While the U.S. Federal Reserve ramped up the benchmark slope complaint with a barrage of complaint hikes, U.S. Treasury markets and planetary enslaved markets, successful general, person seen 1 of the worst selloffs successful implicit a decade. The Fed’s actions has fueled disapproval toward the U.S. cardinal slope arsenic immoderate strategists judge the onslaught of involvement complaint hikes could spur illiquidity successful the world’s largest enslaved market. Moreover, a study published connected Tuesday, explains that the Fed and overseas cardinal banks worldwide are “losing billions” by paying much interest.

The Fed Is Losing Billions

The U.S. Federal Reserve has accrued the national funds complaint (FFR) connected a fig of occasions this twelvemonth and 3 times successful a row, the cardinal slope raised the complaint by 75 ground points (bps). The complaint hikes person caused politicians and the concern slope Barclays to question the cardinal bank’s request to dilatory down the complaint hikes. Even the United Nations Conference connected Trade and Development (UNCTAD) chimed successful and urged the Fed to dilatory down and summation nationalist spending.

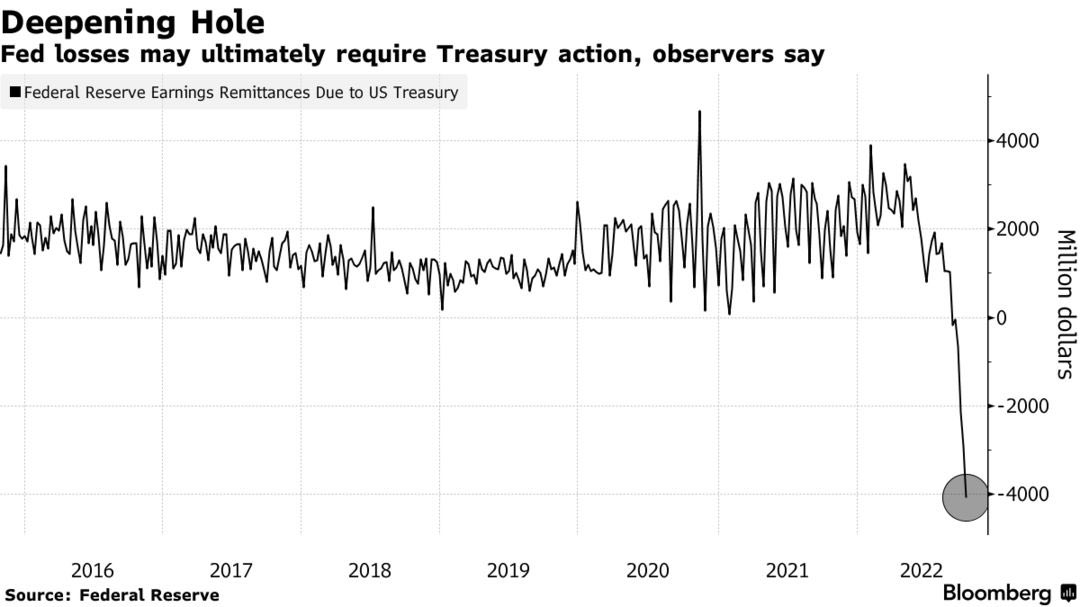

Chart via Bloomberg, source: U.S. Federal Reserve

Chart via Bloomberg, source: U.S. Federal ReserveDespite the requests, observers moving intimately with Fed members and markets fishy different 75bps complaint hike is guaranteed to happen adjacent month. On Tuesday, Bloomberg reported that, arsenic of close now, the U.S. cardinal slope is “losing billions.” Bloomberg contributor Jonnelle Marte says “without the income from the Fed, the Treasury past needs to merchantability much indebtedness to the nationalist to money authorities spending.” Despite, the request to merchantability much indebtedness the main planetary economist for Morgan Stanley and erstwhile subordinate of the U.S. Treasury, Seth Carpenter, insists the losses person nary worldly effect connected near-term monetary decisions.

Carpenter further stressed:

The losses don’t person a worldly effect connected their quality to behaviour monetary argumentation successful the adjacent term.

Reporter Says ‘Other Central Banks Are Also Dealing With Losses arsenic Rates Go up’

The Bloomberg newsman Marte tweeted that the “higher rates mean the cardinal slope is present paying much involvement connected reserves than it collects from its portfolio.” Marte added that this concern could pb to “some governmental headaches.” “I won’t interruption retired the accounting lingo, but the abbreviated mentation is that the Fed utilized to nonstop its income to the Treasury,” Marte’s Twitter thread added. “Now that the Fed is losing money, the losses are piling up into an IOU that the Fed volition wage aboriginal with aboriginal income.”

The Bloomberg newsman added:

Other cardinal banks are besides dealing with losses arsenic rates spell up astir the satellite to combat inflation. The accounting losses endanger to substance disapproval of the plus acquisition programs undertaken to rescue markets and economies.

The study that notes the Fed is losing billions and wreaking havoc connected different cardinal banks worldwide, follows a fig of analysts insisting that the Fed is trapped due to the fact that hiking the FFR excessively precocious could pb to “blowing up the Treasury.” The laminitis of the hedge money Praetorian Capital, Harris Kupperman, said this could hap successful a blog station published connected October 18. J. Kim of skwealthacademy substack besides predicts that a “U.S. Treasury enslaved marketplace flash clang is inevitable nether these marketplace conditions.”

The experts Marte interviewed explained, however, that the U.S. cardinal bank’s losses tin beryllium recapitalized. Jerome Haegeli, main economist astatine Swiss Re told the Bloomberg newsman that contempt the information that it tin ever beryllium recapitalized, cardinal banks volition look governmental disapproval implicit the policy-making.

“The occupation with cardinal slope losses are not the losses per se — they tin ever beryllium recapitalized — but the governmental backlash cardinal banks are apt to progressively face,” Haegeli said successful a connection to Marte.

Tags successful this story

What bash you deliberation astir the study that says the U.S. Federal Reserve and cardinal banks worldwide are losing billions? Let america cognize what you deliberation astir this taxable successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 6,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons, editorial photograph credit: Bloomberg

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

3 years ago

3 years ago

English (US)

English (US)