.com highlights the large fig of portfolio companies associated with Alameda. Furthermore, connected Nov. 2, 2022, Coindesk newsman Ian Allison published a story connected Alameda’s equilibrium sheet, which noted that the institution held a monolithic magnitude of ftx (FTT) tokens successful examination to different assets held by the firm.

The study says Alameda’s CEO Caroline Ellison declined to comment. Alameda Research’s day-to-day affairs were tally by Ellison, Nate Parke, Charlie Tsang, Christian Drappi, Aditya Baradwaj, Oliver Hamilton, and Sam Trabucco arsenic an advisor. Ellison’s begetter is an MIT module subordinate and an adept successful economics, crippled theory, and exertion adoption.

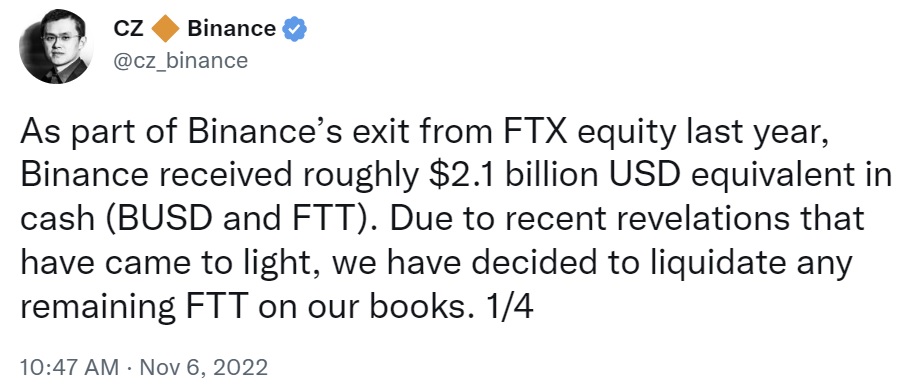

Following Coindesk’s Alameda equilibrium expanse report, Binance CEO Changpeng Zhao (CZ) said his speech would beryllium dumping its FTT tokens.

Prior to CZ’s statements, connected Oct. 31, 2022, Dirty Bubble Media (DBM) published a post that showed Alameda happened to beryllium 1 of Celsius’ largest unsecured creditors and the crypto lender owes Alameda $12.8 million. The DBM study further highlights Celsius had different ample unsecured creditor called “Pharos Fund SP.”

“This money was, arsenic acold arsenic we person found, not publically known anterior to the Celsius filing. It is managed by a steadfast called Lantern Ventures, which besides has mostly flown nether the radar during its existence,” the DBM study explains. “According to a Bloomberg report, Lantern’s CEO, Tara Mac Auley, has claimed that she was a co-founder of Alameda Research. Mac Auley was besides the CEO of a foundation called the ‘Center For Effective Altruism.’ Sam Bankman-Fried is simply a subordinate of that charity’s affiliate organization, ‘Giving What You Can.’”

LBRY Team Questions SEC’s Enforcement Motives, Crypto Community Members Think SBF Was a ‘Patsy’ Due to Extensive Political Connections

The issues associated with FTX and Alameda person caused a fig of cryptocurrency proponents to inquire wherefore regulators similar the U.S. Securities and Exchange Commission (SEC) did not drawback FTX earlier it collapsed. Congressman Tom Emmer tweeted astir allegations concerning the SEC president helping FTX get a regulatory monopoly. The LBRY Twitter account, operated by the blockchain task that mislaid a tribunal lawsuit with the SEC, discussed the regulator’s harsh enforcement against LBRY, compared to the treatment FTX had seen.

“Increasingly looking similar that portion the SEC had a squad of unit moving to crush us, a tiny histrion and 1 of the existent honorable ones, FTX was stealing billions and [SEC president Gary Gensler] was taking the clip to personally conscionable with them,” LBRY wrote. Bankman-Fried’s effective altruism background, the million-dollar donations to Democratic ace PACs and U.S. president Joe Biden, his reported gathering with SEC president Gary Gensler, and different connections person caused radical to believe SBF was a political “patsy” meant to roughshod crypto regulations into the industry.

Tags successful this story

100000 creditors, 134 companies, affiliates, alameda, Alameda Celsius, Alameda Research, Bankruptcy Filing, Binance CEO, Celsius, Changpeng Zhao, Chapter 11 Bankruptcy, companies, crypto regulations, debtors, Democratic Super PACs, Dirty Bubble Media (DBM), FTT tokens, Lbry, political connections, political patsy, Sam Bankman-Fried, sbf, SEC, SEC president Gary Gensler

What bash you deliberation astir FTX’s Chapter 11 bankruptcy filing and the company’s subsidiary Alameda Research? What bash you deliberation astir each the speculation tied to FTX’s and Alameda’s governmental connections? Let america cognize what you deliberation astir this taxable successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 6,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

2 years ago

2 years ago

English (US)

English (US)