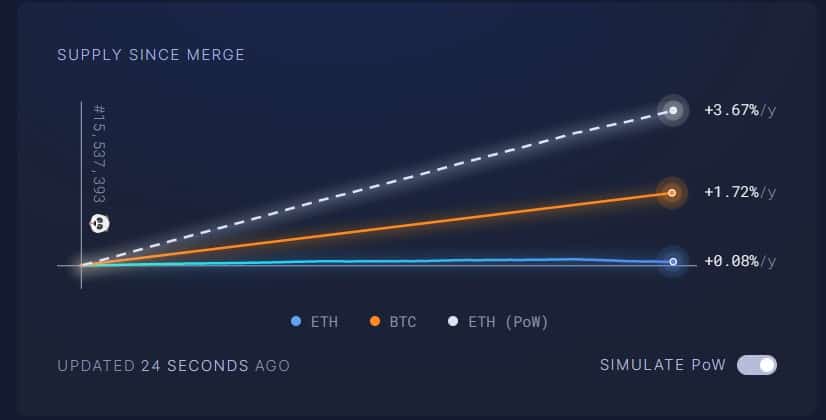

Ethereum completed 1 of its historical upgrades successful mid-September. The Merge created the modulation from Proof-of-Work (PoW) to Proof-of-Stake (PoS). Unfortunately, the post-Merge events brought deflationary situations for the blockchain.

As predicted by immoderate crypto experts, the terms of Ethereum has dropped drastically pursuing its modulation to PoS. Also, the dynamics of ETH proviso person changed aft the upgrade.

According to information from Ultrasound Money, there’s a simplification successful the regular magnitude of ETH that deed the market. Furthermore, the information revealed that the declining grounds was astir 90% aft the Merge. This alteration could beryllium due to the fact that Ether is nary longer mined since it’s present a PoS network.

Burning Mechanism Reduces Ethereum Supply

A cautious survey of Ethereum proviso indicated a simplification implicit the past 5 days. With specified a trend, the full proviso for the 2nd largest crypto plus plunged by astir 5,500 ETHs since October 8.

The diminution is linked to the accusation of EIP-1559 and the burning mechanics for the token. This ensures that a percent of fees paid for ETH transactions is burned.

Before the modulation to PoS, miners person astir 13,000 ETH from the Ethereum web arsenic rewards. The web makes payments regular to unafraid the ecosystem and for processing transactions. But the Merge changed the series for the network.

The Ethereum web is present issuing a regular reward of astir $1,600 ETH to validators. This is due to the fact that the basal fees for processing ETH transactions are burned. With specified a practice, Ethereum volition beryllium deflationary, particularly erstwhile the usage increases.

Image Credit: Ultrasound Money

Image Credit: Ultrasound MoneyToday, astir 7,525 ETH has deed the marketplace arsenic a caller token proviso aft the Merge. But successful examination with its cognition arsenic a PoW blockchain, the worth would person reached astir 340,000 ETH.

Ethereum experiences monolithic stroke l ETHUSDT connected Tradingview.com

Ethereum experiences monolithic stroke l ETHUSDT connected Tradingview.comXEN Crypto Project Plays A Role

The ETH burning mechanics indispensable instrumentality much tokens retired of circulation. The ETH Foundation calculated that ETH would beryllium deflationary if the state terms reached 15 gwei.

On Sunday, XEN Crypto was launched connected the Ethereum blockchain. Unfortunately, its task operates arsenic a caller Ethereum state guzzler, and immoderate users person already started minting the crypto XEN. The abrupt enactment spiked Ethereum state fees implicit the weekend.

Since each code connected the Ethereum web could mint XEN, this accounts for accrued Ethereum state prices. Minting XEN to merchantability instantly has an incentive. Also, users person much important amounts conscionable by locking the tokens. Hence, the script with the airdrop is that of the golden rush. It places XEN arsenic the golden and Ether arsenic the pickaxe for its mining.

Etherscan revealed that it took astir 1,470 ETH arsenic state fees to mint XEN successful a day. This worth represents up to 40% of the full state expenditure connected the Ethereum network. Hence, ETH proviso is dropping arsenic the magnitude of burned ETH is much important than what stakers summation arsenic a reward.

Featured representation from Pixabay and illustration from TradingView.com

3 years ago

3 years ago

English (US)

English (US)